Flood insurance integration specifically covers damages caused by flooding, protecting properties in high-risk flood zones, while umbrella insurance integration offers broader liability coverage extending beyond standard homeowners or auto policies. Flood insurance is essential for properties in flood-prone areas, as most standard policies exclude flood damage, whereas umbrella insurance provides high-limit liability protection against lawsuits or large claims. Discover more about how integrating these insurance types can enhance your comprehensive risk management strategy.

Why it is important

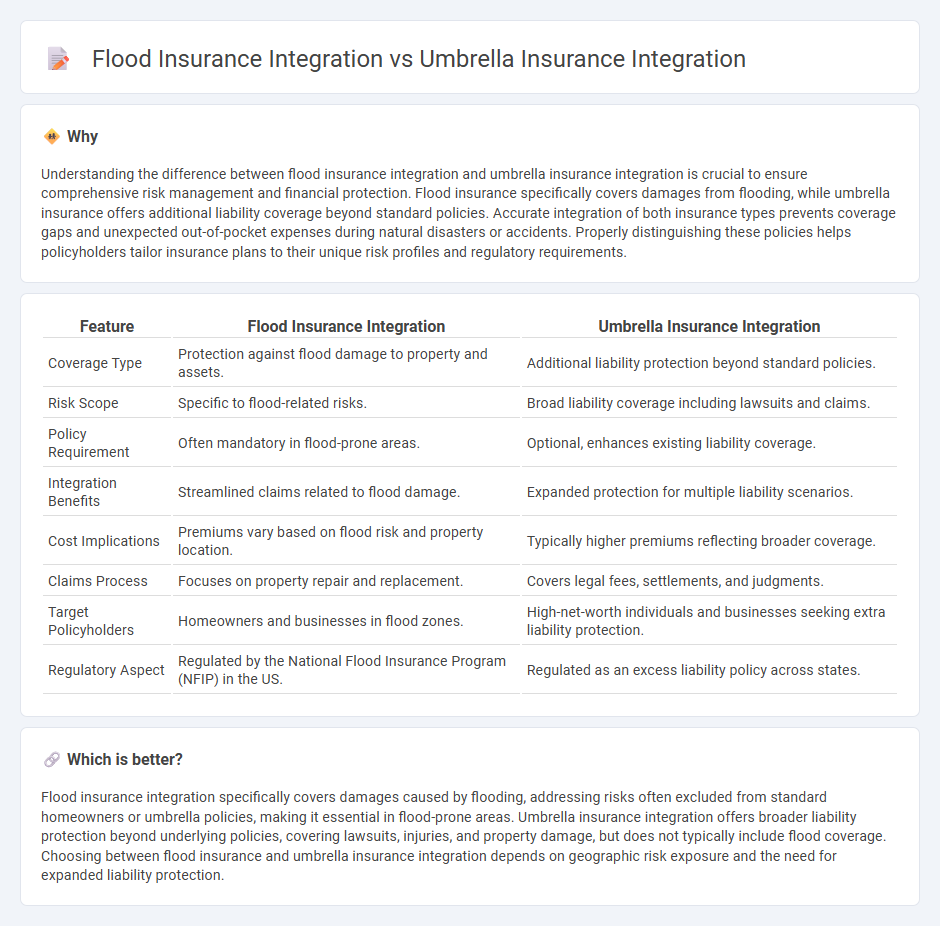

Understanding the difference between flood insurance integration and umbrella insurance integration is crucial to ensure comprehensive risk management and financial protection. Flood insurance specifically covers damages from flooding, while umbrella insurance offers additional liability coverage beyond standard policies. Accurate integration of both insurance types prevents coverage gaps and unexpected out-of-pocket expenses during natural disasters or accidents. Properly distinguishing these policies helps policyholders tailor insurance plans to their unique risk profiles and regulatory requirements.

Comparison Table

| Feature | Flood Insurance Integration | Umbrella Insurance Integration |

|---|---|---|

| Coverage Type | Protection against flood damage to property and assets. | Additional liability protection beyond standard policies. |

| Risk Scope | Specific to flood-related risks. | Broad liability coverage including lawsuits and claims. |

| Policy Requirement | Often mandatory in flood-prone areas. | Optional, enhances existing liability coverage. |

| Integration Benefits | Streamlined claims related to flood damage. | Expanded protection for multiple liability scenarios. |

| Cost Implications | Premiums vary based on flood risk and property location. | Typically higher premiums reflecting broader coverage. |

| Claims Process | Focuses on property repair and replacement. | Covers legal fees, settlements, and judgments. |

| Target Policyholders | Homeowners and businesses in flood zones. | High-net-worth individuals and businesses seeking extra liability protection. |

| Regulatory Aspect | Regulated by the National Flood Insurance Program (NFIP) in the US. | Regulated as an excess liability policy across states. |

Which is better?

Flood insurance integration specifically covers damages caused by flooding, addressing risks often excluded from standard homeowners or umbrella policies, making it essential in flood-prone areas. Umbrella insurance integration offers broader liability protection beyond underlying policies, covering lawsuits, injuries, and property damage, but does not typically include flood coverage. Choosing between flood insurance and umbrella insurance integration depends on geographic risk exposure and the need for expanded liability protection.

Connection

Flood insurance integration enhances property coverage by specifically protecting against water damage caused by natural flooding, while umbrella insurance integration extends liability protection beyond the limits of standard policies. Combining both insurance types ensures comprehensive risk management by addressing distinct but complementary hazards--property loss from floods and broader liability claims. This interconnected approach provides policyholders with robust financial security against diverse vulnerabilities often excluded in basic insurance plans.

Key Terms

Coverage Scope

Umbrella insurance integration expands liability coverage beyond standard policies, protecting against major claims and lawsuits, while flood insurance integration specifically addresses damages caused by flooding, which is typically excluded from standard homeowner policies. The coverage scope of umbrella insurance provides an extra layer of financial protection across multiple insurance types, whereas flood insurance targets a singular, high-risk environmental peril. Explore detailed differences to determine the best coverage solution for comprehensive risk management.

Claim Coordination

Umbrella insurance integration offers broader liability coverage that supplements primary policies, enhancing overall protection during claim coordination by addressing gaps in underlying policies. Flood insurance integration specifically deals with water damage claims, requiring specialized processes due to FEMA guidelines and separate claim systems, making coordination more complex. Explore how efficient claim coordination can streamline both umbrella and flood insurance integrations for comprehensive risk management.

Policy Exclusions

Umbrella insurance integration typically excludes coverage for flood-related damages, which are specifically addressed under flood insurance policies governed by the National Flood Insurance Program (NFIP). Flood insurance integration provides explicit protection for water damage caused by flooding events, filling critical gaps left by standard and umbrella policies. Explore the detailed policy exclusions and overlap benefits to understand how combining both insurances can offer comprehensive risk management.

Source and External Links

How Personal Umbrella Insurance Works with Your Existing Policies - This article explains how to integrate umbrella insurance with existing policies by ensuring primary liability coverage limits are met and choosing an appropriate umbrella policy amount.

Umbrella Insurance Explained - This resource provides an overview of umbrella insurance, explaining its role as a safety net for catastrophic losses that exceed primary liability policy limits.

What's an Umbrella Policy? - This page describes how umbrella policies provide additional coverage for liability and defense costs beyond what primary insurance policies cover, offering protection against unforeseen claims.

dowidth.com

dowidth.com