Peer-to-peer insurance leverages a network of individuals who pool their premiums to cover collective risks, fostering transparency and reducing administrative costs compared to traditional models. Group insurance typically covers members of an organization or association with the insurer assuming the risk and managing claims, often resulting in broader coverage and fixed benefits. Explore detailed comparisons to determine which insurance model best fits your needs.

Why it is important

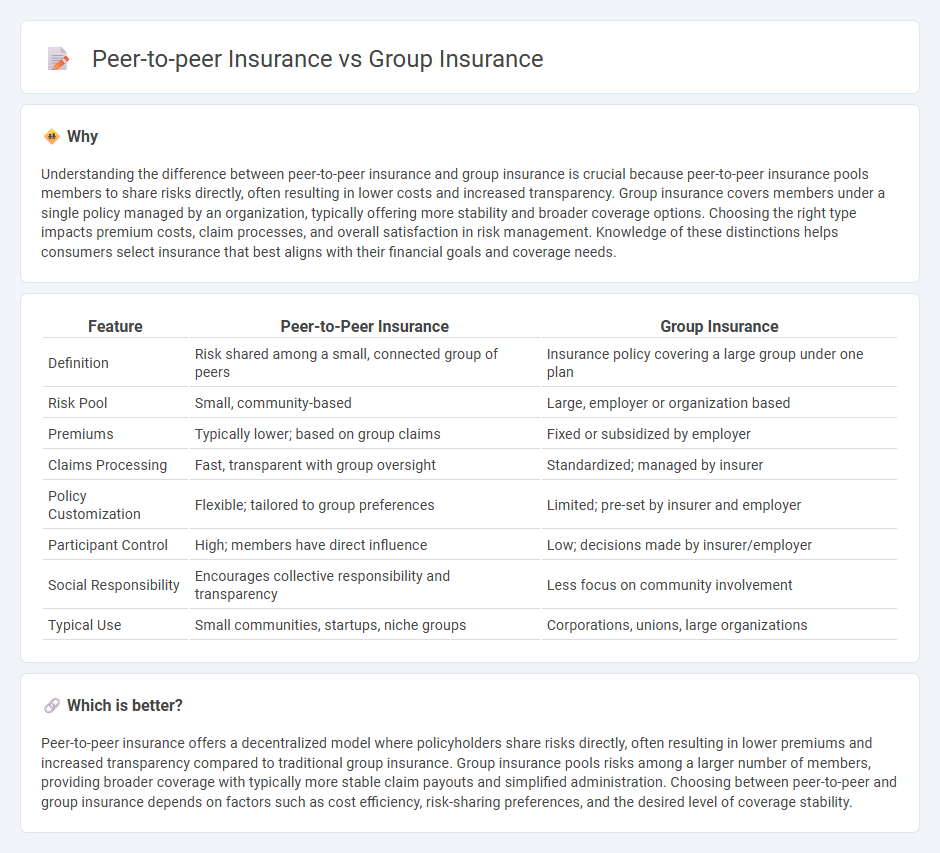

Understanding the difference between peer-to-peer insurance and group insurance is crucial because peer-to-peer insurance pools members to share risks directly, often resulting in lower costs and increased transparency. Group insurance covers members under a single policy managed by an organization, typically offering more stability and broader coverage options. Choosing the right type impacts premium costs, claim processes, and overall satisfaction in risk management. Knowledge of these distinctions helps consumers select insurance that best aligns with their financial goals and coverage needs.

Comparison Table

| Feature | Peer-to-Peer Insurance | Group Insurance |

|---|---|---|

| Definition | Risk shared among a small, connected group of peers | Insurance policy covering a large group under one plan |

| Risk Pool | Small, community-based | Large, employer or organization based |

| Premiums | Typically lower; based on group claims | Fixed or subsidized by employer |

| Claims Processing | Fast, transparent with group oversight | Standardized; managed by insurer |

| Policy Customization | Flexible; tailored to group preferences | Limited; pre-set by insurer and employer |

| Participant Control | High; members have direct influence | Low; decisions made by insurer/employer |

| Social Responsibility | Encourages collective responsibility and transparency | Less focus on community involvement |

| Typical Use | Small communities, startups, niche groups | Corporations, unions, large organizations |

Which is better?

Peer-to-peer insurance offers a decentralized model where policyholders share risks directly, often resulting in lower premiums and increased transparency compared to traditional group insurance. Group insurance pools risks among a larger number of members, providing broader coverage with typically more stable claim payouts and simplified administration. Choosing between peer-to-peer and group insurance depends on factors such as cost efficiency, risk-sharing preferences, and the desired level of coverage stability.

Connection

Peer-to-peer insurance and group insurance both leverage collective risk sharing to reduce individual premiums and enhance coverage reliability. By pooling resources, these models incentivize mutual accountability and lower claims frequency through community-driven trust. Data analytics and smart contracts often support both systems, optimizing transparency and claim processing efficiency.

Key Terms

Risk Pooling

Group insurance leverages a large pool of policyholders to spread and mitigate risk, resulting in lower premiums and more stable coverage. Peer-to-peer insurance creates smaller, more transparent risk pools among members who share similar risk profiles, fostering trust and potential cost savings. Explore how each model optimizes risk pooling to suit different insurance needs.

Underwriting

Group insurance leverages collective risk assessment, allowing insurers to evaluate the overall risk profile based on aggregated data from members, resulting in standardized coverage terms and premiums. Peer-to-peer insurance employs decentralized underwriting, where risk evaluation is often influenced by smaller, self-selected groups, promoting transparency and potentially lowering costs through shared claims management. Explore the nuances of underwriting differences to determine which model best fits your insurance needs.

Premium Structure

Group insurance offers fixed premium structures where costs are pooled among a defined group, often resulting in lower rates and predictable payments. Peer-to-peer insurance features dynamic premiums that adjust based on group risk profiles and claims experience, fostering transparency and potentially lowering costs for low-risk members. Explore detailed comparisons to understand which premium model best aligns with your financial goals.

Source and External Links

What is Group Insurance & How Does It Work? - MetLife - Group insurance is coverage provided to a group of members, typically as part of an employee benefits package, offering health, dental, vision, or other insurance at a lower cost than individual policies, with employers often subsidizing premiums.

Group-term life insurance | Internal Revenue Service - The first $50,000 of employer-provided group-term life insurance is tax-free for employees, but any coverage above this amount must be reported as taxable income using IRS Premium Table rates.

Group insurance - Wikipedia - Group insurance covers a defined group, such as employees or association members, with underwriting requirements generally less strict than individual policies, and coverage may be compulsory or voluntary depending on the plan.

dowidth.com

dowidth.com