Pet insurance covers veterinary expenses for accidental injuries, illnesses, and routine care, protecting your furry friend's health costs. Health insurance focuses on human medical coverage, including doctor visits, hospital stays, prescription drugs, and preventive care, ensuring access to essential health services. Discover the key differences and benefits of pet insurance versus health insurance to make informed protection choices.

Why it is important

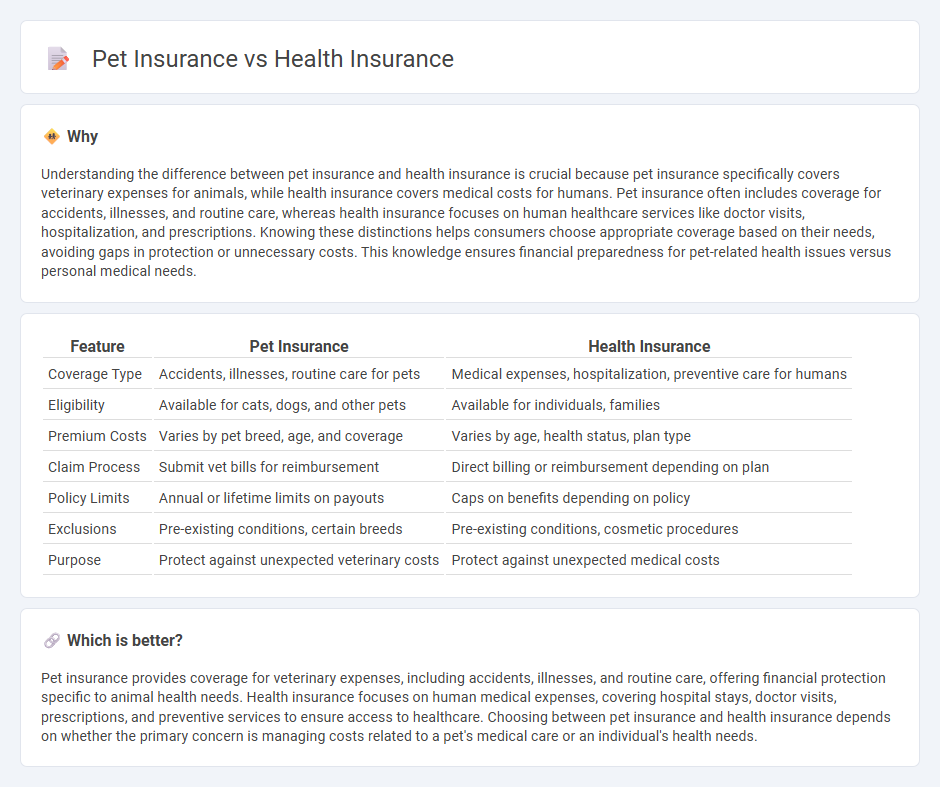

Understanding the difference between pet insurance and health insurance is crucial because pet insurance specifically covers veterinary expenses for animals, while health insurance covers medical costs for humans. Pet insurance often includes coverage for accidents, illnesses, and routine care, whereas health insurance focuses on human healthcare services like doctor visits, hospitalization, and prescriptions. Knowing these distinctions helps consumers choose appropriate coverage based on their needs, avoiding gaps in protection or unnecessary costs. This knowledge ensures financial preparedness for pet-related health issues versus personal medical needs.

Comparison Table

| Feature | Pet Insurance | Health Insurance |

|---|---|---|

| Coverage Type | Accidents, illnesses, routine care for pets | Medical expenses, hospitalization, preventive care for humans |

| Eligibility | Available for cats, dogs, and other pets | Available for individuals, families |

| Premium Costs | Varies by pet breed, age, and coverage | Varies by age, health status, plan type |

| Claim Process | Submit vet bills for reimbursement | Direct billing or reimbursement depending on plan |

| Policy Limits | Annual or lifetime limits on payouts | Caps on benefits depending on policy |

| Exclusions | Pre-existing conditions, certain breeds | Pre-existing conditions, cosmetic procedures |

| Purpose | Protect against unexpected veterinary costs | Protect against unexpected medical costs |

Which is better?

Pet insurance provides coverage for veterinary expenses, including accidents, illnesses, and routine care, offering financial protection specific to animal health needs. Health insurance focuses on human medical expenses, covering hospital stays, doctor visits, prescriptions, and preventive services to ensure access to healthcare. Choosing between pet insurance and health insurance depends on whether the primary concern is managing costs related to a pet's medical care or an individual's health needs.

Connection

Pet insurance and health insurance both protect against unexpected medical expenses by covering veterinary or human healthcare costs, respectively. They use risk assessment models and policy structures to manage financial exposure for treatment of illnesses or injuries. Insurers in both fields analyze medical histories and promote preventive care to reduce claims and enhance policyholder wellbeing.

Key Terms

**Health insurance:**

Health insurance provides comprehensive coverage for medical expenses related to illnesses, injuries, and preventive care, including doctor visits, hospital stays, prescription drugs, and diagnostic tests. Often customizable, plans vary by premiums, deductibles, copayments, and network providers, ensuring tailored protection for individuals and families. Explore the benefits and options of health insurance to safeguard your well-being effectively.

Premium

Health insurance premiums vary widely based on factors such as age, medical history, and coverage options, with average monthly costs ranging from $300 to $600 for an individual. Pet insurance premiums depend on the pet's species, breed, age, and coverage level, typically ranging from $20 to $50 per month for common pets like dogs and cats. Explore detailed comparisons of health and pet insurance premiums to make an informed decision that fits your budget.

Deductible

Deductibles in health insurance typically range from $500 to $2,000 annually, affecting out-of-pocket costs before coverage begins, while pet insurance deductibles are often annual or per-incident and usually between $100 and $500. Health insurance deductibles tend to reset yearly, impacting premium rates and overall expenses, whereas pet insurance deductibles may reset per condition or incident depending on the policy. Explore detailed deductible structures to optimize your insurance choice and manage healthcare or veterinary expenses effectively.

Source and External Links

Health insurance | USAGov - Get detailed information about major U.S. health insurance programs like Medicaid, Medicare, the ACA marketplace, and COBRA, including how to apply and eligibility.

Individual and family health insurance plans | UnitedHealthcare - Explore individual and family plans with benefits such as preventive care, maternity, mental health, and prescription coverage, and learn common insurance terms and cost management tips.

Individual Health - Family Medical Insurance | Blue Cross Blue Shield - Find and compare individual or family health insurance plans offering quality care and member discounts, including specialty care programs and global coverage options.

dowidth.com

dowidth.com