Drone insurance protects against liability and damages related to drone operations, covering risks like property damage and personal injury caused by drones. Renters insurance safeguards personal belongings and provides liability coverage for tenants in rental properties, including protection against theft, fire, and water damage. Explore the key differences and benefits of each insurance type to determine the best coverage for your needs.

Why it is important

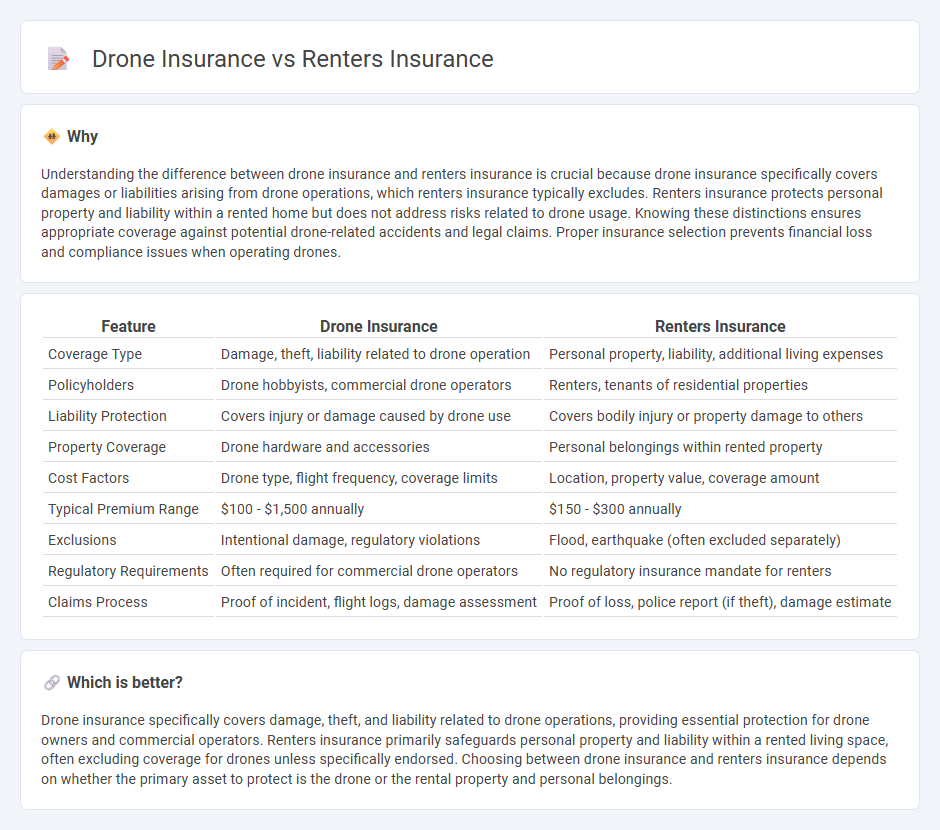

Understanding the difference between drone insurance and renters insurance is crucial because drone insurance specifically covers damages or liabilities arising from drone operations, which renters insurance typically excludes. Renters insurance protects personal property and liability within a rented home but does not address risks related to drone usage. Knowing these distinctions ensures appropriate coverage against potential drone-related accidents and legal claims. Proper insurance selection prevents financial loss and compliance issues when operating drones.

Comparison Table

| Feature | Drone Insurance | Renters Insurance |

|---|---|---|

| Coverage Type | Damage, theft, liability related to drone operation | Personal property, liability, additional living expenses |

| Policyholders | Drone hobbyists, commercial drone operators | Renters, tenants of residential properties |

| Liability Protection | Covers injury or damage caused by drone use | Covers bodily injury or property damage to others |

| Property Coverage | Drone hardware and accessories | Personal belongings within rented property |

| Cost Factors | Drone type, flight frequency, coverage limits | Location, property value, coverage amount |

| Typical Premium Range | $100 - $1,500 annually | $150 - $300 annually |

| Exclusions | Intentional damage, regulatory violations | Flood, earthquake (often excluded separately) |

| Regulatory Requirements | Often required for commercial drone operators | No regulatory insurance mandate for renters |

| Claims Process | Proof of incident, flight logs, damage assessment | Proof of loss, police report (if theft), damage estimate |

Which is better?

Drone insurance specifically covers damage, theft, and liability related to drone operations, providing essential protection for drone owners and commercial operators. Renters insurance primarily safeguards personal property and liability within a rented living space, often excluding coverage for drones unless specifically endorsed. Choosing between drone insurance and renters insurance depends on whether the primary asset to protect is the drone or the rental property and personal belongings.

Connection

Drone insurance and renters insurance intersect primarily through coverage of personal property and liability risks in residential settings. Renters insurance policies may include provisions that protect drone owners from liability claims arising from drone-related accidents or damages occurring on or near the insured property. Both types of insurance help mitigate financial risks by ensuring coverage for potential losses or damages involving drones within a renter's living environment.

Key Terms

Personal Property Coverage (Renters Insurance)

Renters insurance provides Personal Property Coverage that protects belongings such as furniture, electronics, and clothing against risks like theft, fire, and vandalism, typically up to a specified limit. Drone insurance, in contrast, primarily covers the drone itself, liability for damages or injuries caused during operation, and may not include coverage for personal property unrelated to the drone. To understand how personal property protection differs between renters and drone insurance policies, explore detailed coverage options and limits.

Liability Coverage (Both)

Renters insurance typically includes liability coverage that protects policyholders against claims of bodily injury or property damage occurring within their rented residence, while drone insurance liability coverage specifically addresses risks associated with drone operations, such as injury to third parties or damage caused by the drone. Unlike renters insurance, drone insurance liability is often required for commercial drone pilots and can cover incidents that occur outside of the home environment, including flight-related accidents and property damage. Explore more to understand how liability coverage varies between renters insurance and specialized drone insurance policies.

Hull Coverage (Drone Insurance)

Hull coverage in drone insurance specifically protects the physical body of the drone against damage or loss due to accidents, crashes, theft, or natural disasters, which renter's insurance typically does not cover for drones. While renters insurance covers personal property, it often excludes high-value or specialized equipment like drones, making dedicated hull coverage essential for drone operators. Explore the benefits of comprehensive hull coverage to safeguard your investment in drone technology.

Source and External Links

Get A Renters Insurance Quote - GEICO - Provides coverage for your personal belongings, liability, and additional living expenses if your rental becomes uninhabitable, but does not cover the structure itself, which is the responsibility of your landlord.

Renters Insurance: Get a free quote today - State Farm(r) - Protects your possessions like electronics, furniture, and clothing from various risks, offers liability coverage, and can be bundled with auto insurance for additional savings.

Renters Insurance - Quotes Starting at $5/month - Allstate - Offers four main types of coverage: personal property, liability, guest medical, and additional living expenses, and may also help with costs from pet liability and legal fees if sued for an injury on your property.

dowidth.com

dowidth.com