Artificial intelligence underwriting leverages machine learning algorithms and vast datasets to analyze risk factors with high accuracy and speed, reducing human error and operational costs. Manual underwriting relies on human expertise and judgment to evaluate insurance applications, which can be time-consuming and prone to inconsistencies. Explore the advantages and challenges of AI underwriting compared to traditional manual processes to understand their impact on the insurance industry.

Why it is important

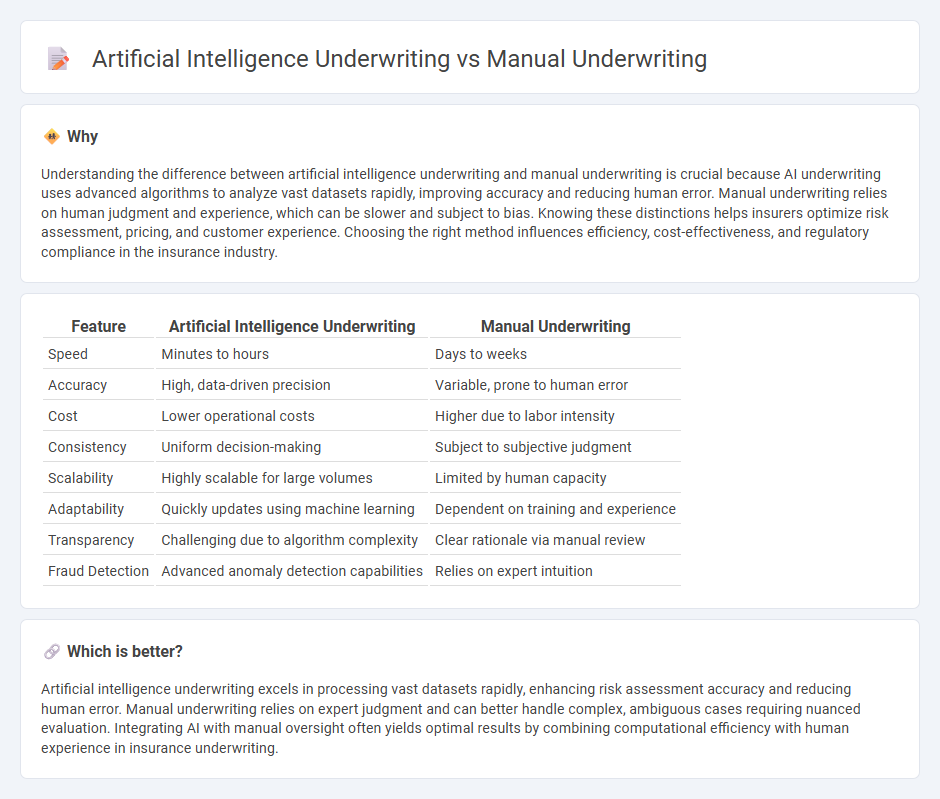

Understanding the difference between artificial intelligence underwriting and manual underwriting is crucial because AI underwriting uses advanced algorithms to analyze vast datasets rapidly, improving accuracy and reducing human error. Manual underwriting relies on human judgment and experience, which can be slower and subject to bias. Knowing these distinctions helps insurers optimize risk assessment, pricing, and customer experience. Choosing the right method influences efficiency, cost-effectiveness, and regulatory compliance in the insurance industry.

Comparison Table

| Feature | Artificial Intelligence Underwriting | Manual Underwriting |

|---|---|---|

| Speed | Minutes to hours | Days to weeks |

| Accuracy | High, data-driven precision | Variable, prone to human error |

| Cost | Lower operational costs | Higher due to labor intensity |

| Consistency | Uniform decision-making | Subject to subjective judgment |

| Scalability | Highly scalable for large volumes | Limited by human capacity |

| Adaptability | Quickly updates using machine learning | Dependent on training and experience |

| Transparency | Challenging due to algorithm complexity | Clear rationale via manual review |

| Fraud Detection | Advanced anomaly detection capabilities | Relies on expert intuition |

Which is better?

Artificial intelligence underwriting excels in processing vast datasets rapidly, enhancing risk assessment accuracy and reducing human error. Manual underwriting relies on expert judgment and can better handle complex, ambiguous cases requiring nuanced evaluation. Integrating AI with manual oversight often yields optimal results by combining computational efficiency with human experience in insurance underwriting.

Connection

Artificial intelligence underwriting enhances manual underwriting by automating data analysis, improving accuracy, and accelerating risk assessment processes. AI algorithms process vast amounts of customer information, identifying patterns and predicting risk levels that manual underwriters can verify and validate. Integrating AI with traditional underwriting practices optimizes decision-making efficiency and reduces human error in insurance policy approvals.

Key Terms

Risk Assessment

Manual underwriting relies on expert judgment to evaluate risk factors such as credit history, income verification, and debt-to-income ratio, often resulting in a personalized but time-intensive assessment. Artificial intelligence underwriting utilizes machine learning algorithms and large datasets to quickly analyze patterns and predict risk with higher accuracy and consistency. Explore the evolving methodologies and benefits of each approach in risk assessment.

Decision Criteria

Manual underwriting relies on human expertise to evaluate factors like credit history, income stability, and debt-to-income ratio, allowing for nuanced judgment in complex cases. Artificial intelligence underwriting uses algorithms to analyze vast datasets, assessing risk with speed and consistency based on predictive modeling and behavioral patterns. Explore more to understand how these decision criteria impact loan approval efficiency and accuracy.

Data Sources

Manual underwriting relies heavily on traditional data sources such as credit reports, income statements, and employment verification, which are often time-consuming to gather and analyze. Artificial intelligence underwriting leverages diverse and expansive data sets including social media activity, transaction histories, and real-time behavioral data, enabling faster and more accurate risk assessment. Explore how integrating varied data sources through AI transforms underwriting efficiency and precision.

Source and External Links

What is manual mortgage underwriting? - Manual underwriting is when a human reviews your mortgage application by examining documents like bank statements, tax returns, and credit history, rather than relying on automated systems.

What Is Manual Underwriting? - Manual underwriting is used when automated systems would likely deny an applicant, such as those with limited credit history, high debt-to-income ratios, or previous financial setbacks, allowing a loan officer to assess individual circumstances more flexibly.

What is manual underwriting and how does it work? - During manual underwriting, a lender's underwriter personally evaluates your income, assets, debts, and credit report, typically requiring more documentation and taking longer than automated processes.

dowidth.com

dowidth.com