Social prescribing insurance supports holistic health by covering services prescribed outside traditional medical treatments, such as counseling or wellness programs, enhancing overall patient wellbeing. Hospital indemnity insurance provides financial protection by paying fixed cash benefits during hospital stays, helping policyholders manage unexpected medical expenses. Discover how these insurance options can complement each other to optimize health and financial security.

Why it is important

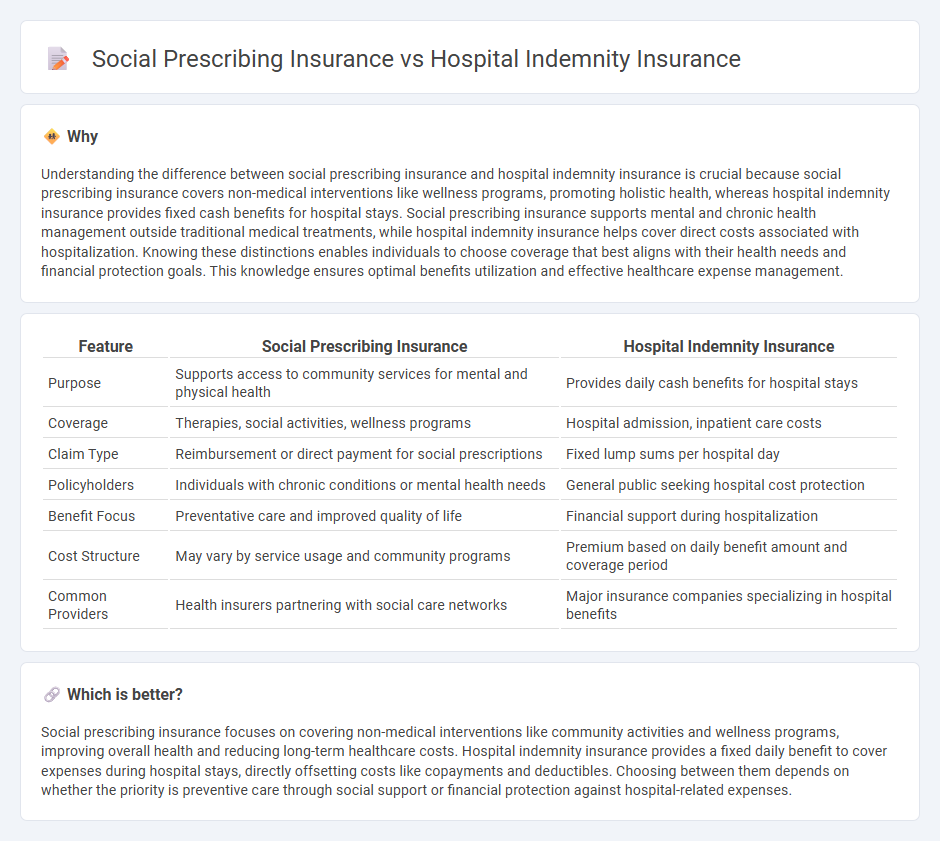

Understanding the difference between social prescribing insurance and hospital indemnity insurance is crucial because social prescribing insurance covers non-medical interventions like wellness programs, promoting holistic health, whereas hospital indemnity insurance provides fixed cash benefits for hospital stays. Social prescribing insurance supports mental and chronic health management outside traditional medical treatments, while hospital indemnity insurance helps cover direct costs associated with hospitalization. Knowing these distinctions enables individuals to choose coverage that best aligns with their health needs and financial protection goals. This knowledge ensures optimal benefits utilization and effective healthcare expense management.

Comparison Table

| Feature | Social Prescribing Insurance | Hospital Indemnity Insurance |

|---|---|---|

| Purpose | Supports access to community services for mental and physical health | Provides daily cash benefits for hospital stays |

| Coverage | Therapies, social activities, wellness programs | Hospital admission, inpatient care costs |

| Claim Type | Reimbursement or direct payment for social prescriptions | Fixed lump sums per hospital day |

| Policyholders | Individuals with chronic conditions or mental health needs | General public seeking hospital cost protection |

| Benefit Focus | Preventative care and improved quality of life | Financial support during hospitalization |

| Cost Structure | May vary by service usage and community programs | Premium based on daily benefit amount and coverage period |

| Common Providers | Health insurers partnering with social care networks | Major insurance companies specializing in hospital benefits |

Which is better?

Social prescribing insurance focuses on covering non-medical interventions like community activities and wellness programs, improving overall health and reducing long-term healthcare costs. Hospital indemnity insurance provides a fixed daily benefit to cover expenses during hospital stays, directly offsetting costs like copayments and deductibles. Choosing between them depends on whether the priority is preventive care through social support or financial protection against hospital-related expenses.

Connection

Social prescribing insurance supports coverage for non-medical interventions that improve overall health outcomes, which can reduce hospital admissions. Hospital indemnity insurance provides direct financial compensation during hospital stays, complementing social prescribing by alleviating the economic burden of inpatient care. Both insurance types enhance comprehensive healthcare by addressing prevention and protection against hospitalization costs.

Key Terms

Lump-sum benefits

Hospital indemnity insurance provides lump-sum cash payments directly to policyholders upon hospital admission, helping cover unexpected out-of-pocket expenses beyond standard healthcare coverage. Social prescribing insurance, a newer concept, may offer lump-sum benefits tied to accessing non-clinical health services such as community activities and wellness programs aimed at holistic well-being. Explore the distinctive features and benefits of these insurance types to determine which aligns best with your healthcare financial planning.

Preventive care coverage

Hospital indemnity insurance provides fixed cash benefits during hospital stays, covering costs like copayments and deductibles but typically excludes broader preventive care services. Social prescribing insurance emphasizes integrative preventive care by funding services such as mental health support, fitness programs, and nutrition counseling to improve overall well-being and reduce hospital admissions. Explore the differences in coverage and benefits to determine which plan best supports your preventive care needs.

Wellness program integration

Hospital indemnity insurance provides fixed cash benefits for hospital stays, focusing on covering out-of-pocket medical expenses, while social prescribing insurance emphasizes holistic health by funding wellness programs like mental health support, nutrition counseling, and physical activities. Wellness program integration in hospital indemnity insurance is limited, often restricted to post-hospitalization recovery, whereas social prescribing insurance actively incorporates community-based health initiatives to reduce hospital admissions and promote preventive care. Explore the advantages of combining social prescribing insurance with hospital indemnity for a comprehensive approach to health and wellness.

Source and External Links

Hospital Indemnity Insurance - What Is It | Anthem - Hospital indemnity insurance is a supplemental plan that pays cash benefits directly to you during a hospital stay to help cover extra expenses beyond your health insurance, such as deductibles, copays, or living costs while recovering, with payments typically based on days hospitalized and no provider network restrictions.

Hospital insurance and Hospital Indemnity - United Healthcare - Hospital indemnity plans provide fixed cash benefits to help pay for hospital-related expenses like deductibles, prescriptions, and transportation, with benefits paid directly to you or your provider regardless of actual costs, helping to manage financial impacts of hospital stays.

Hospital Indemnity Insurance for Individuals - Cigna Healthcare - This insurance helps cover out-of-pocket hospital expenses by paying a fixed dollar amount per covered hospitalization, useable for deductibles, coinsurance, prescriptions, extended stays, and household expenses, available for around $10/month, and is renewable for life including coverage for dependents ages 50-85.

dowidth.com

dowidth.com