Insurance as a service offers customizable, on-demand coverage through digital platforms, enabling consumers to purchase policies independently and with flexibility. Embedded insurance integrates protection seamlessly into the purchase process of products or services, providing instant coverage without separate transactions. Discover how these innovative insurance models transform risk management and customer experience.

Why it is important

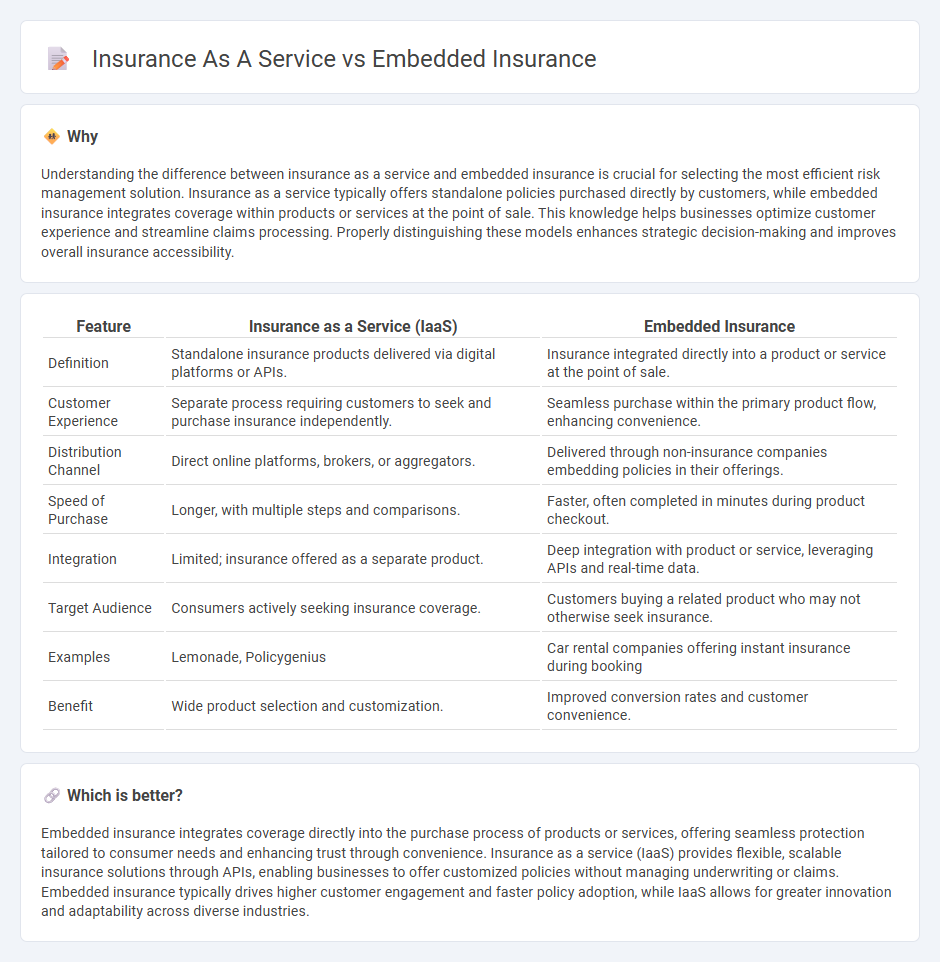

Understanding the difference between insurance as a service and embedded insurance is crucial for selecting the most efficient risk management solution. Insurance as a service typically offers standalone policies purchased directly by customers, while embedded insurance integrates coverage within products or services at the point of sale. This knowledge helps businesses optimize customer experience and streamline claims processing. Properly distinguishing these models enhances strategic decision-making and improves overall insurance accessibility.

Comparison Table

| Feature | Insurance as a Service (IaaS) | Embedded Insurance |

|---|---|---|

| Definition | Standalone insurance products delivered via digital platforms or APIs. | Insurance integrated directly into a product or service at the point of sale. |

| Customer Experience | Separate process requiring customers to seek and purchase insurance independently. | Seamless purchase within the primary product flow, enhancing convenience. |

| Distribution Channel | Direct online platforms, brokers, or aggregators. | Delivered through non-insurance companies embedding policies in their offerings. |

| Speed of Purchase | Longer, with multiple steps and comparisons. | Faster, often completed in minutes during product checkout. |

| Integration | Limited; insurance offered as a separate product. | Deep integration with product or service, leveraging APIs and real-time data. |

| Target Audience | Consumers actively seeking insurance coverage. | Customers buying a related product who may not otherwise seek insurance. |

| Examples | Lemonade, Policygenius | Car rental companies offering instant insurance during booking |

| Benefit | Wide product selection and customization. | Improved conversion rates and customer convenience. |

Which is better?

Embedded insurance integrates coverage directly into the purchase process of products or services, offering seamless protection tailored to consumer needs and enhancing trust through convenience. Insurance as a service (IaaS) provides flexible, scalable insurance solutions through APIs, enabling businesses to offer customized policies without managing underwriting or claims. Embedded insurance typically drives higher customer engagement and faster policy adoption, while IaaS allows for greater innovation and adaptability across diverse industries.

Connection

Insurance as a service leverages digital platforms to offer flexible, on-demand coverage, seamlessly integrating with various customer touchpoints. Embedded insurance integrates these services directly into third-party products or platforms, enabling real-time, contextual insurance offerings. This synergy enhances customer experience by providing instant protection without the need for separate transactions or extensive paperwork.

Key Terms

Distribution Channel

Embedded insurance integrates coverage directly into a product or service purchase, streamlining the customer journey by eliminating the need for separate policy shopping. Insurance as a service (IaaS) offers flexible, API-driven solutions that enable insurers to distribute policies through multiple digital channels, enhancing scalability and customization. Explore how these distribution channels transform insurance accessibility and customer engagement.

Integration

Embedded insurance integrates coverage seamlessly within a product or service purchase, enhancing customer experience by offering tailored protection at the point of sale. Insurance as a service (IaaS) provides modular, API-driven insurance solutions that businesses can customize and integrate into their platforms for flexible, scalable risk management. Explore how companies leverage these models to streamline insurance offerings and improve customer engagement.

Customization

Embedded insurance integrates coverage directly into a product or service purchase, offering tailored protection that aligns with specific customer needs and purchase behaviors. Insurance as a service provides flexible, modular insurance solutions via APIs, enabling businesses to customize policy options and pricing dynamically based on real-time data and customer profiles. Explore deeper insights into how customization shapes these innovative insurance models.

Source and External Links

What is embedded insurance | Chubb - Embedded insurance integrates relevant risk protection directly into customers' purchase journeys, allowing seamless add-on coverage at the point of sale without needing separate purchase steps.

Embedded insurance: Definition, types, benefits - Endava - Embedded insurance is seamlessly offered within a product or service purchase process, making insurance more accessible and enhancing businesses' value proposition by simplifying the buying experience.

The Rise of Embedded Insurance: Opportunities & Challenges - Embedded insurance is transforming the insurance market by embedding coverage into purchase journeys, predicted to reach significant market share and premiums by 2030, driven by improved customer experience and streamlined insurance acquisition.

dowidth.com

dowidth.com