Insurtech sandboxes enable insurers to test innovative solutions in a controlled environment, accelerating digital transformation while mitigating risks. Underwriting automation streamlines risk assessment processes using AI and data analytics, reducing human error and speeding policy issuance. Explore our detailed comparison to understand how these technologies reshape the insurance industry.

Why it is important

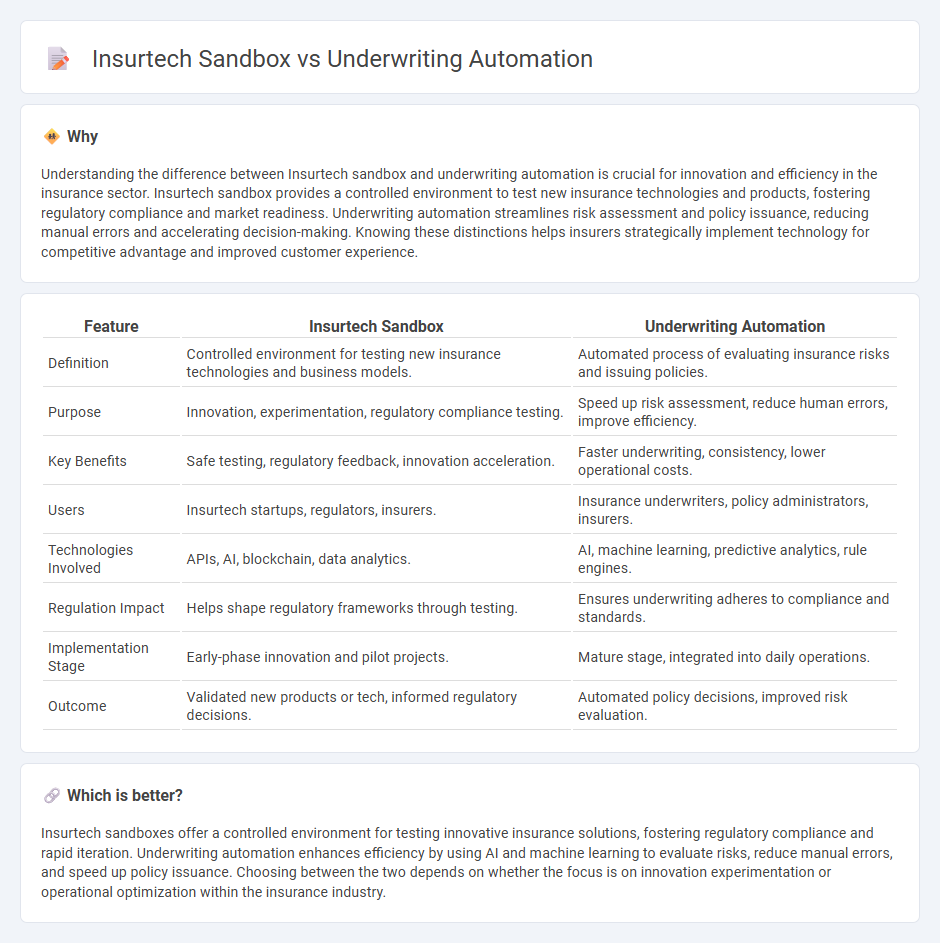

Understanding the difference between Insurtech sandbox and underwriting automation is crucial for innovation and efficiency in the insurance sector. Insurtech sandbox provides a controlled environment to test new insurance technologies and products, fostering regulatory compliance and market readiness. Underwriting automation streamlines risk assessment and policy issuance, reducing manual errors and accelerating decision-making. Knowing these distinctions helps insurers strategically implement technology for competitive advantage and improved customer experience.

Comparison Table

| Feature | Insurtech Sandbox | Underwriting Automation |

|---|---|---|

| Definition | Controlled environment for testing new insurance technologies and business models. | Automated process of evaluating insurance risks and issuing policies. |

| Purpose | Innovation, experimentation, regulatory compliance testing. | Speed up risk assessment, reduce human errors, improve efficiency. |

| Key Benefits | Safe testing, regulatory feedback, innovation acceleration. | Faster underwriting, consistency, lower operational costs. |

| Users | Insurtech startups, regulators, insurers. | Insurance underwriters, policy administrators, insurers. |

| Technologies Involved | APIs, AI, blockchain, data analytics. | AI, machine learning, predictive analytics, rule engines. |

| Regulation Impact | Helps shape regulatory frameworks through testing. | Ensures underwriting adheres to compliance and standards. |

| Implementation Stage | Early-phase innovation and pilot projects. | Mature stage, integrated into daily operations. |

| Outcome | Validated new products or tech, informed regulatory decisions. | Automated policy decisions, improved risk evaluation. |

Which is better?

Insurtech sandboxes offer a controlled environment for testing innovative insurance solutions, fostering regulatory compliance and rapid iteration. Underwriting automation enhances efficiency by using AI and machine learning to evaluate risks, reduce manual errors, and speed up policy issuance. Choosing between the two depends on whether the focus is on innovation experimentation or operational optimization within the insurance industry.

Connection

Insurtech sandboxes provide a controlled environment for testing underwriting automation technologies, enabling insurers to innovate risk assessment and policy pricing models with real-world data while minimizing regulatory risks. Underwriting automation leverages AI and machine learning to streamline risk analysis, improve accuracy, and accelerate policy issuance, directly benefiting from insights gained through sandbox experimentation. The collaboration between insurtech sandboxes and underwriting automation drives digital transformation in insurance by enhancing operational efficiency and customer experience.

Key Terms

**Underwriting automation:**

Underwriting automation leverages advanced algorithms and artificial intelligence to streamline risk assessment and policy issuance, significantly reducing manual errors and processing time. Implementing machine learning models enables real-time data analysis and decision-making, enhancing accuracy and customer experience in insurance underwriting. Explore deeper insights into underwriting automation to transform your insurance operations and boost efficiency.

Risk assessment algorithms

Risk assessment algorithms in underwriting automation enhance accuracy by analyzing vast datasets to predict potential losses and streamline policy approval processes. Insurtech sandboxes provide a controlled environment for testing these algorithms, fostering innovation and regulatory compliance before full-scale implementation. Explore how these technologies revolutionize risk evaluation in insurance.

Machine learning models

Underwriting automation leverages machine learning models to streamline risk assessment by analyzing vast datasets and improving prediction accuracy, enhancing decision speed and reducing human error. Insurtech sandboxes provide a controlled environment for testing these advanced algorithms and novel insurance solutions, ensuring compliance and robustness before full market deployment. Explore how integrating these technologies transforms underwriting efficiency and innovation in insurance.

Source and External Links

Exploring Role of Automation in Various Underwriting Types - Underwriting automation leverages AI and intelligent document processing to reduce manual tasks by up to 40%, accelerating data intake and risk assessment for faster, more accurate decisions in insurance underwriting.

Automated Underwriting Explained: Types, Benefits, and ... - Automated underwriting uses AI-powered rule-based routing and intelligent Agentic AI to streamline workflows, enable real-time, expert-level decisions while ensuring compliance and seamless integration with enterprise systems.

Insurance Underwriting Automation: A Strategy Guide - Insurance automation platforms like Indico Data automate submission intake, risk assessment, and policy decisioning to increase speed and accuracy, addressing the inefficiencies of manual, document-heavy underwriting workflows.

dowidth.com

dowidth.com