Decoupled insurance separates risk assessment and capital providers, enabling more flexible and efficient coverage solutions tailored to specific needs. Parametric insurance offers predefined payouts triggered by measurable events, such as weather data or natural disasters, reducing claims processing time and enhancing transparency. Explore how these innovative insurance models can transform risk management strategies.

Why it is important

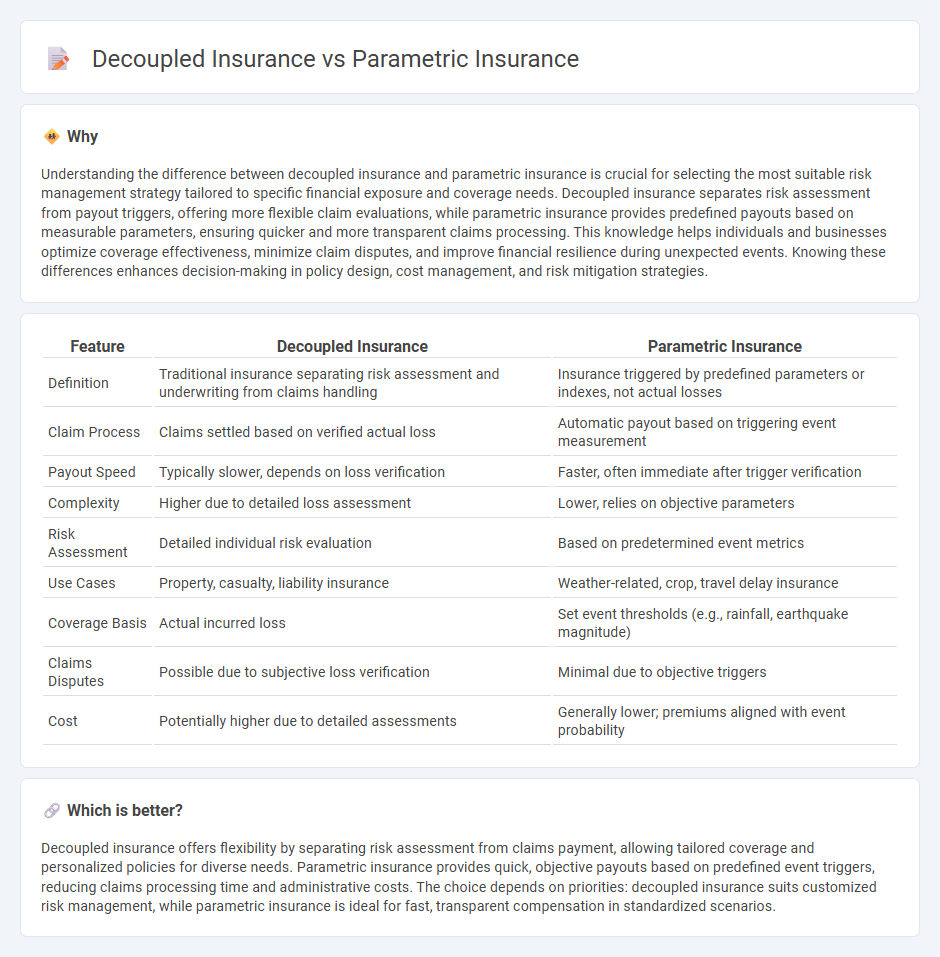

Understanding the difference between decoupled insurance and parametric insurance is crucial for selecting the most suitable risk management strategy tailored to specific financial exposure and coverage needs. Decoupled insurance separates risk assessment from payout triggers, offering more flexible claim evaluations, while parametric insurance provides predefined payouts based on measurable parameters, ensuring quicker and more transparent claims processing. This knowledge helps individuals and businesses optimize coverage effectiveness, minimize claim disputes, and improve financial resilience during unexpected events. Knowing these differences enhances decision-making in policy design, cost management, and risk mitigation strategies.

Comparison Table

| Feature | Decoupled Insurance | Parametric Insurance |

|---|---|---|

| Definition | Traditional insurance separating risk assessment and underwriting from claims handling | Insurance triggered by predefined parameters or indexes, not actual losses |

| Claim Process | Claims settled based on verified actual loss | Automatic payout based on triggering event measurement |

| Payout Speed | Typically slower, depends on loss verification | Faster, often immediate after trigger verification |

| Complexity | Higher due to detailed loss assessment | Lower, relies on objective parameters |

| Risk Assessment | Detailed individual risk evaluation | Based on predetermined event metrics |

| Use Cases | Property, casualty, liability insurance | Weather-related, crop, travel delay insurance |

| Coverage Basis | Actual incurred loss | Set event thresholds (e.g., rainfall, earthquake magnitude) |

| Claims Disputes | Possible due to subjective loss verification | Minimal due to objective triggers |

| Cost | Potentially higher due to detailed assessments | Generally lower; premiums aligned with event probability |

Which is better?

Decoupled insurance offers flexibility by separating risk assessment from claims payment, allowing tailored coverage and personalized policies for diverse needs. Parametric insurance provides quick, objective payouts based on predefined event triggers, reducing claims processing time and administrative costs. The choice depends on priorities: decoupled insurance suits customized risk management, while parametric insurance is ideal for fast, transparent compensation in standardized scenarios.

Connection

Decoupled insurance separates risk coverage from traditional indemnity-based claims, relying on pre-agreed triggers rather than loss assessments. Parametric insurance operates on a similar principle by paying out predetermined amounts based on measurable parameters like weather events or natural disasters. Both models streamline claims processing, reduce moral hazard, and enhance transparency in risk transfer mechanisms.

Key Terms

Trigger Event (Parametric)

Parametric insurance activates payout based on predefined trigger events such as specific weather conditions, seismic readings, or other quantifiable metrics, eliminating the need for traditional loss assessments. Decoupled insurance separates the trigger event from the indemnity payment, allowing flexibility but often requiring more complex claims processing. Explore the nuances of trigger event mechanisms to understand how parametric solutions deliver faster, data-driven risk management.

Indemnity Coverage (Decoupled)

Parametric insurance triggers payouts based on predefined parameters like weather data, offering rapid claims resolution without assessing actual losses, whereas decoupled insurance provides indemnity coverage that compensates policyholders for verified financial losses independent of traditional risks. Indemnity coverage under decoupled insurance ensures precise reimbursement corresponding to the loss magnitude, enhancing financial protection and risk management for businesses. Explore how decoupled indemnity insurance can safeguard your assets with tailored compensation solutions.

Payout Structure

Parametric insurance offers fixed, pre-agreed payouts based on the occurrence of specific triggers like weather events or natural disasters, enabling swift claims processing without loss assessment. Decoupled insurance separates the risk measurement and indemnity calculation, allowing for more flexible payout structures tailored to actual losses rather than fixed parameters. Explore the nuances and benefits of each payout model to optimize your risk management strategy.

Source and External Links

What is parametric insurance? - Swiss Re Corporate Solutions - Parametric insurance covers the probability of a loss-causing event by paying out when a pre-defined threshold is met, such as earthquake magnitude or tropical cyclone wind speed.

Parametric Insurance Solutions - Amwins - Parametric insurance policies pay based on pre-defined event triggers, offering quick payouts without requiring extensive loss assessment, making them beneficial for disaster recovery.

Parametric insurance - Wikipedia - Parametric insurance provides pre-specified payouts based on trigger events, differing from traditional indemnity insurance by focusing on event parameters rather than actual losses.

dowidth.com

dowidth.com