Catastrophe bonds provide insurance companies with capital market funding to cover losses from catastrophic events, transferring risk to investors and reducing balance sheet exposure. Reinsurance involves insurers purchasing coverage from other reinsurers to share the risk of large claims and enhance underwriting capacity. Explore the differences in risk management strategies and financial impact between catastrophe bonds and traditional reinsurance solutions.

Why it is important

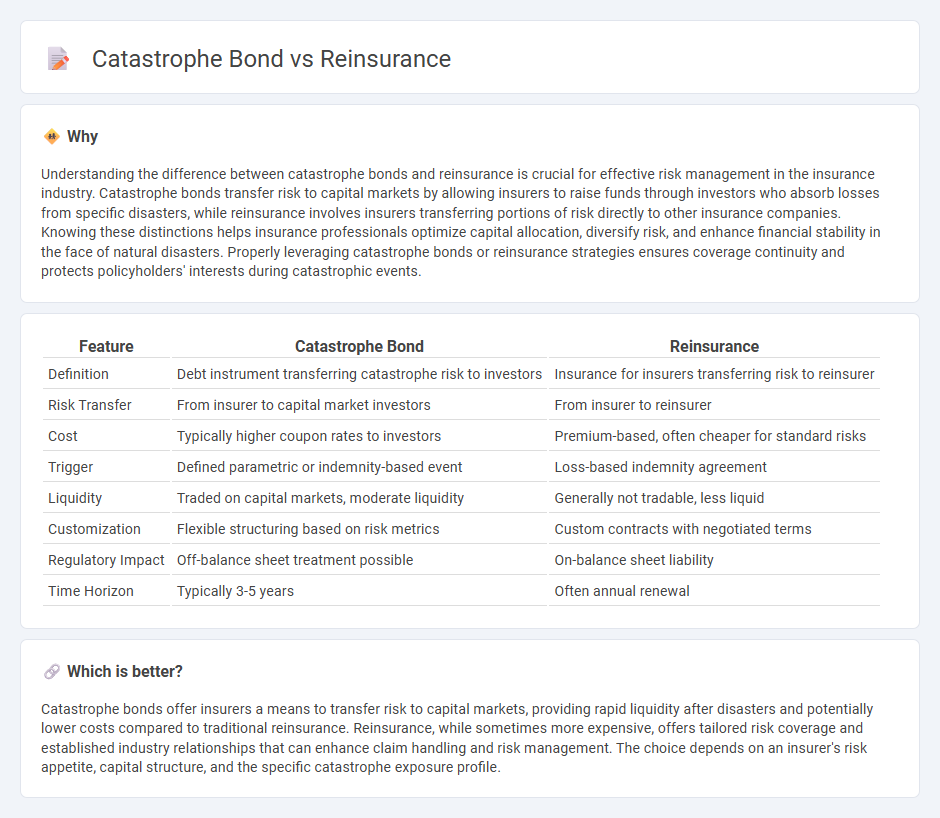

Understanding the difference between catastrophe bonds and reinsurance is crucial for effective risk management in the insurance industry. Catastrophe bonds transfer risk to capital markets by allowing insurers to raise funds through investors who absorb losses from specific disasters, while reinsurance involves insurers transferring portions of risk directly to other insurance companies. Knowing these distinctions helps insurance professionals optimize capital allocation, diversify risk, and enhance financial stability in the face of natural disasters. Properly leveraging catastrophe bonds or reinsurance strategies ensures coverage continuity and protects policyholders' interests during catastrophic events.

Comparison Table

| Feature | Catastrophe Bond | Reinsurance |

|---|---|---|

| Definition | Debt instrument transferring catastrophe risk to investors | Insurance for insurers transferring risk to reinsurer |

| Risk Transfer | From insurer to capital market investors | From insurer to reinsurer |

| Cost | Typically higher coupon rates to investors | Premium-based, often cheaper for standard risks |

| Trigger | Defined parametric or indemnity-based event | Loss-based indemnity agreement |

| Liquidity | Traded on capital markets, moderate liquidity | Generally not tradable, less liquid |

| Customization | Flexible structuring based on risk metrics | Custom contracts with negotiated terms |

| Regulatory Impact | Off-balance sheet treatment possible | On-balance sheet liability |

| Time Horizon | Typically 3-5 years | Often annual renewal |

Which is better?

Catastrophe bonds offer insurers a means to transfer risk to capital markets, providing rapid liquidity after disasters and potentially lower costs compared to traditional reinsurance. Reinsurance, while sometimes more expensive, offers tailored risk coverage and established industry relationships that can enhance claim handling and risk management. The choice depends on an insurer's risk appetite, capital structure, and the specific catastrophe exposure profile.

Connection

Catastrophe bonds and reinsurance are connected as both serve to transfer and mitigate risk for insurance companies facing large-scale disasters. Reinsurance provides traditional risk-sharing agreements where insurers cede portions of their risk to reinsurers, while catastrophe bonds offer capital market solutions by allowing insurers to raise funds from investors in exchange for higher yields if a predefined catastrophe occurs. This synergy enhances insurers' capacity to manage financial exposure from events like hurricanes or earthquakes.

Key Terms

Risk Transfer

Reinsurance provides traditional risk transfer by allowing insurance companies to cede portions of their risk portfolios to reinsurers, ensuring financial stability against large claims. Catastrophe bonds transfer specific risks to capital market investors, offering a direct link between disaster events and financial compensation without intermediaries. Explore the nuances of risk transfer through reinsurance and catastrophe bonds to enhance your risk management strategy.

Securitization

Reinsurance involves transferring risk from an insurer to another company to reduce potential losses, while catastrophe bonds utilize securitization to transfer catastrophic risk to capital markets through bond issuance. Catastrophe bonds, a form of insurance-linked securities (ILS), allow insurers to raise capital from investors who receive attractive yields but face the risk of principal loss if predefined catastrophic events occur. Explore the details of securitization mechanisms in catastrophe bonds to understand its impact on risk management and capital efficiency.

Indemnity Trigger

Indemnity triggers in reinsurance involve payouts based on the actual losses experienced by the ceding insurer, whereas catastrophe bonds use parametric or modeled loss triggers tied to predefined event metrics. Reinsurance indemnity contracts provide precise risk transfer reflective of the insurer's portfolio loss, while catastrophe bonds offer quicker liquidity with less basis risk but might not fully match losses. Explore more to understand how indemnity triggers influence risk financing decisions between reinsurance and catastrophe bonds.

Source and External Links

REINSURANCE (ACLI Fact Book) - Reinsurance is a risk management tool that allows insurers to transfer some or all of their insurance risk to another insurer, helping them spread risk, manage capital, and offer coverage beyond their own retention limits.

What is reinsurance? - Reinsurance enables insurance companies to transfer portions of the risk they assume when issuing policies, acting as a safeguard against large or catastrophic losses by allowing claims to be funded through reinsurance agreements.

What is Reinsurance? - Reinsurance is essentially "insurance for insurance companies," providing primary insurers with protection against unforeseen or extraordinary losses, increasing their capacity, and stabilizing their business by sharing liability with reinsurers.

dowidth.com

dowidth.com