Cyber risk underwriting focuses on assessing digital threats and vulnerabilities impacting businesses, while agricultural underwriting evaluates risks related to weather, pests, and crop yields. Both require specialized knowledge to accurately price policies and manage exposures in their respective domains. Discover how these distinct underwriting approaches shape the future of insurance.

Why it is important

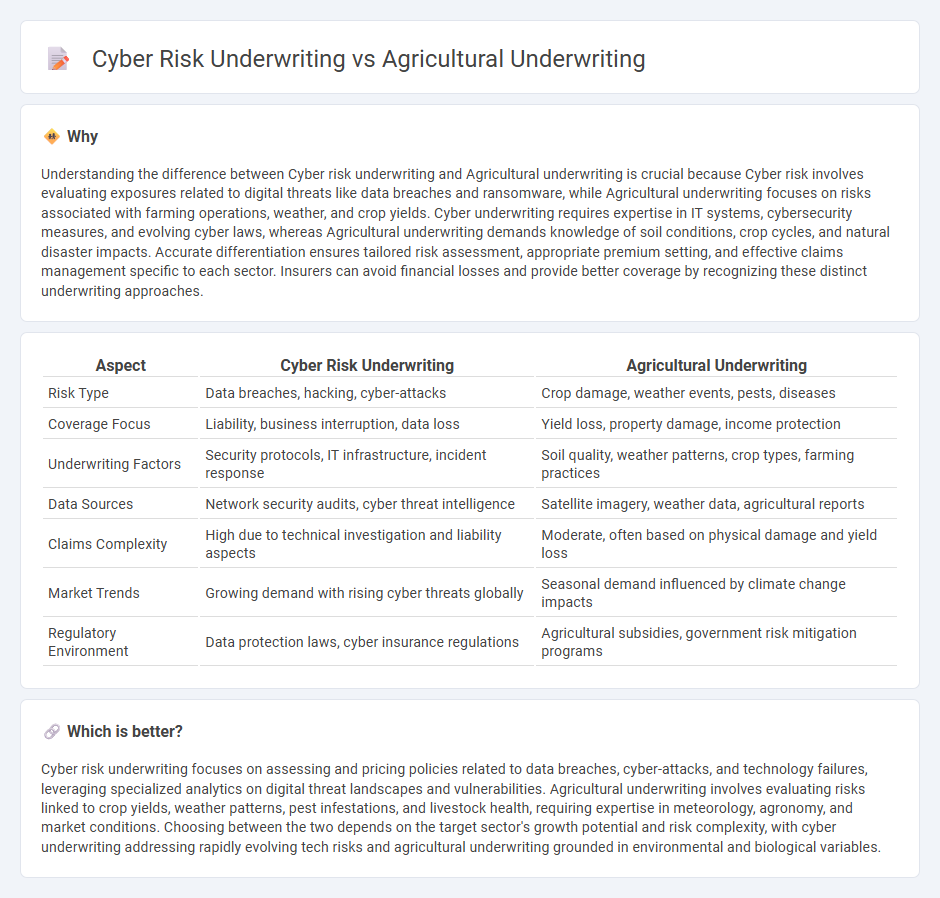

Understanding the difference between Cyber risk underwriting and Agricultural underwriting is crucial because Cyber risk involves evaluating exposures related to digital threats like data breaches and ransomware, while Agricultural underwriting focuses on risks associated with farming operations, weather, and crop yields. Cyber underwriting requires expertise in IT systems, cybersecurity measures, and evolving cyber laws, whereas Agricultural underwriting demands knowledge of soil conditions, crop cycles, and natural disaster impacts. Accurate differentiation ensures tailored risk assessment, appropriate premium setting, and effective claims management specific to each sector. Insurers can avoid financial losses and provide better coverage by recognizing these distinct underwriting approaches.

Comparison Table

| Aspect | Cyber Risk Underwriting | Agricultural Underwriting |

|---|---|---|

| Risk Type | Data breaches, hacking, cyber-attacks | Crop damage, weather events, pests, diseases |

| Coverage Focus | Liability, business interruption, data loss | Yield loss, property damage, income protection |

| Underwriting Factors | Security protocols, IT infrastructure, incident response | Soil quality, weather patterns, crop types, farming practices |

| Data Sources | Network security audits, cyber threat intelligence | Satellite imagery, weather data, agricultural reports |

| Claims Complexity | High due to technical investigation and liability aspects | Moderate, often based on physical damage and yield loss |

| Market Trends | Growing demand with rising cyber threats globally | Seasonal demand influenced by climate change impacts |

| Regulatory Environment | Data protection laws, cyber insurance regulations | Agricultural subsidies, government risk mitigation programs |

Which is better?

Cyber risk underwriting focuses on assessing and pricing policies related to data breaches, cyber-attacks, and technology failures, leveraging specialized analytics on digital threat landscapes and vulnerabilities. Agricultural underwriting involves evaluating risks linked to crop yields, weather patterns, pest infestations, and livestock health, requiring expertise in meteorology, agronomy, and market conditions. Choosing between the two depends on the target sector's growth potential and risk complexity, with cyber underwriting addressing rapidly evolving tech risks and agricultural underwriting grounded in environmental and biological variables.

Connection

Cyber risk underwriting and agricultural underwriting intersect through the integration of advanced data analytics and risk assessment technologies. Precision agriculture relies on IoT devices and digital platforms vulnerable to cyber threats, making cyber risk evaluation essential for protecting critical farming infrastructure. Effective underwriting in both domains demands comprehensive analysis of digital and physical risk factors to ensure resilient coverage in an increasingly interconnected landscape.

Key Terms

**Agricultural Underwriting:**

Agricultural underwriting involves assessing risks related to crop yields, livestock health, weather patterns, and market fluctuations to provide tailored insurance solutions for farmers and agribusinesses. It requires expertise in agronomy, meteorology, and regional agricultural practices to accurately evaluate potential losses and set premiums. Explore more about how agricultural underwriting safeguards farm operations and enhances risk management in the agriculture sector.

Crop Yield Assessment

Agricultural underwriting emphasizes precise crop yield assessment by analyzing factors such as soil quality, weather patterns, pest infestations, and historical yield data to determine insurance premiums and risk exposure. In contrast, cyber risk underwriting focuses on evaluating threats related to data breaches, ransomware attacks, and system vulnerabilities without direct ties to agricultural yields. Explore advanced methodologies in agricultural underwriting to enhance crop yield risk management and insurance accuracy.

Weather Risk Evaluation

Weather risk evaluation in agricultural underwriting centers on assessing climate variables such as rainfall, temperature, and drought frequency to predict crop yields and potential losses. In cyber risk underwriting, weather risk is less direct but can influence secondary factors like data center operations affected by natural disasters. Explore in-depth methodologies and comparative risk management strategies to enhance underwriting precision.

Source and External Links

Crop Insurance Underwriting Series 1162 - OPM - Agricultural underwriting involves understanding agricultural concepts, principles, and practices applied in crop insurance underwriting, including knowledge of crops, soils, farming practices, and farm management for evaluating insurance risks and policies.

Bulletin E-3428 Farm Loans and Credit Underwriting: The Five C's of ... - Agricultural underwriting for farm loans assesses creditworthiness using the Five C's: character, capital, capacity, collateral, and conditions, which collectively determine the risk and repayment ability of a farm borrower.

Agriculture | Geo Underwriting - Agricultural underwriting in insurance offers specialized coverage products for the farming community, using a flexible underwriting approach to assess farm risks and provide insurance solutions tailored to diverse agricultural operations.

dowidth.com

dowidth.com