Pet health insurance covers veterinary expenses, including surgeries, medications, and routine care for cats, dogs, and other pets, ensuring affordable access to medical treatment. Life insurance provides financial security by offering death benefits to beneficiaries, helping cover expenses such as mortgage payments, debts, and living costs after the policyholder's passing. Explore the key differences between pet health insurance and life insurance to secure the best protection for your loved ones.

Why it is important

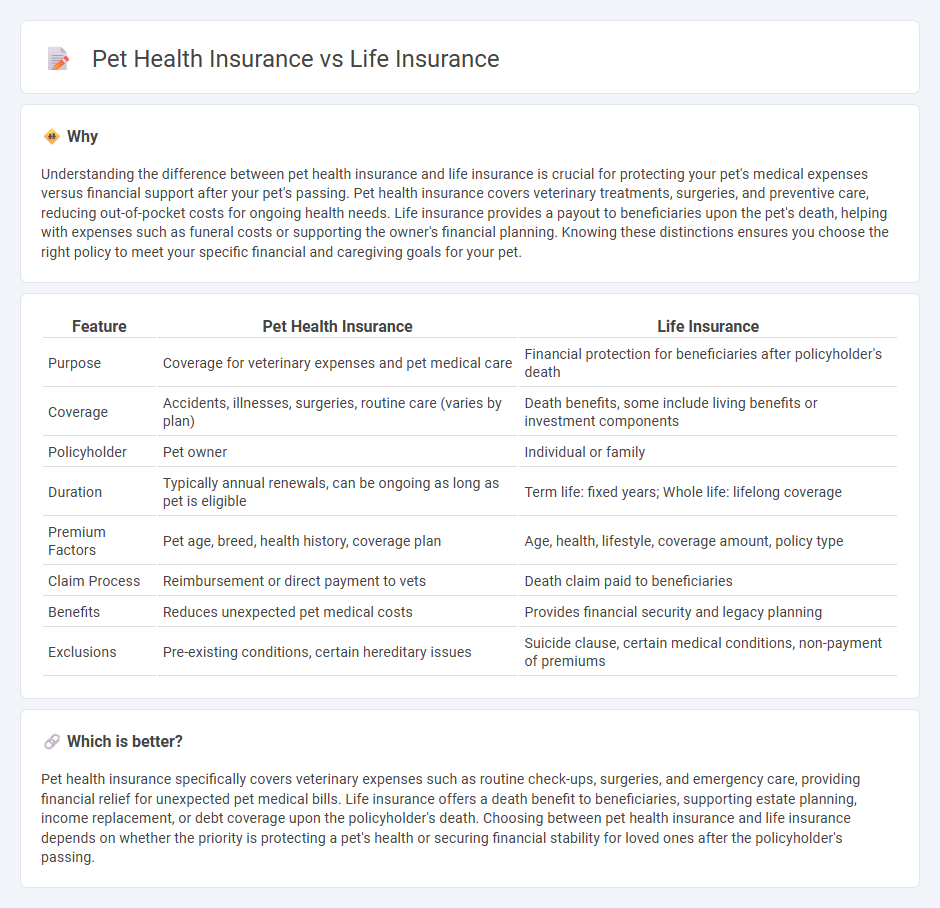

Understanding the difference between pet health insurance and life insurance is crucial for protecting your pet's medical expenses versus financial support after your pet's passing. Pet health insurance covers veterinary treatments, surgeries, and preventive care, reducing out-of-pocket costs for ongoing health needs. Life insurance provides a payout to beneficiaries upon the pet's death, helping with expenses such as funeral costs or supporting the owner's financial planning. Knowing these distinctions ensures you choose the right policy to meet your specific financial and caregiving goals for your pet.

Comparison Table

| Feature | Pet Health Insurance | Life Insurance |

|---|---|---|

| Purpose | Coverage for veterinary expenses and pet medical care | Financial protection for beneficiaries after policyholder's death |

| Coverage | Accidents, illnesses, surgeries, routine care (varies by plan) | Death benefits, some include living benefits or investment components |

| Policyholder | Pet owner | Individual or family |

| Duration | Typically annual renewals, can be ongoing as long as pet is eligible | Term life: fixed years; Whole life: lifelong coverage |

| Premium Factors | Pet age, breed, health history, coverage plan | Age, health, lifestyle, coverage amount, policy type |

| Claim Process | Reimbursement or direct payment to vets | Death claim paid to beneficiaries |

| Benefits | Reduces unexpected pet medical costs | Provides financial security and legacy planning |

| Exclusions | Pre-existing conditions, certain hereditary issues | Suicide clause, certain medical conditions, non-payment of premiums |

Which is better?

Pet health insurance specifically covers veterinary expenses such as routine check-ups, surgeries, and emergency care, providing financial relief for unexpected pet medical bills. Life insurance offers a death benefit to beneficiaries, supporting estate planning, income replacement, or debt coverage upon the policyholder's death. Choosing between pet health insurance and life insurance depends on whether the priority is protecting a pet's health or securing financial stability for loved ones after the policyholder's passing.

Connection

Pet health insurance and life insurance both provide financial protection by covering unexpected health-related expenses; pet health insurance specifically offsets veterinary costs, while life insurance safeguards beneficiaries against income loss due to the policyholder's death. Both insurance types involve risk assessment, premium payments, and claims processes designed to manage uncertainties tied to wellbeing and life expectancy. Integration of these policies in a household enhances comprehensive coverage, ensuring economic stability for both the insured and their dependents, including pets.

Key Terms

Life Insurance:

Life insurance provides crucial financial security by offering beneficiaries a lump sum payment upon the insured person's death, helping cover expenses like mortgage, debts, and living costs. Policy types include term, whole, and universal life insurance, each with unique benefits tailored to different financial goals and timelines. Discover comprehensive options to safeguard your family's future and learn how life insurance compares to pet health insurance.

Beneficiary

Life insurance policies designate beneficiaries who receive the payout upon the policyholder's death, often family members or dependents, ensuring financial support. Pet health insurance, however, does not have beneficiaries; instead, it reimburses the policyholder for eligible veterinary expenses, directly covering the pet's medical costs. Explore the distinct roles beneficiaries play in these insurances to understand how each policy serves your financial protection goals.

Death Benefit

Life insurance provides a death benefit to beneficiaries, offering financial security and covering expenses such as funeral costs and loss of income. Pet health insurance, on the other hand, typically does not include a death benefit but focuses on reimbursing veterinary bills and medical treatments. Explore the distinctions between these insurance types to determine which best suits your needs.

Source and External Links

Life Insurance Policy - Get a Free Quote - Aflac offers term, whole, and final expense life insurance policies that provide a death benefit to beneficiaries upon the policyholder's death, with options including guaranteed-issue and no medical questions for select products.

Life Insurance | Get Your Quote Today - Allstate provides customizable life insurance policies including permanent types like whole, universal, and variable life insurance, designed to protect loved ones financially by covering expenses, debts, and future needs.

Life Insurance - Get a Free Quote Now - Geico explains various life insurance types such as term, whole, and universal life insurance, helping customers estimate their coverage needs and offering options like no-medical-exam policies to ease the application process.

dowidth.com

dowidth.com