Cyber risk insurance covers financial losses from data breaches, hacking incidents, and cyberattacks, protecting businesses from digital threats. Umbrella insurance provides extra liability coverage beyond standard policies, safeguarding assets against large claims in cases such as bodily injury or property damage. Discover how to choose the right insurance to protect your business from diverse risks.

Why it is important

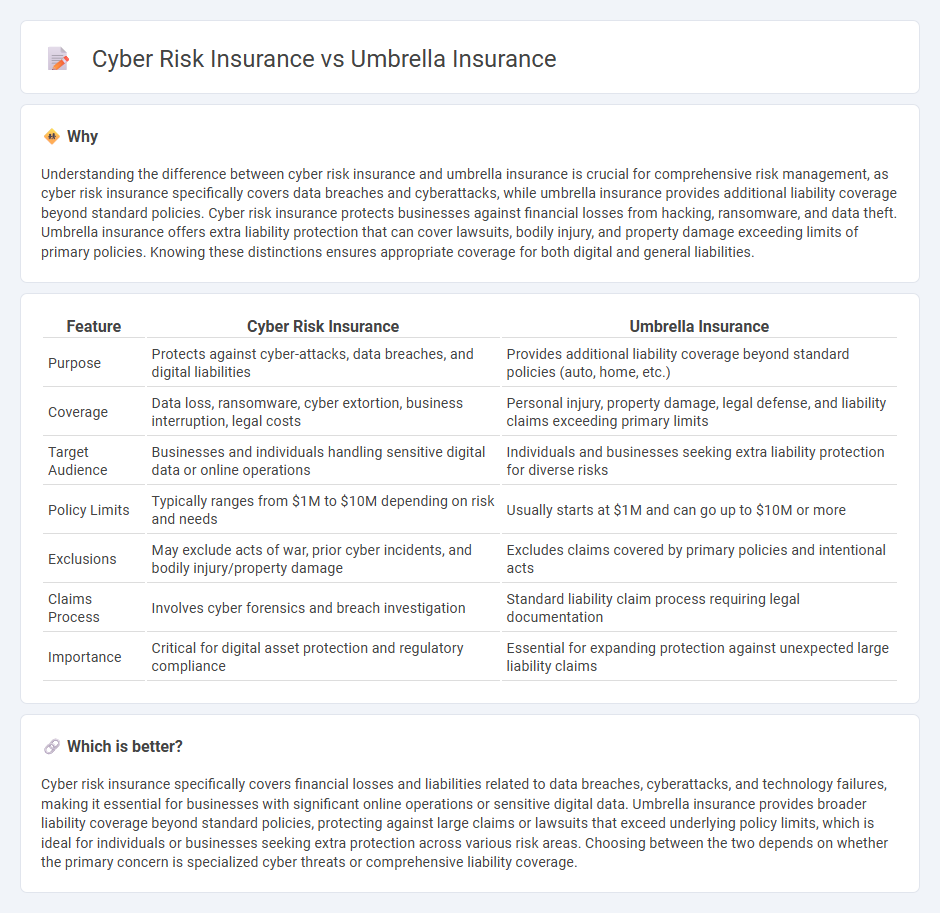

Understanding the difference between cyber risk insurance and umbrella insurance is crucial for comprehensive risk management, as cyber risk insurance specifically covers data breaches and cyberattacks, while umbrella insurance provides additional liability coverage beyond standard policies. Cyber risk insurance protects businesses against financial losses from hacking, ransomware, and data theft. Umbrella insurance offers extra liability protection that can cover lawsuits, bodily injury, and property damage exceeding limits of primary policies. Knowing these distinctions ensures appropriate coverage for both digital and general liabilities.

Comparison Table

| Feature | Cyber Risk Insurance | Umbrella Insurance |

|---|---|---|

| Purpose | Protects against cyber-attacks, data breaches, and digital liabilities | Provides additional liability coverage beyond standard policies (auto, home, etc.) |

| Coverage | Data loss, ransomware, cyber extortion, business interruption, legal costs | Personal injury, property damage, legal defense, and liability claims exceeding primary limits |

| Target Audience | Businesses and individuals handling sensitive digital data or online operations | Individuals and businesses seeking extra liability protection for diverse risks |

| Policy Limits | Typically ranges from $1M to $10M depending on risk and needs | Usually starts at $1M and can go up to $10M or more |

| Exclusions | May exclude acts of war, prior cyber incidents, and bodily injury/property damage | Excludes claims covered by primary policies and intentional acts |

| Claims Process | Involves cyber forensics and breach investigation | Standard liability claim process requiring legal documentation |

| Importance | Critical for digital asset protection and regulatory compliance | Essential for expanding protection against unexpected large liability claims |

Which is better?

Cyber risk insurance specifically covers financial losses and liabilities related to data breaches, cyberattacks, and technology failures, making it essential for businesses with significant online operations or sensitive digital data. Umbrella insurance provides broader liability coverage beyond standard policies, protecting against large claims or lawsuits that exceed underlying policy limits, which is ideal for individuals or businesses seeking extra protection across various risk areas. Choosing between the two depends on whether the primary concern is specialized cyber threats or comprehensive liability coverage.

Connection

Cyber risk insurance and umbrella insurance are connected through their complementary roles in providing comprehensive liability coverage. Cyber risk insurance specifically addresses data breaches, cyberattacks, and related digital liabilities, whereas umbrella insurance extends the liability limits beyond primary policies, including cyber-related claims if those limits are exceeded. Together, they ensure broader financial protection against the increasing threats in cybersecurity and other liability risks.

Key Terms

Liability Coverage

Umbrella insurance extends liability coverage beyond the limits of homeowners, auto, and other primary policies, offering protection against large claims or lawsuits, typically up to $1 million or more. Cyber risk insurance focuses specifically on liabilities arising from data breaches, cyberattacks, and other digital threats, covering costs such as legal fees, notification expenses, and reputational damage. Explore the distinct liability coverages of umbrella and cyber risk insurance to understand which policy best safeguards your assets.

Data Breach

Umbrella insurance provides broad liability coverage extending beyond standard policies, but it generally excludes specific cyber risk exposures like data breaches. Cyber risk insurance specifically covers losses related to data breaches, including notification costs, legal fees, and regulatory fines, offering targeted financial protection in digital security incidents. Explore detailed comparisons to understand which policy best secures your digital assets against evolving cyber threats.

Excess Coverage

Umbrella insurance provides excess liability coverage beyond the limits of underlying policies such as auto and homeowners insurance, offering broad protection against bodily injury, property damage, and personal liability claims. Cyber risk insurance specifically addresses costs related to data breaches, cyberattacks, and network security failures, including notification expenses, legal fees, and business interruption losses that umbrella policies typically exclude. Explore how integrating excess umbrella and cyber risk insurance can create a comprehensive defense strategy for both physical and digital liabilities.

Source and External Links

Umbrella Insurance - Provides additional liability coverage beyond existing insurance policies like auto or homeowners insurance, often covering broader risks and acting as primary insurance for certain claims.

Umbrella Policy: What is it and when do you need one? - Explains how umbrella policies protect assets by covering large medical and repair bills, often starting at $300,000 and providing coverage for various unforeseen events.

Umbrella Insurance: What It Is & What It Covers - Describes umbrella insurance as a form of liability coverage that helps protect against significant claims or judgments, often covering bodily injury, property damage, and more.

dowidth.com

dowidth.com