Buy now insurance offers immediate coverage with a single upfront payment, providing convenience and simplicity for short-term needs. Annual renewable insurance requires yearly renewal, allowing policy adjustments and potentially lower initial costs but involves recurring payments. Explore detailed comparisons to determine which option best suits your financial and coverage preferences.

Why it is important

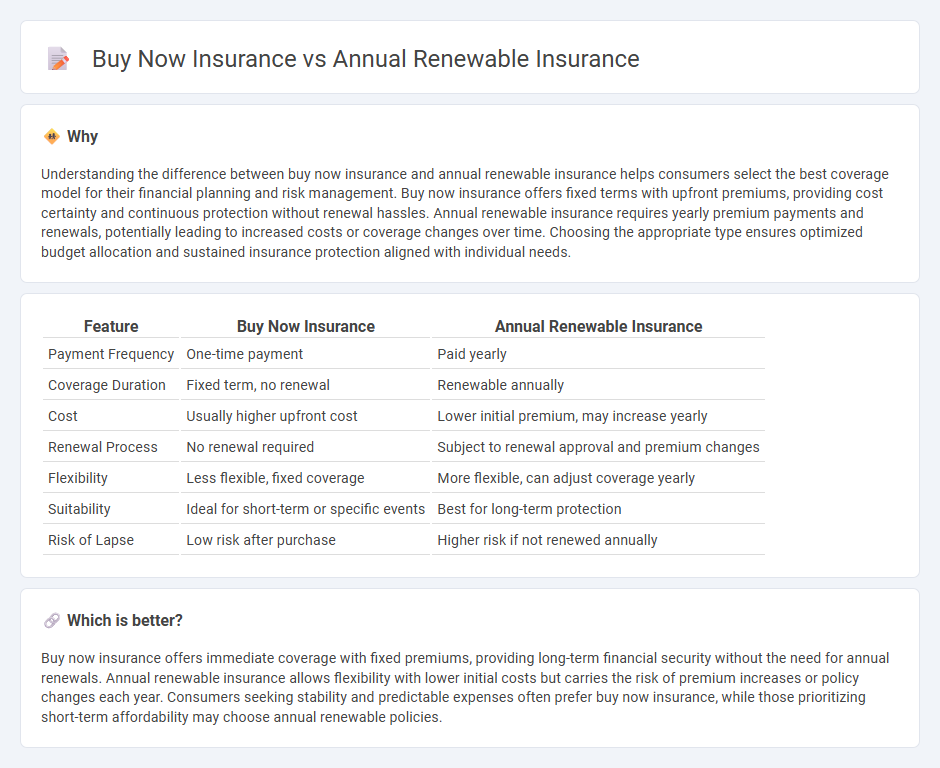

Understanding the difference between buy now insurance and annual renewable insurance helps consumers select the best coverage model for their financial planning and risk management. Buy now insurance offers fixed terms with upfront premiums, providing cost certainty and continuous protection without renewal hassles. Annual renewable insurance requires yearly premium payments and renewals, potentially leading to increased costs or coverage changes over time. Choosing the appropriate type ensures optimized budget allocation and sustained insurance protection aligned with individual needs.

Comparison Table

| Feature | Buy Now Insurance | Annual Renewable Insurance |

|---|---|---|

| Payment Frequency | One-time payment | Paid yearly |

| Coverage Duration | Fixed term, no renewal | Renewable annually |

| Cost | Usually higher upfront cost | Lower initial premium, may increase yearly |

| Renewal Process | No renewal required | Subject to renewal approval and premium changes |

| Flexibility | Less flexible, fixed coverage | More flexible, can adjust coverage yearly |

| Suitability | Ideal for short-term or specific events | Best for long-term protection |

| Risk of Lapse | Low risk after purchase | Higher risk if not renewed annually |

Which is better?

Buy now insurance offers immediate coverage with fixed premiums, providing long-term financial security without the need for annual renewals. Annual renewable insurance allows flexibility with lower initial costs but carries the risk of premium increases or policy changes each year. Consumers seeking stability and predictable expenses often prefer buy now insurance, while those prioritizing short-term affordability may choose annual renewable policies.

Connection

Buy now insurance offers immediate coverage upon purchase, providing instant protection that can seamlessly transition into annual renewable insurance policies. Annual renewable insurance extends coverage on a yearly basis, allowing policyholders to renew their plans without reapplying, ensuring continuous protection. Both insurance types are interconnected through their ability to provide flexible coverage durations tailored to the insured's needs.

Key Terms

Premium

Annual renewable insurance typically offers lower initial premiums compared to buy now insurance, allowing policyholders to pay periodically while maintaining coverage flexibility. Buy now insurance often requires a higher upfront premium, providing long-term coverage without the need for renewal payments. Explore more to understand which option aligns best with your budget and coverage needs.

Coverage period

Annual renewable insurance offers coverage for a full year with the option to renew upon expiration, providing continuous protection without interruption. Buy now insurance typically covers shorter, fixed periods such as days or weeks, catering to immediate, short-term needs. Explore the benefits and ideal use cases of both coverage options to determine which aligns best with your insurance requirements.

Renewal option

Annual renewable insurance offers policyholders the flexibility to renew coverage each year without reapplying, providing consistent protection and the ability to adjust terms as needed. Buy now insurance typically involves a one-time purchase for a fixed term, with coverage ending unless a new policy is bought after expiration. Explore the advantages of renewal options to determine the best fit for your insurance needs.

Source and External Links

Annual Renewable Term Life Insurance: What You Need to Know - Annual renewable term life insurance is a flexible, cost-effective option that allows policy renewal annually without a medical exam, often starting with lower premiums that increase over time.

Annual Renewable Term Life Insurance: What It Is & Who Should - Annual renewable term life insurance provides flexible coverage that can be renewed yearly without needing a medical exam, making it suitable for transitional life phases.

ART: Annual Renewable Term - Annual renewable term insurance offers a less expensive initial premium with guaranteed future insurability, allowing for protection without ongoing medical exams.

dowidth.com

dowidth.com