Pre-existing condition coverage ensures individuals with prior health issues receive necessary medical protection without financial penalty, while coverage denial occurs when insurance providers reject claims based on those existing health conditions, leading to significant out-of-pocket expenses. Understanding the nuances of policy terms and state regulations can prevent unexpected denials and secure appropriate healthcare access. Explore more to make informed decisions about your insurance options.

Why it is important

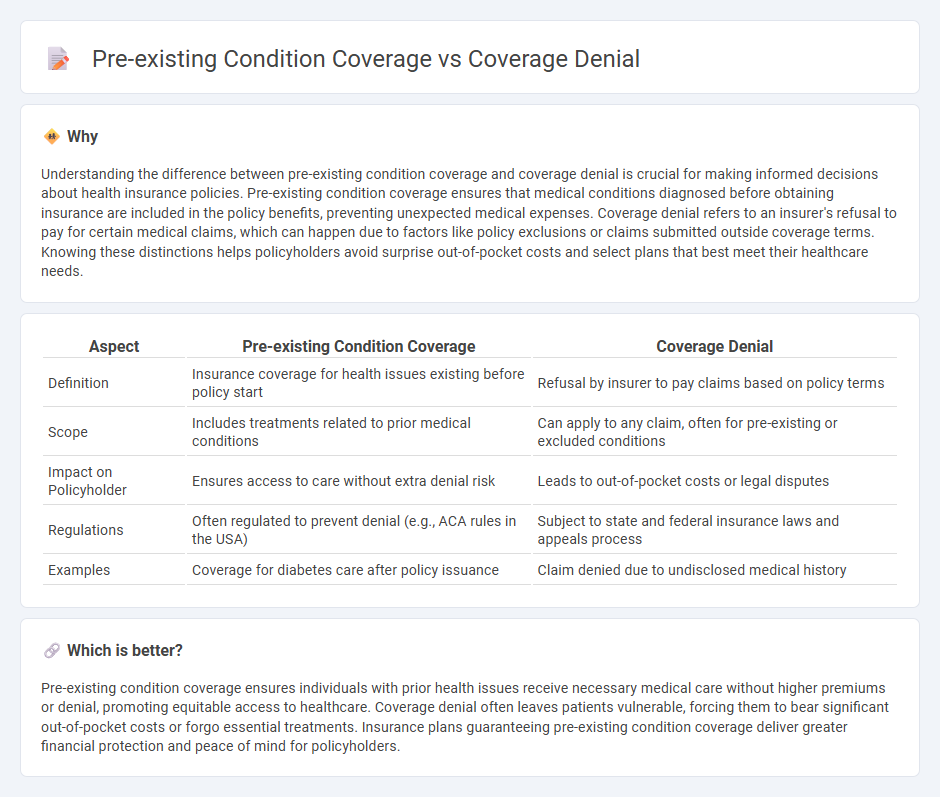

Understanding the difference between pre-existing condition coverage and coverage denial is crucial for making informed decisions about health insurance policies. Pre-existing condition coverage ensures that medical conditions diagnosed before obtaining insurance are included in the policy benefits, preventing unexpected medical expenses. Coverage denial refers to an insurer's refusal to pay for certain medical claims, which can happen due to factors like policy exclusions or claims submitted outside coverage terms. Knowing these distinctions helps policyholders avoid surprise out-of-pocket costs and select plans that best meet their healthcare needs.

Comparison Table

| Aspect | Pre-existing Condition Coverage | Coverage Denial |

|---|---|---|

| Definition | Insurance coverage for health issues existing before policy start | Refusal by insurer to pay claims based on policy terms |

| Scope | Includes treatments related to prior medical conditions | Can apply to any claim, often for pre-existing or excluded conditions |

| Impact on Policyholder | Ensures access to care without extra denial risk | Leads to out-of-pocket costs or legal disputes |

| Regulations | Often regulated to prevent denial (e.g., ACA rules in the USA) | Subject to state and federal insurance laws and appeals process |

| Examples | Coverage for diabetes care after policy issuance | Claim denied due to undisclosed medical history |

Which is better?

Pre-existing condition coverage ensures individuals with prior health issues receive necessary medical care without higher premiums or denial, promoting equitable access to healthcare. Coverage denial often leaves patients vulnerable, forcing them to bear significant out-of-pocket costs or forgo essential treatments. Insurance plans guaranteeing pre-existing condition coverage deliver greater financial protection and peace of mind for policyholders.

Connection

Pre-existing condition coverage directly impacts the likelihood of coverage denial in insurance policies, as insurers often exclude or limit benefits for health issues diagnosed before the policy's effective date. Denial of coverage typically occurs when claims relate to these pre-existing conditions, raising disputes over policy terms and medical documentation. Understanding the insurer's criteria for pre-existing conditions is crucial for policyholders to avoid unexpected claim rejections and ensure adequate protection.

Key Terms

Underwriting

Coverage denial often results from underwriting assessments identifying specific risks that fall outside policy terms, whereas pre-existing condition coverage limits are determined by evaluating an applicant's health history during underwriting. Underwriting uses medical records and risk factors to decide eligibility and premium rates, significantly impacting the availability of coverage for pre-existing conditions. Explore more insights into underwriting practices and their influence on insurance coverage decisions.

Exclusion

Coverage denial often arises when insurance providers identify specific exclusions in a policy, preventing claims related to certain conditions or treatments. Pre-existing condition coverage exclusions specifically deny claims for health issues that existed prior to the start of the insurance contract, limiting coverage options for affected individuals. Explore in-depth insights on how exclusions impact your insurance benefits and protect your rights.

Waiting period

Coverage denial often results from policy exclusions related to pre-existing conditions, with insurers imposing waiting periods that can extend from several months to over a year before benefits apply. Pre-existing condition coverage typically activates only after these waiting periods, designed to mitigate risk for insurers while protecting patients from immediate denial of claims. Explore more about how waiting periods impact your insurance benefits and choices.

Source and External Links

Denial of Claim - Denial of claim occurs when an insurance company refuses to cover the cost of a medical treatment provided by a healthcare professional.

Navigating Insurance Denials and Filing Appeals - This resource provides guidance on understanding and appealing insurance denials for medical treatments or procedures.

Where to Start if Insurance Has Denied Your Service - Offers steps to follow if your insurance plan denies a medical claim, including understanding your appeal rights and process.

dowidth.com

dowidth.com