Digital nomad insurance offers comprehensive coverage tailored to individuals working remotely while traveling internationally, addressing unique risks like trip interruptions and global healthcare access. Freelancer insurance focuses on protecting self-employed professionals with policies covering liability, equipment, and income loss specific to their home base. Explore the key differences to choose the best insurance solution for your freelance or nomadic lifestyle.

Why it is important

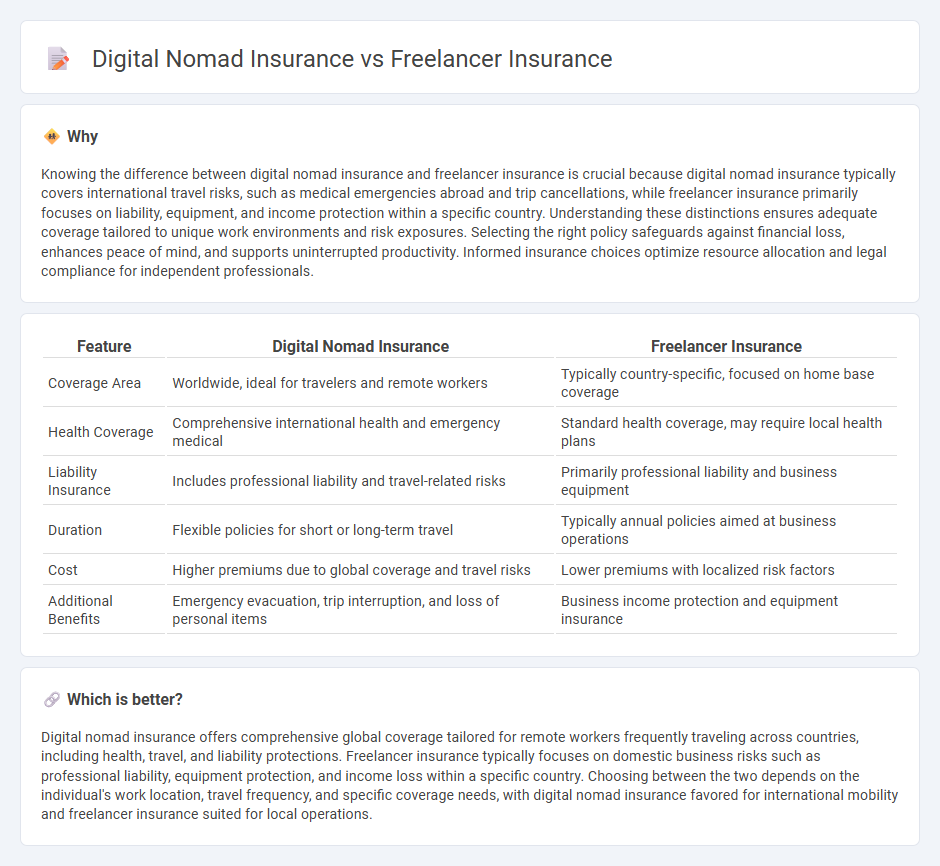

Knowing the difference between digital nomad insurance and freelancer insurance is crucial because digital nomad insurance typically covers international travel risks, such as medical emergencies abroad and trip cancellations, while freelancer insurance primarily focuses on liability, equipment, and income protection within a specific country. Understanding these distinctions ensures adequate coverage tailored to unique work environments and risk exposures. Selecting the right policy safeguards against financial loss, enhances peace of mind, and supports uninterrupted productivity. Informed insurance choices optimize resource allocation and legal compliance for independent professionals.

Comparison Table

| Feature | Digital Nomad Insurance | Freelancer Insurance |

|---|---|---|

| Coverage Area | Worldwide, ideal for travelers and remote workers | Typically country-specific, focused on home base coverage |

| Health Coverage | Comprehensive international health and emergency medical | Standard health coverage, may require local health plans |

| Liability Insurance | Includes professional liability and travel-related risks | Primarily professional liability and business equipment |

| Duration | Flexible policies for short or long-term travel | Typically annual policies aimed at business operations |

| Cost | Higher premiums due to global coverage and travel risks | Lower premiums with localized risk factors |

| Additional Benefits | Emergency evacuation, trip interruption, and loss of personal items | Business income protection and equipment insurance |

Which is better?

Digital nomad insurance offers comprehensive global coverage tailored for remote workers frequently traveling across countries, including health, travel, and liability protections. Freelancer insurance typically focuses on domestic business risks such as professional liability, equipment protection, and income loss within a specific country. Choosing between the two depends on the individual's work location, travel frequency, and specific coverage needs, with digital nomad insurance favored for international mobility and freelancer insurance suited for local operations.

Connection

Digital nomad insurance and freelancer insurance both cater to the needs of independent workers by offering tailored coverage for health, liability, and income protection in flexible work environments. These insurance types address the unique risks faced by remote professionals, including travel-related health issues and client disputes, ensuring continuous security regardless of location. By combining global health coverage with freelance-specific liability protection, they create a comprehensive safety net for mobile workers.

Key Terms

Liability Coverage

Freelancer insurance typically offers tailored liability coverage that protects against client claims related to property damage or bodily injury during work engagements, while digital nomad insurance extends this protection globally, often including international legal liability and personal property risks. Both plans aim to shield professionals from financial losses due to lawsuits or damages, but digital nomad insurance adapts to the challenges of working remotely across multiple countries. Discover the key differences and find the ideal coverage for your freelance lifestyle.

International Portability

Freelancer insurance often provides coverage limited to a specific country, while digital nomad insurance emphasizes international portability, ensuring protection across multiple borders and varying healthcare systems. Key features include global emergency medical coverage, trip interruption benefits, and flexible policy terms adaptable to changing locations. Explore the best options tailored for your lifestyle to secure seamless international insurance coverage.

Income Protection

Freelancer insurance primarily covers income protection by compensating for lost earnings due to illness or injury, ensuring financial stability during periods of unable work. Digital nomad insurance often includes income protection but is tailored to the needs of remote global workers, including coverage for travel-related risks and health emergencies abroad. Explore in-depth comparisons of income protection benefits to choose the best fit for your professional lifestyle.

Source and External Links

A Guide to Insurance for Freelance Professionals - Covers essential insurance types for freelancers including health, professional liability, general liability, and business insurance, highlighting the need for financial protection and peace of mind in freelancing.

Freelancer Business Insurance: Get Fast & Free Quotes - Details important freelancers' insurance policies like general liability, professional (errors and omissions) liability, workers' compensation, cyber insurance, and business vehicle coverage, emphasizing protection from lawsuits and financial risks.

Freelancers liability insurance: What you need to know - Explains different liability insurance options for freelancers, including professional liability for service errors, general liability for bodily injury or property damage, and cyber security insurance to protect against data breaches.

dowidth.com

dowidth.com