Artificial intelligence underwriting leverages machine learning algorithms and vast datasets to assess risk with enhanced accuracy and speed compared to traditional credit-based underwriting, which primarily relies on credit scores and financial history. AI underwriting enables real-time analysis, identifying nuanced risk factors that credit-based models may overlook, leading to more personalized and fair insurance pricing. Explore how AI is transforming risk assessment to optimize insurance underwriting processes.

Why it is important

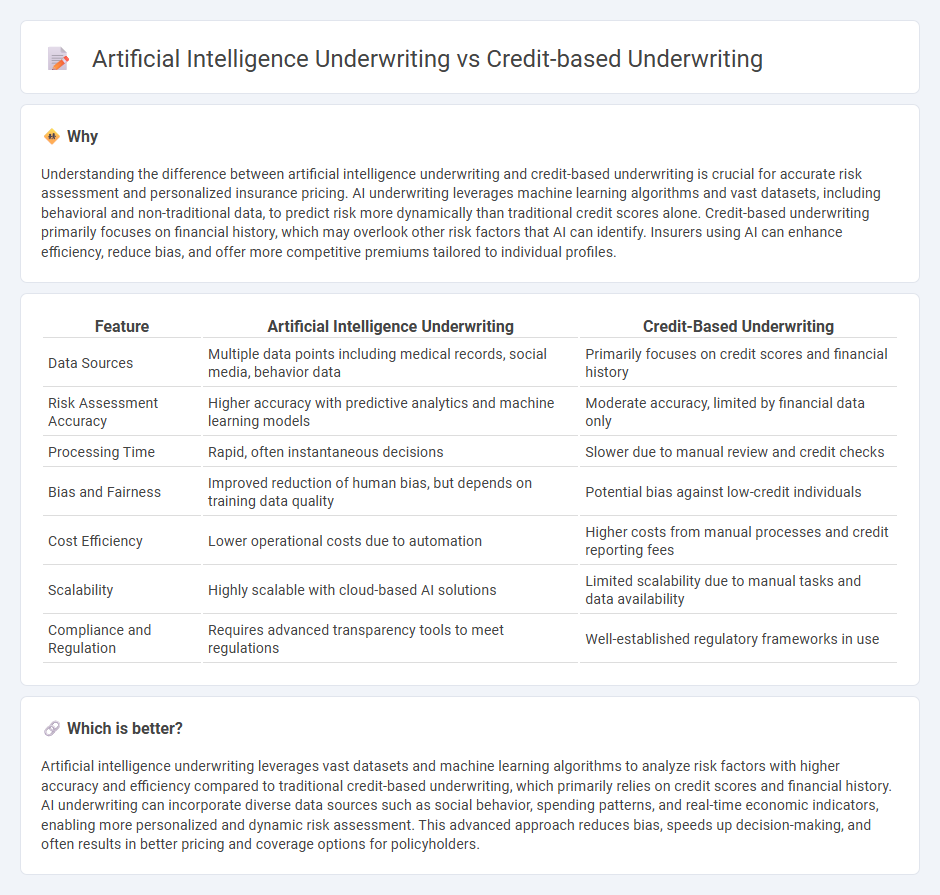

Understanding the difference between artificial intelligence underwriting and credit-based underwriting is crucial for accurate risk assessment and personalized insurance pricing. AI underwriting leverages machine learning algorithms and vast datasets, including behavioral and non-traditional data, to predict risk more dynamically than traditional credit scores alone. Credit-based underwriting primarily focuses on financial history, which may overlook other risk factors that AI can identify. Insurers using AI can enhance efficiency, reduce bias, and offer more competitive premiums tailored to individual profiles.

Comparison Table

| Feature | Artificial Intelligence Underwriting | Credit-Based Underwriting |

|---|---|---|

| Data Sources | Multiple data points including medical records, social media, behavior data | Primarily focuses on credit scores and financial history |

| Risk Assessment Accuracy | Higher accuracy with predictive analytics and machine learning models | Moderate accuracy, limited by financial data only |

| Processing Time | Rapid, often instantaneous decisions | Slower due to manual review and credit checks |

| Bias and Fairness | Improved reduction of human bias, but depends on training data quality | Potential bias against low-credit individuals |

| Cost Efficiency | Lower operational costs due to automation | Higher costs from manual processes and credit reporting fees |

| Scalability | Highly scalable with cloud-based AI solutions | Limited scalability due to manual tasks and data availability |

| Compliance and Regulation | Requires advanced transparency tools to meet regulations | Well-established regulatory frameworks in use |

Which is better?

Artificial intelligence underwriting leverages vast datasets and machine learning algorithms to analyze risk factors with higher accuracy and efficiency compared to traditional credit-based underwriting, which primarily relies on credit scores and financial history. AI underwriting can incorporate diverse data sources such as social behavior, spending patterns, and real-time economic indicators, enabling more personalized and dynamic risk assessment. This advanced approach reduces bias, speeds up decision-making, and often results in better pricing and coverage options for policyholders.

Connection

Artificial intelligence underwriting enhances credit-based underwriting by analyzing vast datasets to evaluate an individual's creditworthiness with greater accuracy and speed. Machine learning algorithms in AI underwriting identify patterns and anomalies in credit history, financial behavior, and risk factors, thus refining risk assessment models used in credit-based underwriting. This integration optimizes policy pricing and approval processes, reducing fraud and improving decision-making efficiency in insurance.

Key Terms

Credit Score

Credit-based underwriting primarily relies on traditional credit scores such as FICO and VantageScore to evaluate borrower risk, using historical credit data and payment behavior. Artificial intelligence underwriting integrates credit scores with advanced algorithms that analyze alternative data sources, including transaction history and social behavior, enabling more accurate and holistic risk assessment. Discover how AI-driven underwriting transforms credit risk evaluation by enhancing predictive accuracy beyond conventional credit scoring models.

Machine Learning

Credit-based underwriting relies on traditional credit scores and financial history to evaluate borrower risk, whereas artificial intelligence underwriting incorporates advanced machine learning algorithms to analyze a wider range of data, including transactional behavior and non-traditional data sources. Machine learning models continuously improve their predictive accuracy by learning from vast datasets, enabling more precise risk assessment and personalized lending decisions. Explore the evolving landscape of AI-driven underwriting to understand its impact on financial services and risk management.

Risk Assessment

Credit-based underwriting relies on traditional financial metrics such as credit scores, income verification, and debt-to-income ratios to assess borrower risk, emphasizing historical financial behavior. Artificial intelligence underwriting integrates advanced algorithms, machine learning models, and alternative data sources like social media activity and transaction patterns to deliver more dynamic and predictive risk assessments. Explore how AI is reshaping underwriting processes and enhancing risk evaluation accuracy.

Source and External Links

Credit - How Insurers Use It - Illinois Department of Insurance - Credit-based underwriting in insurance uses credit-based insurance scores, which rely on elements of a consumer's credit history, to assess risk for underwriting and premium rating, helping insurers decide eligibility and pricing of policies.

Credit-Based Insurance Scores | NAIC - Credit-based underwriting involves using credit-related data to predict insurance loss risk, guiding insurers in deciding coverage eligibility and pricing, with about 95% of auto insurers and 85% of homeowners' insurers applying these scores where allowed.

What Is Credit Underwriting? - Alloy - In credit underwriting for lending, a process closely related to credit-based insurance underwriting, lenders analyze credit bureau and alternative financial data to assess a customer's repayment risk and creditworthiness.

dowidth.com

dowidth.com