Insurtech platforms leverage advanced technology to streamline policy management, offering personalized coverage and real-time claims processing through AI and big data analytics. Peer-to-peer insurance models create a community-driven approach where members pool premiums to insure each other, reducing overhead and aligning interests for greater transparency and lower costs. Explore how these innovative frameworks are reshaping the future of insurance with enhanced efficiency and customer empowerment.

Why it is important

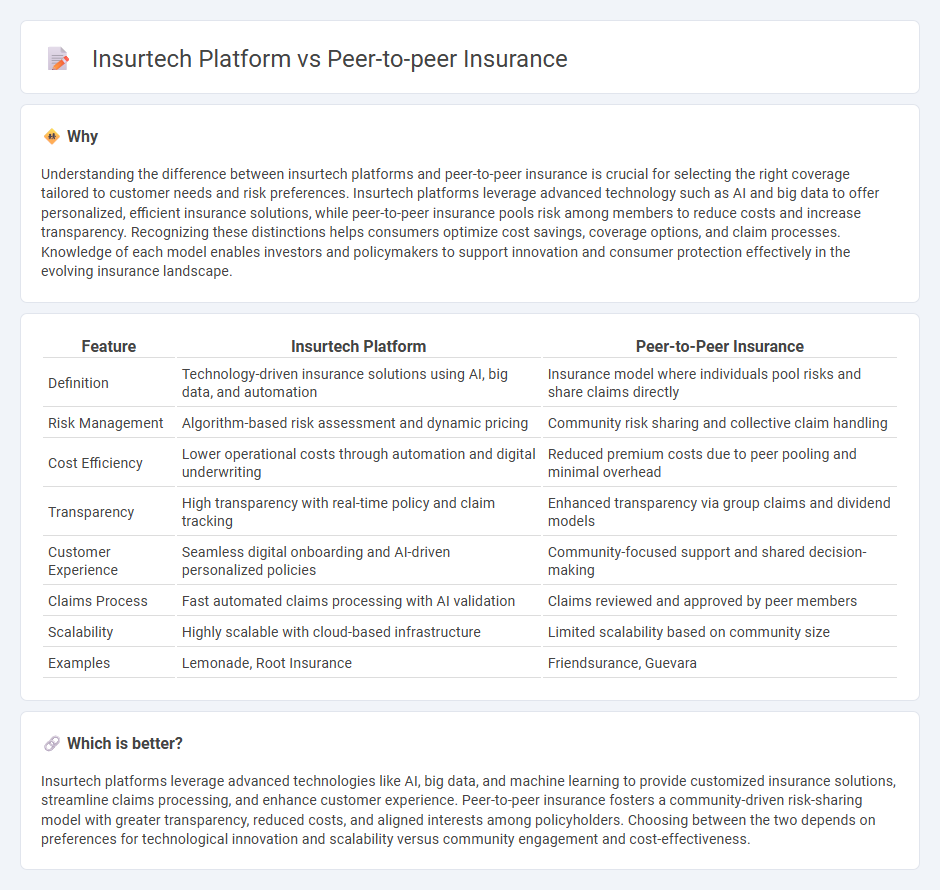

Understanding the difference between insurtech platforms and peer-to-peer insurance is crucial for selecting the right coverage tailored to customer needs and risk preferences. Insurtech platforms leverage advanced technology such as AI and big data to offer personalized, efficient insurance solutions, while peer-to-peer insurance pools risk among members to reduce costs and increase transparency. Recognizing these distinctions helps consumers optimize cost savings, coverage options, and claim processes. Knowledge of each model enables investors and policymakers to support innovation and consumer protection effectively in the evolving insurance landscape.

Comparison Table

| Feature | Insurtech Platform | Peer-to-Peer Insurance |

|---|---|---|

| Definition | Technology-driven insurance solutions using AI, big data, and automation | Insurance model where individuals pool risks and share claims directly |

| Risk Management | Algorithm-based risk assessment and dynamic pricing | Community risk sharing and collective claim handling |

| Cost Efficiency | Lower operational costs through automation and digital underwriting | Reduced premium costs due to peer pooling and minimal overhead |

| Transparency | High transparency with real-time policy and claim tracking | Enhanced transparency via group claims and dividend models |

| Customer Experience | Seamless digital onboarding and AI-driven personalized policies | Community-focused support and shared decision-making |

| Claims Process | Fast automated claims processing with AI validation | Claims reviewed and approved by peer members |

| Scalability | Highly scalable with cloud-based infrastructure | Limited scalability based on community size |

| Examples | Lemonade, Root Insurance | Friendsurance, Guevara |

Which is better?

Insurtech platforms leverage advanced technologies like AI, big data, and machine learning to provide customized insurance solutions, streamline claims processing, and enhance customer experience. Peer-to-peer insurance fosters a community-driven risk-sharing model with greater transparency, reduced costs, and aligned interests among policyholders. Choosing between the two depends on preferences for technological innovation and scalability versus community engagement and cost-effectiveness.

Connection

Insurtech platforms leverage advanced technology to streamline insurance processes, enabling peer-to-peer insurance models that connect individuals directly to share risk and reduce costs. These platforms utilize blockchain, AI, and data analytics to enhance transparency, automate claims, and optimize risk assessment within peer-to-peer networks. By integrating technology-driven solutions, insurtech accelerates the adoption of peer-to-peer insurance, fostering community-based coverage with improved efficiency and lower premiums.

Key Terms

Risk Pooling

Peer-to-peer insurance leverages collective risk pooling by grouping individuals with similar risk profiles to share losses directly, reducing reliance on traditional insurers. Insurtech platforms enhance these models with advanced data analytics, real-time risk assessment, and automated claims processing to optimize pooling efficiency and transparency. Explore how innovative risk pooling mechanisms transform insurance through technology-driven solutions.

Digital Platform

Peer-to-peer insurance leverages a digital platform to connect individuals directly, facilitating risk sharing without traditional intermediaries, which reduces costs and enhances transparency. Insurtech platforms integrate advanced technologies such as AI, big data analytics, and blockchain to streamline underwriting, claims processing, and customer experience on a scalable digital infrastructure. Explore the latest innovations in these digital platforms to understand their growing impact on the insurance industry.

Claims Automation

Peer-to-peer insurance leverages decentralized risk-sharing among members to streamline claims processing, enhancing transparency and reducing fraud through collective oversight. Insurtech platforms employ advanced algorithms and AI-driven claims automation to expedite claim adjudication, minimize human error, and improve customer experience. Explore the latest innovations in claims automation to understand how these models are transforming the insurance landscape.

Source and External Links

Peer-to-peer insurance - A type of insurance where participants pool funds to cover similar risks, often utilizing technology and collaborative consumption concepts.

How Peer-to-Peer Insurance Works - This model combines technology and sharing economy principles to create risk-sharing networks among individuals.

Peer-To-Peer Car Rental Insurance - Explains how insurance works for car owners and renters in peer-to-peer car-sharing services.

dowidth.com

dowidth.com