Peer-to-peer insurance enables groups of individuals to pool resources and share risks without relying on traditional insurers, often resulting in lower premiums and greater transparency. Microinsurance targets low-income populations, offering affordable, limited-coverage policies designed to protect against specific risks like health issues, crop failures, or natural disasters. Explore the distinct features and benefits of these innovative insurance models to understand which best suits your needs.

Why it is important

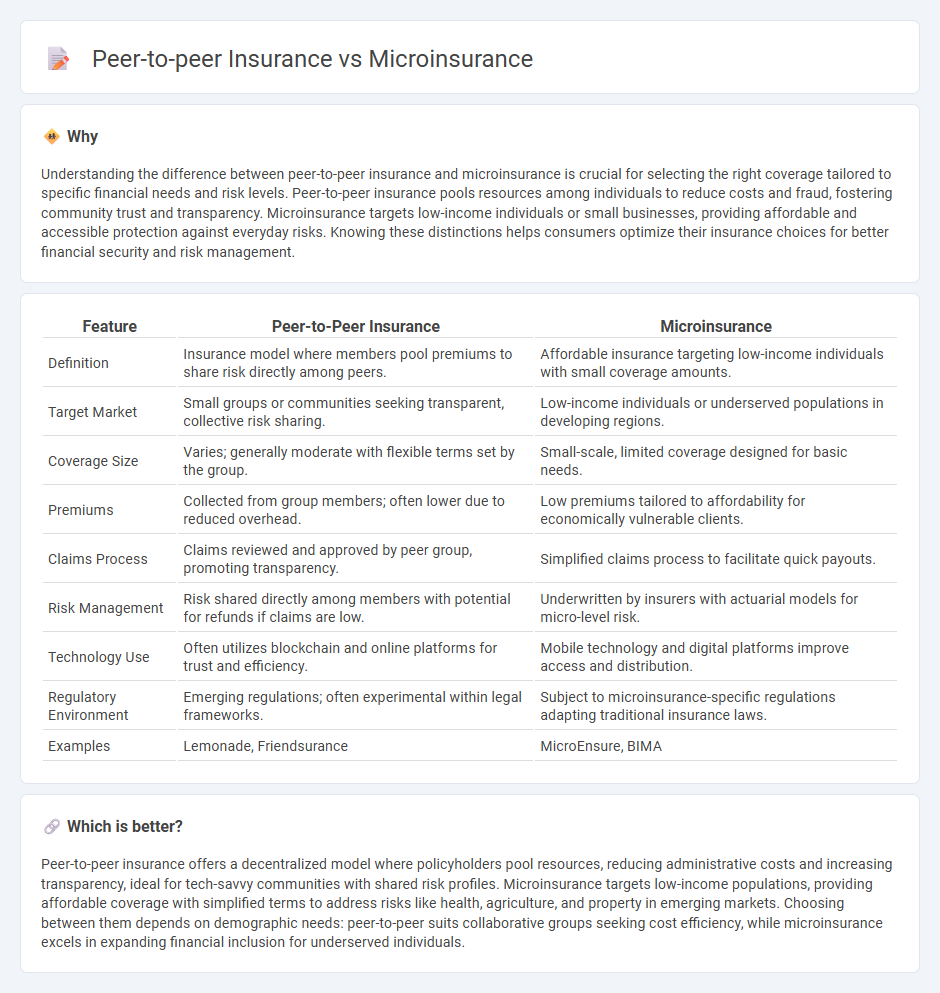

Understanding the difference between peer-to-peer insurance and microinsurance is crucial for selecting the right coverage tailored to specific financial needs and risk levels. Peer-to-peer insurance pools resources among individuals to reduce costs and fraud, fostering community trust and transparency. Microinsurance targets low-income individuals or small businesses, providing affordable and accessible protection against everyday risks. Knowing these distinctions helps consumers optimize their insurance choices for better financial security and risk management.

Comparison Table

| Feature | Peer-to-Peer Insurance | Microinsurance |

|---|---|---|

| Definition | Insurance model where members pool premiums to share risk directly among peers. | Affordable insurance targeting low-income individuals with small coverage amounts. |

| Target Market | Small groups or communities seeking transparent, collective risk sharing. | Low-income individuals or underserved populations in developing regions. |

| Coverage Size | Varies; generally moderate with flexible terms set by the group. | Small-scale, limited coverage designed for basic needs. |

| Premiums | Collected from group members; often lower due to reduced overhead. | Low premiums tailored to affordability for economically vulnerable clients. |

| Claims Process | Claims reviewed and approved by peer group, promoting transparency. | Simplified claims process to facilitate quick payouts. |

| Risk Management | Risk shared directly among members with potential for refunds if claims are low. | Underwritten by insurers with actuarial models for micro-level risk. |

| Technology Use | Often utilizes blockchain and online platforms for trust and efficiency. | Mobile technology and digital platforms improve access and distribution. |

| Regulatory Environment | Emerging regulations; often experimental within legal frameworks. | Subject to microinsurance-specific regulations adapting traditional insurance laws. |

| Examples | Lemonade, Friendsurance | MicroEnsure, BIMA |

Which is better?

Peer-to-peer insurance offers a decentralized model where policyholders pool resources, reducing administrative costs and increasing transparency, ideal for tech-savvy communities with shared risk profiles. Microinsurance targets low-income populations, providing affordable coverage with simplified terms to address risks like health, agriculture, and property in emerging markets. Choosing between them depends on demographic needs: peer-to-peer suits collaborative groups seeking cost efficiency, while microinsurance excels in expanding financial inclusion for underserved individuals.

Connection

Peer-to-peer insurance and microinsurance both focus on enhancing affordability and accessibility by pooling risks among small groups or low-income individuals. Peer-to-peer insurance leverages community-based risk sharing to reduce costs, while microinsurance provides tailored coverage for underserved markets with limited resources. Together, they promote inclusive financial protection by addressing gaps in traditional insurance through innovative, grassroots approaches.

Key Terms

Risk Pooling

Microinsurance and peer-to-peer insurance both rely on risk pooling to spread potential losses across a large group, enhancing financial protection for participants. While microinsurance typically involves pooling risks among low-income individuals through formal insurers and reinsurers, peer-to-peer insurance leverages decentralized groups where members mutually share risk and claims directly. Explore the differences in risk pooling mechanisms and benefits between these models to understand their impact on affordable coverage.

Premium Structure

Microinsurance typically features low, fixed premium payments tailored to low-income populations, ensuring affordability and consistent coverage. Peer-to-peer insurance employs a flexible premium structure based on group risk pools, where premiums can be adjusted according to collective claims experience, promoting transparency and potential cost savings. Explore how these premium models impact customer engagement and risk management strategies in the insurance sector.

Claims Process

Microinsurance typically offers streamlined claims processes with simplified documentation to accommodate low-income clients, enabling faster disbursement of benefits. Peer-to-peer insurance leverages community-based risk sharing, often using digital platforms to enhance transparency and speed in claims adjudication. Explore how these models optimize claims handling and customer experience for deeper insights.

Source and External Links

Background on Microinsurance and Emerging Markets - Microinsurance provides low-cost insurance to individuals in developing countries, often through partnerships with microfinance institutions and offering diverse products like crop and livestock insurance.

Microinsurance | Milliman - Microinsurance is designed for low-income individuals and families, focusing on price, terms, coverage, and delivery, protecting them against risks that can perpetuate poverty.

Microinsurance Network - The Microinsurance Network is a global organization working to promote the development and delivery of risk management tools for low-income populations worldwide.

dowidth.com

dowidth.com