Cyber insurance protects businesses and individuals from financial losses due to data breaches, cyberattacks, and other online threats, covering costs like legal fees and notification expenses. Auto insurance provides coverage against physical damage, bodily injury, and liability resulting from vehicle accidents, offering protection for drivers, passengers, and third parties. Explore the key differences and benefits of cyber insurance versus auto insurance to determine which coverage suits your needs.

Why it is important

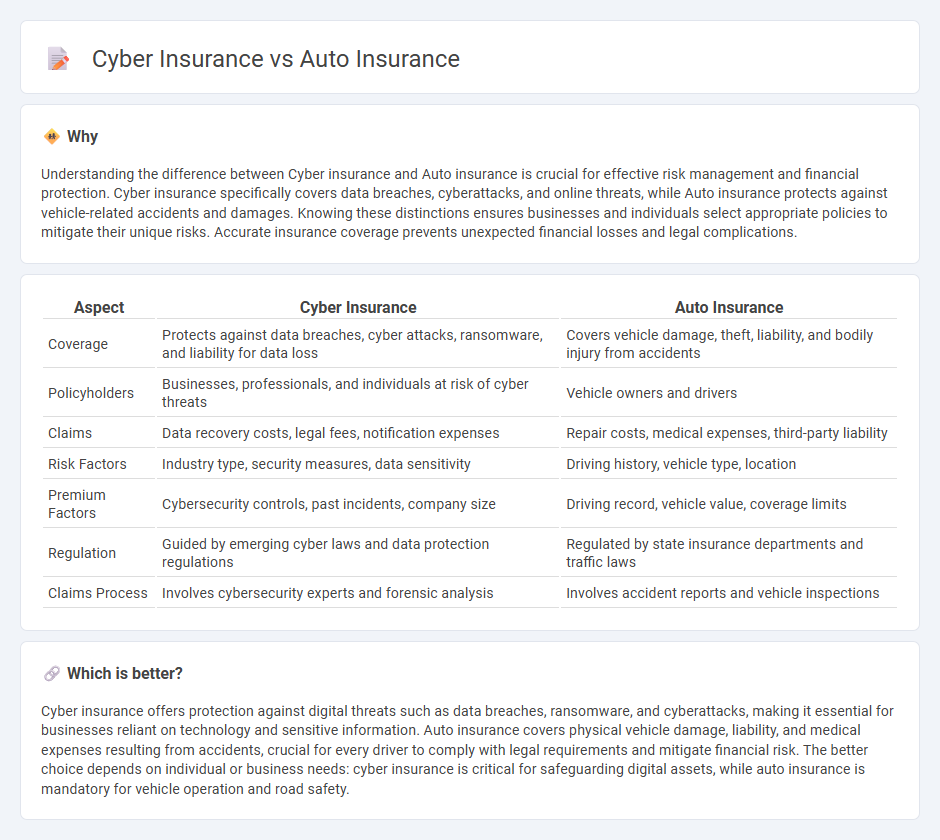

Understanding the difference between Cyber insurance and Auto insurance is crucial for effective risk management and financial protection. Cyber insurance specifically covers data breaches, cyberattacks, and online threats, while Auto insurance protects against vehicle-related accidents and damages. Knowing these distinctions ensures businesses and individuals select appropriate policies to mitigate their unique risks. Accurate insurance coverage prevents unexpected financial losses and legal complications.

Comparison Table

| Aspect | Cyber Insurance | Auto Insurance |

|---|---|---|

| Coverage | Protects against data breaches, cyber attacks, ransomware, and liability for data loss | Covers vehicle damage, theft, liability, and bodily injury from accidents |

| Policyholders | Businesses, professionals, and individuals at risk of cyber threats | Vehicle owners and drivers |

| Claims | Data recovery costs, legal fees, notification expenses | Repair costs, medical expenses, third-party liability |

| Risk Factors | Industry type, security measures, data sensitivity | Driving history, vehicle type, location |

| Premium Factors | Cybersecurity controls, past incidents, company size | Driving record, vehicle value, coverage limits |

| Regulation | Guided by emerging cyber laws and data protection regulations | Regulated by state insurance departments and traffic laws |

| Claims Process | Involves cybersecurity experts and forensic analysis | Involves accident reports and vehicle inspections |

Which is better?

Cyber insurance offers protection against digital threats such as data breaches, ransomware, and cyberattacks, making it essential for businesses reliant on technology and sensitive information. Auto insurance covers physical vehicle damage, liability, and medical expenses resulting from accidents, crucial for every driver to comply with legal requirements and mitigate financial risk. The better choice depends on individual or business needs: cyber insurance is critical for safeguarding digital assets, while auto insurance is mandatory for vehicle operation and road safety.

Connection

Cyber insurance and auto insurance intersect through the rise of connected vehicles and autonomous driving technology, which increase exposure to cyber threats such as hacking and data breaches. As vehicles become more integrated with digital systems, cyber insurance policies cover risks related to software vulnerabilities, while auto insurance addresses physical damage and liability. This convergence necessitates comprehensive coverage strategies that address both cyber risks and traditional automotive liabilities.

Key Terms

Auto insurance:

Auto insurance provides financial protection against physical damage and liability from car accidents, theft, or natural disasters, with coverage options including collision, comprehensive, and liability insurance. It typically covers medical expenses, property damage, and legal costs resulting from vehicle incidents, making it essential for drivers to comply with state laws and safeguard assets. Explore comprehensive auto insurance plans to ensure optimal protection tailored to your driving needs.

Collision Coverage

Collision coverage in auto insurance protects against physical damage to your vehicle resulting from a collision with another vehicle or object, ensuring repair or replacement costs are covered. Cyber insurance, however, does not include collision coverage, as it focuses on risks related to data breaches, cyberattacks, and liability from digital threats. Explore more about how collision coverage fits into your insurance strategy by diving deeper into both auto and cyber insurance policies.

Liability Coverage

Auto insurance liability coverage protects against damages or injuries caused to others in vehicle-related accidents, including bodily injury and property damage. Cyber insurance liability coverage addresses claims arising from data breaches, cyberattacks, and privacy violations, covering legal fees, notification costs, and regulatory fines. Explore detailed comparisons and determine which liability coverage suits your risk management needs.

dowidth.com

dowidth.com