Workers compensation carveout plans separate specific coverage, such as occupational injuries, from traditional workers compensation insurance to reduce premiums and manage claims efficiently. Voluntary benefits offer employees optional insurance products like life, disability, or accident coverage, often funded through payroll deductions and enhancing overall employee benefits packages. Explore more to understand how these options impact employer risk management and employee satisfaction.

Why it is important

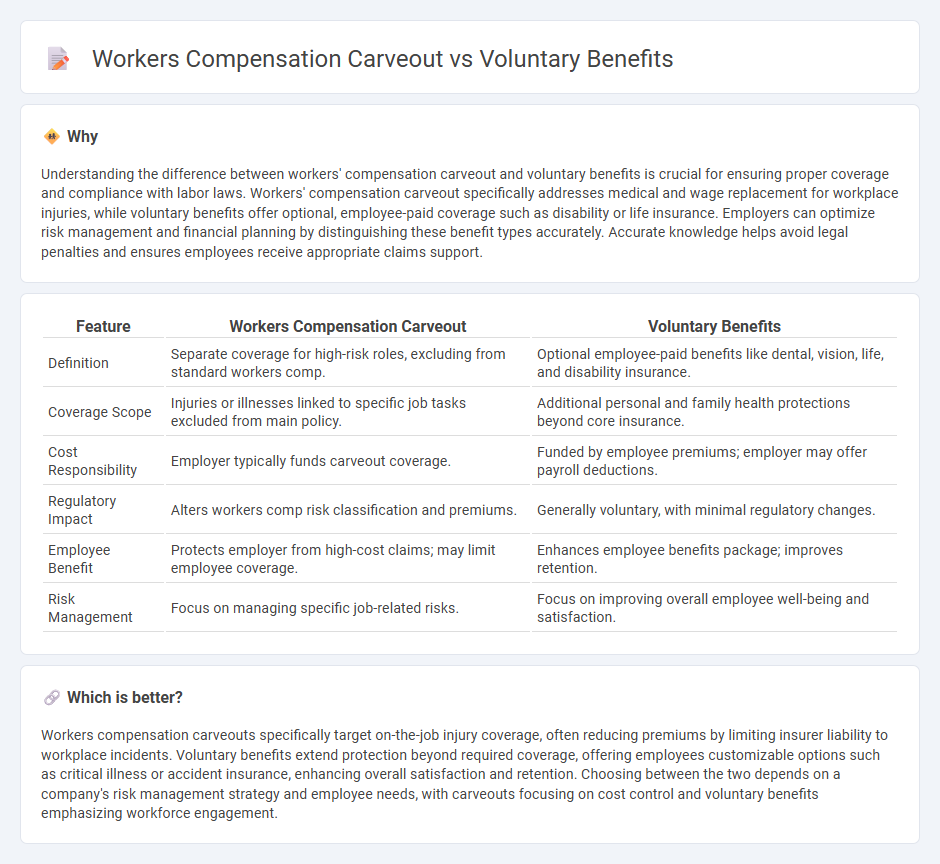

Understanding the difference between workers' compensation carveout and voluntary benefits is crucial for ensuring proper coverage and compliance with labor laws. Workers' compensation carveout specifically addresses medical and wage replacement for workplace injuries, while voluntary benefits offer optional, employee-paid coverage such as disability or life insurance. Employers can optimize risk management and financial planning by distinguishing these benefit types accurately. Accurate knowledge helps avoid legal penalties and ensures employees receive appropriate claims support.

Comparison Table

| Feature | Workers Compensation Carveout | Voluntary Benefits |

|---|---|---|

| Definition | Separate coverage for high-risk roles, excluding from standard workers comp. | Optional employee-paid benefits like dental, vision, life, and disability insurance. |

| Coverage Scope | Injuries or illnesses linked to specific job tasks excluded from main policy. | Additional personal and family health protections beyond core insurance. |

| Cost Responsibility | Employer typically funds carveout coverage. | Funded by employee premiums; employer may offer payroll deductions. |

| Regulatory Impact | Alters workers comp risk classification and premiums. | Generally voluntary, with minimal regulatory changes. |

| Employee Benefit | Protects employer from high-cost claims; may limit employee coverage. | Enhances employee benefits package; improves retention. |

| Risk Management | Focus on managing specific job-related risks. | Focus on improving overall employee well-being and satisfaction. |

Which is better?

Workers compensation carveouts specifically target on-the-job injury coverage, often reducing premiums by limiting insurer liability to workplace incidents. Voluntary benefits extend protection beyond required coverage, offering employees customizable options such as critical illness or accident insurance, enhancing overall satisfaction and retention. Choosing between the two depends on a company's risk management strategy and employee needs, with carveouts focusing on cost control and voluntary benefits emphasizing workforce engagement.

Connection

Workers' compensation carveouts and voluntary benefits are connected through their complementary roles in employee risk management and workplace protection. Carveouts exclude specific coverage, such as occupational diseases, allowing specialized voluntary benefits to fill gaps and provide additional financial support. Employers leverage this combination to tailor comprehensive benefit packages that enhance employee welfare while controlling insurance costs.

Key Terms

Employee choice

Voluntary benefits empower employees with personalized choices such as supplemental health insurance, critical illness, or legal plans, enhancing their overall compensation package beyond mandatory workers' compensation coverage. Workers' compensation carveouts specifically address work-related injuries with employer-managed claims and costs, often limiting employee flexibility in benefit selection. Exploring the impact of employee choice in these benefit structures reveals opportunities for tailored coverage and improved satisfaction--discover more insights here.

Claims management

Voluntary benefits claims management focuses on enhancing employee satisfaction and providing flexible coverage options beyond standard workers compensation, often reducing administrative burdens through streamlined processes and third-party administrators. In contrast, workers compensation carveouts isolate specific injury categories, improving cost control and specialized claims handling but requiring dedicated expertise to manage regulatory compliance effectively. Explore how combining strategic claims management in both areas optimizes risk mitigation and enhances overall employee benefits administration.

Regulatory compliance

Voluntary benefits and workers' compensation carveouts must align with complex regulatory compliance requirements, including OSHA standards and state-specific workers' compensation laws. Employers need to ensure clear documentation, proper employee notification, and adherence to insurance mandates to avoid legal penalties. Explore deeper insights on regulatory frameworks to optimize your benefits strategy effectively.

Source and External Links

Voluntary Benefits 101: How they can benefit employers and employees - Voluntary benefits are optional employee benefits beyond standard packages, including financial, health, and personal coverage, often shared financially by employees and employers, allowing employees to customize their benefit options with minimal additional employer cost.

What Are Voluntary Benefits? - Glossary of Terms - Voluntary benefits are additional services or goods offered at discounted group rates paid fully or partially by employees, helping employers attract and retain talent with low cost while providing employees flexible, tailored benefits that enhance financial and personal security.

What are Voluntary Benefits? Plus Examples | HR Glossary - Voluntary benefits allow employees to opt into additional benefits often paid partially by themselves, providing flexible, personalized compensation that boosts job satisfaction, retention, and overall wellbeing while being cost-effective for employers.

dowidth.com

dowidth.com