Insurtech sandboxes provide a controlled environment for testing innovative insurance solutions, enabling startups and established companies to experiment with new products and regulatory approaches without full compliance constraints. Blockchain technology enhances insurance operations by offering transparent, immutable records and facilitating smart contracts that streamline claims processing and reduce fraud. Explore the evolving landscape of insurance innovation to understand how these technologies reshape risk management and customer experience.

Why it is important

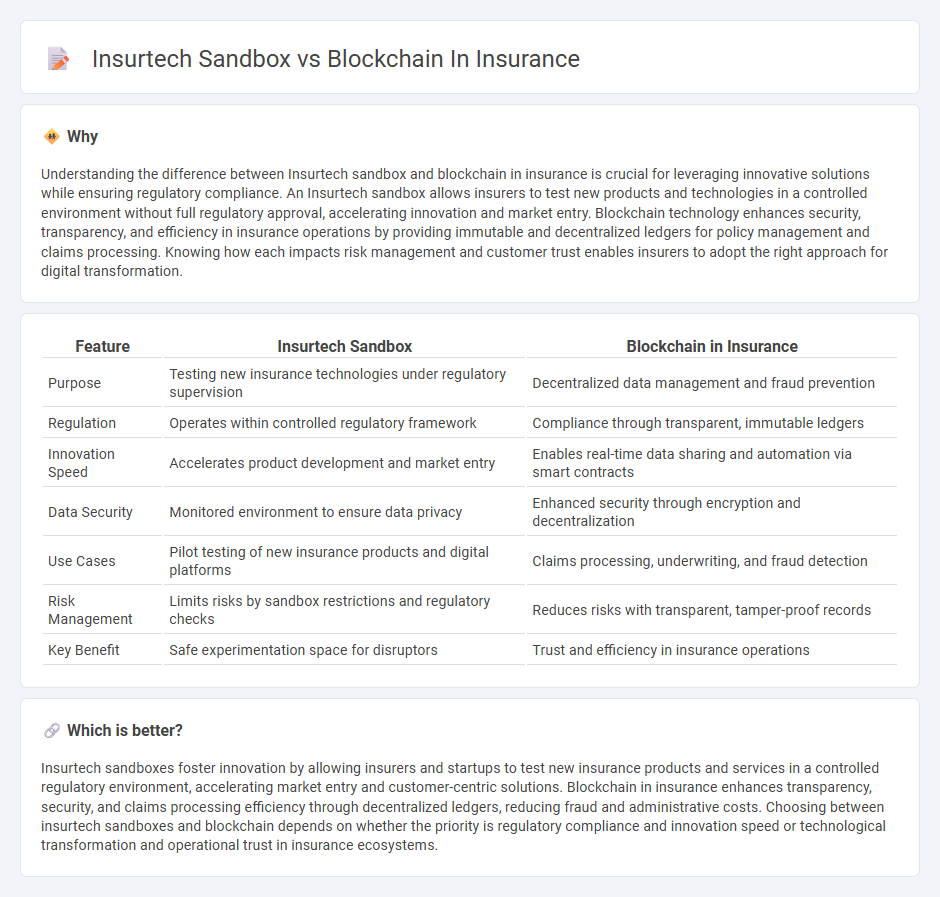

Understanding the difference between Insurtech sandbox and blockchain in insurance is crucial for leveraging innovative solutions while ensuring regulatory compliance. An Insurtech sandbox allows insurers to test new products and technologies in a controlled environment without full regulatory approval, accelerating innovation and market entry. Blockchain technology enhances security, transparency, and efficiency in insurance operations by providing immutable and decentralized ledgers for policy management and claims processing. Knowing how each impacts risk management and customer trust enables insurers to adopt the right approach for digital transformation.

Comparison Table

| Feature | Insurtech Sandbox | Blockchain in Insurance |

|---|---|---|

| Purpose | Testing new insurance technologies under regulatory supervision | Decentralized data management and fraud prevention |

| Regulation | Operates within controlled regulatory framework | Compliance through transparent, immutable ledgers |

| Innovation Speed | Accelerates product development and market entry | Enables real-time data sharing and automation via smart contracts |

| Data Security | Monitored environment to ensure data privacy | Enhanced security through encryption and decentralization |

| Use Cases | Pilot testing of new insurance products and digital platforms | Claims processing, underwriting, and fraud detection |

| Risk Management | Limits risks by sandbox restrictions and regulatory checks | Reduces risks with transparent, tamper-proof records |

| Key Benefit | Safe experimentation space for disruptors | Trust and efficiency in insurance operations |

Which is better?

Insurtech sandboxes foster innovation by allowing insurers and startups to test new insurance products and services in a controlled regulatory environment, accelerating market entry and customer-centric solutions. Blockchain in insurance enhances transparency, security, and claims processing efficiency through decentralized ledgers, reducing fraud and administrative costs. Choosing between insurtech sandboxes and blockchain depends on whether the priority is regulatory compliance and innovation speed or technological transformation and operational trust in insurance ecosystems.

Connection

Insurtech sandboxes enable insurance companies to test and validate blockchain applications in a controlled environment, fostering innovation in smart contracts and claims automation. Blockchain technology enhances transparency, security, and efficiency in insurance processes such as policy issuance, fraud detection, and customer data management. Combining blockchain with insurtech sandboxes accelerates the development of scalable, compliant insurance solutions while reducing operational risks and costs.

Key Terms

**Blockchain in insurance:**

Blockchain in insurance revolutionizes claim processing by ensuring transparent, tamper-proof records and automating contract execution through smart contracts, significantly reducing fraud and operational costs. This technology enhances data security and streamlines interactions between insurers, reinsurers, and policyholders using decentralized ledgers, promoting trust and efficiency in policy management. Explore how blockchain is transforming insurance by driving innovation, improving accuracy, and enabling new business models.

Smart Contracts

Smart contracts revolutionize insurance by automating claim processing, ensuring transparency, and reducing fraud through blockchain technology. Insurtech sandboxes provide a controlled environment for testing these smart contract applications, fostering innovation while maintaining regulatory compliance. Explore how smart contracts within insurtech sandboxes are transforming the future of insurance.

Distributed Ledger

Blockchain technology enhances insurance by enabling secure, transparent, and tamper-proof data sharing through distributed ledger systems, reducing fraud and streamlining claims processing. Insurtech sandboxes, regulated environments for innovation, allow insurers to experiment with blockchain applications under controlled conditions, accelerating adoption while managing risks. Discover how distributed ledger advancements are reshaping insurance through blockchain and insurtech sandbox initiatives.

Source and External Links

8 Blockchain Insurance Examples to Know - This article explores how blockchain technology enhances efficiency, security, and transparency in the insurance industry through smart contracts and automation.

Insurance Topics | Blockchain Technology - Blockchain-based solutions can streamline policy administration, manage claims, prevent fraud, and provide proof of insurance, offering a reliable audit trail.

Blockchain in Insurance - Blockchain technology can improve efficiency in traditional insurance by enabling new business models and enhancing inclusivity with decentralized networks.

dowidth.com

dowidth.com