Earthquake microinsurance provides affordable coverage specifically designed to protect individuals and businesses from the financial impact of seismic events, offering quick payouts to rebuild homes and infrastructure. Livestock microinsurance focuses on safeguarding the livelihoods of farmers and herders by covering losses related to animal death or disease, securing income in vulnerable rural communities. Explore more to understand which microinsurance solution best fits your risk management needs.

Why it is important

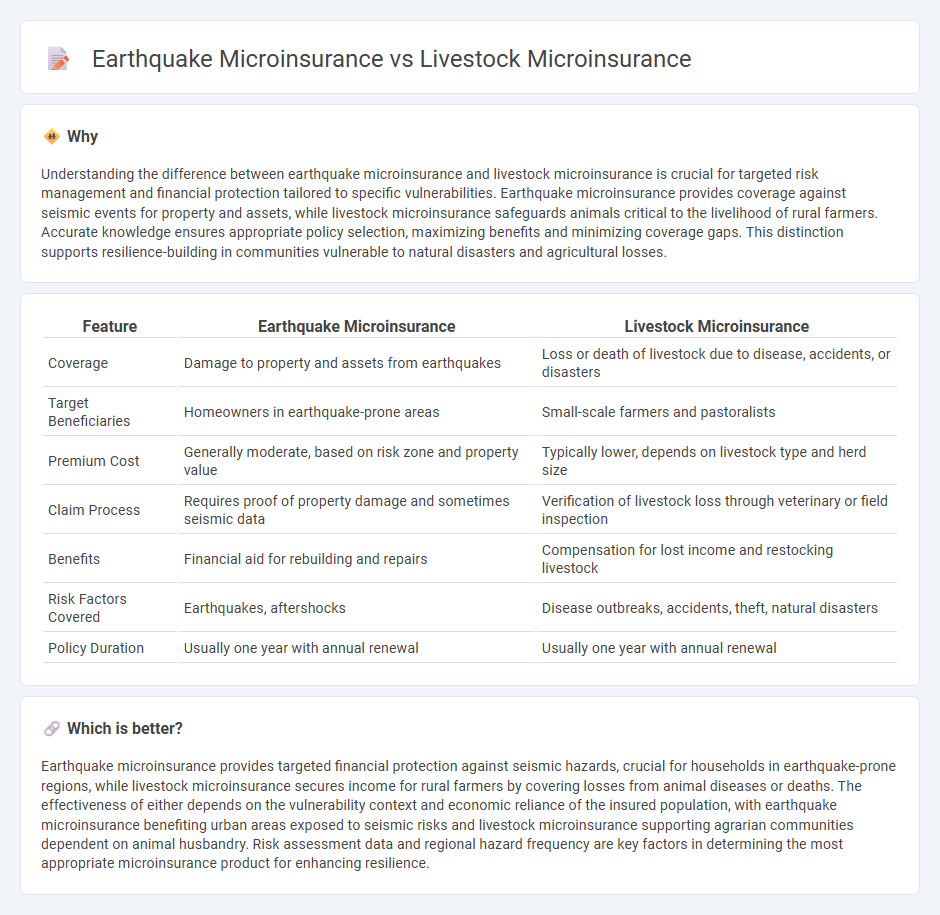

Understanding the difference between earthquake microinsurance and livestock microinsurance is crucial for targeted risk management and financial protection tailored to specific vulnerabilities. Earthquake microinsurance provides coverage against seismic events for property and assets, while livestock microinsurance safeguards animals critical to the livelihood of rural farmers. Accurate knowledge ensures appropriate policy selection, maximizing benefits and minimizing coverage gaps. This distinction supports resilience-building in communities vulnerable to natural disasters and agricultural losses.

Comparison Table

| Feature | Earthquake Microinsurance | Livestock Microinsurance |

|---|---|---|

| Coverage | Damage to property and assets from earthquakes | Loss or death of livestock due to disease, accidents, or disasters |

| Target Beneficiaries | Homeowners in earthquake-prone areas | Small-scale farmers and pastoralists |

| Premium Cost | Generally moderate, based on risk zone and property value | Typically lower, depends on livestock type and herd size |

| Claim Process | Requires proof of property damage and sometimes seismic data | Verification of livestock loss through veterinary or field inspection |

| Benefits | Financial aid for rebuilding and repairs | Compensation for lost income and restocking livestock |

| Risk Factors Covered | Earthquakes, aftershocks | Disease outbreaks, accidents, theft, natural disasters |

| Policy Duration | Usually one year with annual renewal | Usually one year with annual renewal |

Which is better?

Earthquake microinsurance provides targeted financial protection against seismic hazards, crucial for households in earthquake-prone regions, while livestock microinsurance secures income for rural farmers by covering losses from animal diseases or deaths. The effectiveness of either depends on the vulnerability context and economic reliance of the insured population, with earthquake microinsurance benefiting urban areas exposed to seismic risks and livestock microinsurance supporting agrarian communities dependent on animal husbandry. Risk assessment data and regional hazard frequency are key factors in determining the most appropriate microinsurance product for enhancing resilience.

Connection

Earthquake microinsurance and livestock microinsurance both provide financial protection to vulnerable populations against natural disasters and economic shocks, especially in rural and agricultural communities. These microinsurance products mitigate risks by offering affordable coverage for losses related to earthquakes and livestock health, ensuring income stability for small-scale farmers. Integrating both types enhances resilience by safeguarding human livelihoods and critical assets within disaster-prone regions.

Key Terms

**Livestock Microinsurance:**

Livestock microinsurance provides financial protection for small-scale farmers against losses due to animal diseases, theft, or natural disasters, ensuring income stability and food security in vulnerable communities. It typically covers risks specific to livestock, such as mortality and productivity loss, tailored to rural and agricultural contexts. Explore more about how livestock microinsurance strengthens resilience for farming households in developing regions.

Mortality Rate

Livestock microinsurance targets reducing financial losses from animal mortality due to disease or environmental hazards, which can exceed 15% annually in certain regions, severely impacting farmer livelihoods. Earthquake microinsurance covers human mortality risks and property damage, with mortality rates varying greatly by seismic intensity but often resulting in higher immediate fatality rates in densely populated areas. Explore our detailed analysis to better understand how mortality risk profiles shape insurance product design and effectiveness.

Indemnity Payout

Livestock microinsurance typically offers indemnity payouts based on the actual loss of animals, often assessed through veterinary inspections or market value estimations, providing direct compensation that helps farmers recover quickly. Earthquake microinsurance relies on indexed or parametric triggers such as seismic intensity levels and damage zones to determine payout amounts, enabling faster claims processing without individual damage assessments. Explore detailed comparisons and case studies to understand which microinsurance model best suits specific risk management needs.

Source and External Links

BRIEF 7 - Microinsurance for Risk Mitigation and Crisis Recovery - Provides insights on livestock microinsurance, highlighting how microfinance institutions in countries like India partner with insurers to offer group-based livestock coverage against accidental and natural death of cattle, especially for borrowers.

livestock microinsurance - Radiant Yacu - Details a microinsurance policy covering indigenous, crossbred, and exotic cattle, pigs, and chickens against risks including accidents, epidemics, and natural disasters, administered in partnership with national agricultural insurance authorities.

Insuring livestock to protect the poor - Discusses livestock microinsurance as a tool to reduce the vulnerability of poor livestock owners, noting challenges, the role of subsidies, and recent technological innovations improving the viability of such insurance in drought-prone and semi-arid regions.

dowidth.com

dowidth.com