Cyber insurance protects businesses and individuals from financial losses related to cyberattacks, data breaches, and online fraud, covering expenses like legal fees and notification costs. Travel insurance provides coverage for trip cancellations, medical emergencies abroad, lost luggage, and travel delays, ensuring financial protection while traveling. Explore the key differences between cyber insurance and travel insurance to determine which coverage best suits your needs.

Why it is important

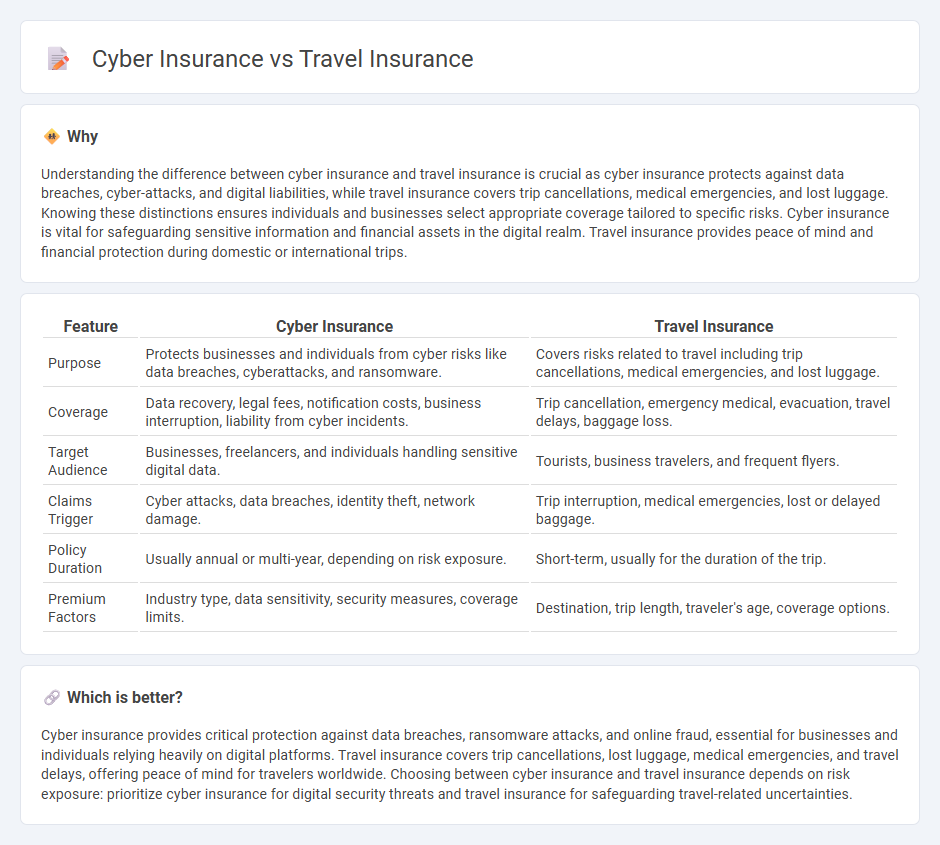

Understanding the difference between cyber insurance and travel insurance is crucial as cyber insurance protects against data breaches, cyber-attacks, and digital liabilities, while travel insurance covers trip cancellations, medical emergencies, and lost luggage. Knowing these distinctions ensures individuals and businesses select appropriate coverage tailored to specific risks. Cyber insurance is vital for safeguarding sensitive information and financial assets in the digital realm. Travel insurance provides peace of mind and financial protection during domestic or international trips.

Comparison Table

| Feature | Cyber Insurance | Travel Insurance |

|---|---|---|

| Purpose | Protects businesses and individuals from cyber risks like data breaches, cyberattacks, and ransomware. | Covers risks related to travel including trip cancellations, medical emergencies, and lost luggage. |

| Coverage | Data recovery, legal fees, notification costs, business interruption, liability from cyber incidents. | Trip cancellation, emergency medical, evacuation, travel delays, baggage loss. |

| Target Audience | Businesses, freelancers, and individuals handling sensitive digital data. | Tourists, business travelers, and frequent flyers. |

| Claims Trigger | Cyber attacks, data breaches, identity theft, network damage. | Trip interruption, medical emergencies, lost or delayed baggage. |

| Policy Duration | Usually annual or multi-year, depending on risk exposure. | Short-term, usually for the duration of the trip. |

| Premium Factors | Industry type, data sensitivity, security measures, coverage limits. | Destination, trip length, traveler's age, coverage options. |

Which is better?

Cyber insurance provides critical protection against data breaches, ransomware attacks, and online fraud, essential for businesses and individuals relying heavily on digital platforms. Travel insurance covers trip cancellations, lost luggage, medical emergencies, and travel delays, offering peace of mind for travelers worldwide. Choosing between cyber insurance and travel insurance depends on risk exposure: prioritize cyber insurance for digital security threats and travel insurance for safeguarding travel-related uncertainties.

Connection

Cyber insurance and travel insurance intersect through coverage for risks faced by travelers using digital devices and online services abroad. Cyber insurance protects against data breaches, identity theft, and cyberattacks on personal devices, which are common vulnerabilities during international travel. Travel insurance complements this by covering trip interruptions, theft of devices, and emergency assistance, creating a comprehensive safety net for tech-reliant travelers.

Key Terms

**Travel Insurance:**

Travel insurance provides financial protection against trip cancellations, medical emergencies, lost luggage, and travel delays, ensuring peace of mind during domestic and international trips. Policies often cover emergency medical evacuation, trip interruption, and coverage for unforeseen events like natural disasters or political unrest. Explore comprehensive travel insurance options to safeguard your journey and learn how to select the best plan for your travel needs.

Trip Cancellation

Trip cancellation coverage in travel insurance reimburses non-refundable expenses due to unforeseen events like illness or weather disruptions. Cyber insurance, while primarily focused on digital risks, may offer coverage for trip cancellation if it results from cyber-related incidents such as data breaches affecting travel bookings. Explore detailed comparisons to understand which policy best safeguards your travel plans against cancellations.

Emergency Medical Coverage

Emergency medical coverage in travel insurance provides protection for unexpected health issues or accidents occurring abroad, including hospital stays, medical treatments, and emergency evacuation. Cyber insurance, by contrast, primarily covers financial losses and liabilities related to data breaches, cyberattacks, and online fraud, without support for medical emergencies. Discover the full scope and critical differences between travel and cyber insurance to make an informed choice.

Source and External Links

Travelers Insurance - Offers travel insurance plans that cover trip cancellations, medical expenses, and baggage losses during travel.

Travel Guard - Provides comprehensive travel insurance plans covering trip cancellations, medical emergencies, and lost or delayed baggage.

Squaremouth - Allows users to compare and purchase travel insurance quotes from multiple insurance companies, offering tailored policies for various travel needs.

dowidth.com

dowidth.com