Silent cyber coverage refers to implicit protection against cyber risks embedded within traditional insurance policies, often without explicit cyber-specific wording, potentially leaving coverage gaps for businesses facing cyber threats. Standalone cyber insurance, in contrast, offers explicit, dedicated coverage tailored to cyber incidents such as data breaches, ransomware attacks, and business interruption caused by cyber events. Explore the differences and benefits of each to determine the best cyber risk management strategy for your organization.

Why it is important

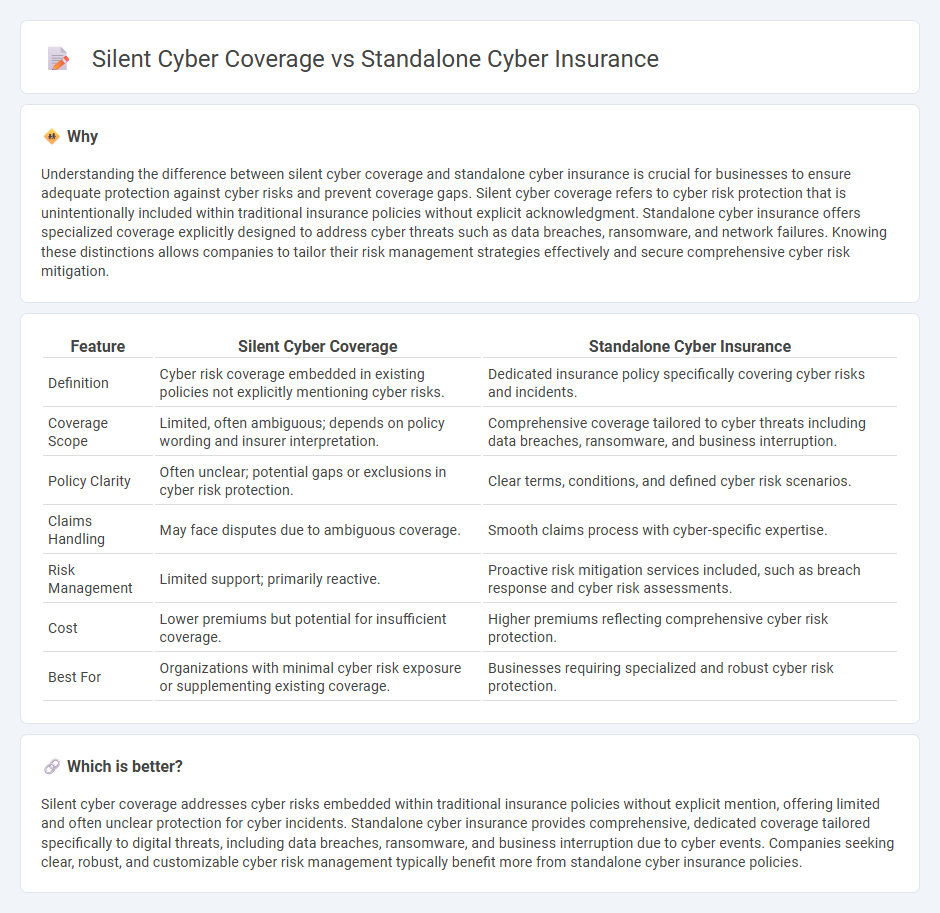

Understanding the difference between silent cyber coverage and standalone cyber insurance is crucial for businesses to ensure adequate protection against cyber risks and prevent coverage gaps. Silent cyber coverage refers to cyber risk protection that is unintentionally included within traditional insurance policies without explicit acknowledgment. Standalone cyber insurance offers specialized coverage explicitly designed to address cyber threats such as data breaches, ransomware, and network failures. Knowing these distinctions allows companies to tailor their risk management strategies effectively and secure comprehensive cyber risk mitigation.

Comparison Table

| Feature | Silent Cyber Coverage | Standalone Cyber Insurance |

|---|---|---|

| Definition | Cyber risk coverage embedded in existing policies not explicitly mentioning cyber risks. | Dedicated insurance policy specifically covering cyber risks and incidents. |

| Coverage Scope | Limited, often ambiguous; depends on policy wording and insurer interpretation. | Comprehensive coverage tailored to cyber threats including data breaches, ransomware, and business interruption. |

| Policy Clarity | Often unclear; potential gaps or exclusions in cyber risk protection. | Clear terms, conditions, and defined cyber risk scenarios. |

| Claims Handling | May face disputes due to ambiguous coverage. | Smooth claims process with cyber-specific expertise. |

| Risk Management | Limited support; primarily reactive. | Proactive risk mitigation services included, such as breach response and cyber risk assessments. |

| Cost | Lower premiums but potential for insufficient coverage. | Higher premiums reflecting comprehensive cyber risk protection. |

| Best For | Organizations with minimal cyber risk exposure or supplementing existing coverage. | Businesses requiring specialized and robust cyber risk protection. |

Which is better?

Silent cyber coverage addresses cyber risks embedded within traditional insurance policies without explicit mention, offering limited and often unclear protection for cyber incidents. Standalone cyber insurance provides comprehensive, dedicated coverage tailored specifically to digital threats, including data breaches, ransomware, and business interruption due to cyber events. Companies seeking clear, robust, and customizable cyber risk management typically benefit more from standalone cyber insurance policies.

Connection

Silent cyber coverage refers to the unintentional inclusion of cyber risk protection within traditional insurance policies, while standalone cyber insurance specifically targets cyber threats with dedicated coverage. Both address cyber risk exposure but standalone cyber insurance offers clearer, explicit protection, reducing ambiguity associated with silent cyber risks. The connection lies in evolving insurer practices to explicitly manage cyber threats, ensuring comprehensive risk mitigation for businesses.

Key Terms

Explicit Coverage

Standalone cyber insurance provides explicit coverage tailored specifically for cyber risks, offering clear protection against data breaches, ransomware, and cyberattacks. Silent cyber coverage refers to cyber risk exposures that are unintentionally included in traditional policies without explicit terms, creating potential gaps or ambiguities in coverage. Discover more about how explicit cyber insurance coverage safeguards your business from evolving digital threats.

Policy Exclusions

Standalone cyber insurance policies explicitly define coverage limits and specific cyber risks, often minimizing policy exclusions related to silent cyber risks. Silent cyber coverage, embedded in traditional insurance policies, tends to have broader and less transparent exclusions, which can lead to unpredictable claim denials due to ambiguous cyber event interpretations. Explore detailed differences in policy exclusions to better understand risk management options and coverage adequacy.

Risk Aggregation

Standalone cyber insurance provides explicit coverage tailored to digital risks, allowing precise risk aggregation and management of cyber exposure. Silent cyber coverage, embedded within traditional policies, often lacks clear terms, leading to potential underestimation of aggregated cyber risks. Explore more to understand how effective risk aggregation influences cyber insurance strategies.

Source and External Links

An Introduction to Cyber - American Academy of Actuaries - This document provides an overview of standalone cyber insurance policies developed to cover losses resulting from cyber breaches and privacy violations not covered by traditional insurance policies.

Cyber Insurance for Small Businesses: BOP vs. Standalone Cyber - This article compares Business Owner Policies (BOP) with cyber extensions to standalone cyber insurance, highlighting the benefits of specialized coverage for small businesses.

Cowbell Adaptive Cyber Insurance - Cowbell offers customized standalone cyber insurance programs tailored to enterprises with unique risk exposures, providing comprehensive coverage for various industries.

dowidth.com

dowidth.com