Embedded insurance integrates coverage seamlessly into the purchase of a product or service, providing users with automatic protection without requiring separate transactions. On-demand insurance offers flexible, short-term policies activated by the user as needed, catering to specific situations or timeframes. Discover how these innovative insurance models can enhance your coverage options and simplify risk management.

Why it is important

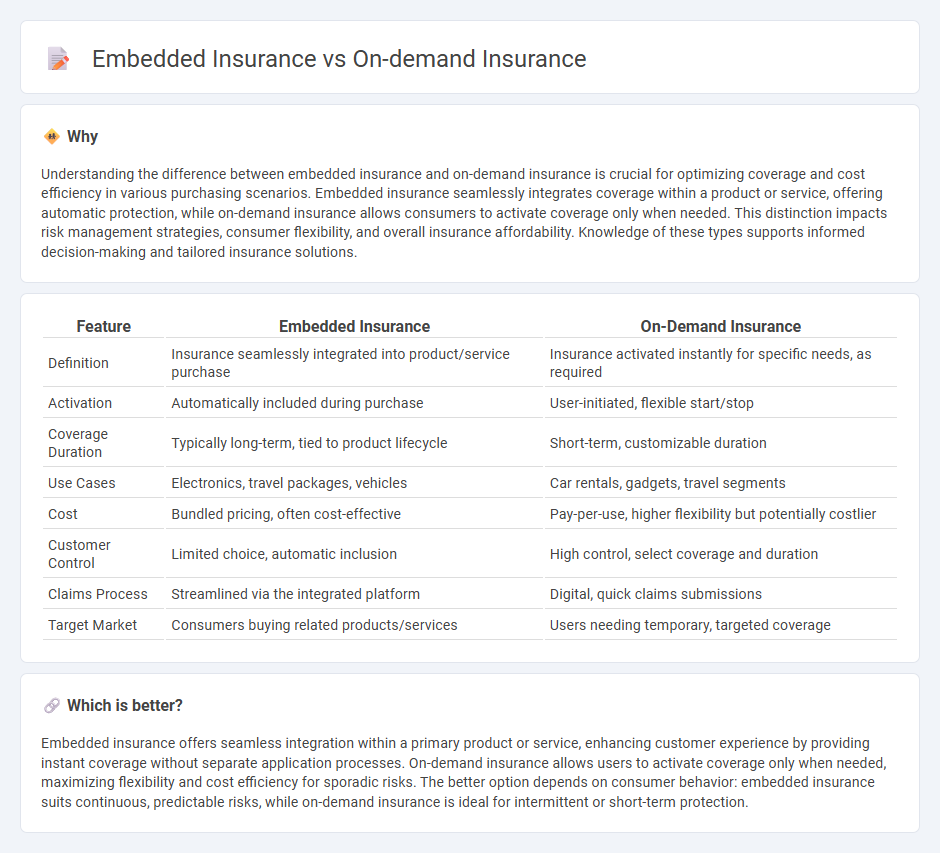

Understanding the difference between embedded insurance and on-demand insurance is crucial for optimizing coverage and cost efficiency in various purchasing scenarios. Embedded insurance seamlessly integrates coverage within a product or service, offering automatic protection, while on-demand insurance allows consumers to activate coverage only when needed. This distinction impacts risk management strategies, consumer flexibility, and overall insurance affordability. Knowledge of these types supports informed decision-making and tailored insurance solutions.

Comparison Table

| Feature | Embedded Insurance | On-Demand Insurance |

|---|---|---|

| Definition | Insurance seamlessly integrated into product/service purchase | Insurance activated instantly for specific needs, as required |

| Activation | Automatically included during purchase | User-initiated, flexible start/stop |

| Coverage Duration | Typically long-term, tied to product lifecycle | Short-term, customizable duration |

| Use Cases | Electronics, travel packages, vehicles | Car rentals, gadgets, travel segments |

| Cost | Bundled pricing, often cost-effective | Pay-per-use, higher flexibility but potentially costlier |

| Customer Control | Limited choice, automatic inclusion | High control, select coverage and duration |

| Claims Process | Streamlined via the integrated platform | Digital, quick claims submissions |

| Target Market | Consumers buying related products/services | Users needing temporary, targeted coverage |

Which is better?

Embedded insurance offers seamless integration within a primary product or service, enhancing customer experience by providing instant coverage without separate application processes. On-demand insurance allows users to activate coverage only when needed, maximizing flexibility and cost efficiency for sporadic risks. The better option depends on consumer behavior: embedded insurance suits continuous, predictable risks, while on-demand insurance is ideal for intermittent or short-term protection.

Connection

Embedded insurance integrates coverage directly within the purchase of products or services, streamlining access for consumers. On-demand insurance offers flexible, real-time protection activated as needed, enhancing convenience and cost efficiency. Both models leverage digital platforms to deliver tailored insurance solutions, meeting evolving customer expectations for seamless, personalized risk management.

Key Terms

Flexibility

On-demand insurance offers unparalleled flexibility by allowing customers to activate coverage precisely when needed, avoiding unnecessary costs associated with continuous policies. Embedded insurance integrates coverage seamlessly within product purchases, providing convenience but with less control over timing and duration. Explore how these flexible insurance models can transform your risk management strategy.

Integration

On-demand insurance offers flexible, real-time coverage activated by users through apps or digital platforms, allowing seamless protection tailored to specific needs and durations. Embedded insurance integrates protection directly within the purchase process of goods or services, providing a hassle-free experience by bundling insurance with the primary product at checkout. Explore how these integration models transform risk management and customer engagement in the insurance industry.

User Experience

On-demand insurance offers users instant coverage tailored to specific needs through seamless app interfaces, enhancing convenience and control. Embedded insurance integrates protection directly into the purchase process of products or services, reducing friction and improving overall customer satisfaction by eliminating separate insurance steps. Explore how these models transform user experience in the evolving insurance landscape.

Source and External Links

The ins and outs of on-demand insurance: a growing trend in coverage flexibility - On-demand insurance allows consumers to buy coverage as needed via digital platforms, offering flexible, short-term protection for items like travel, rental cars, or valuables, and differs from traditional insurance by letting users activate and deactivate policies in real time, paying only for what they use.

On demand and usage based insurance - HFW - On-demand insurance is activated by the insured through smart devices or automatically based on context, allowing flexible, item-specific cover that can be turned on and off, distinguishing it from usage-based insurance which often involves continuous underlying coverage with added usage-calculated premiums.

On-demand Insurance Market Size & Share Report, 2030 - The global market for on-demand insurance was valued at USD 955.3 million in 2022 and is forecasted to grow at a CAGR of 21.2% through 2030, driven by consumer demand for transparent, convenient, app-enabled policies that provide protection only when needed without long-term commitments.

dowidth.com

dowidth.com