Micro-mobility insurance specifically covers personal electric scooters, bikes, and other small vehicles against theft, damage, and accidents, ensuring riders are financially protected. Public liability insurance protects businesses and individuals from legal liabilities arising from injuries or property damage caused to third parties during their operations. Explore the key differences and benefits of each insurance type to safeguard your mobility needs effectively.

Why it is important

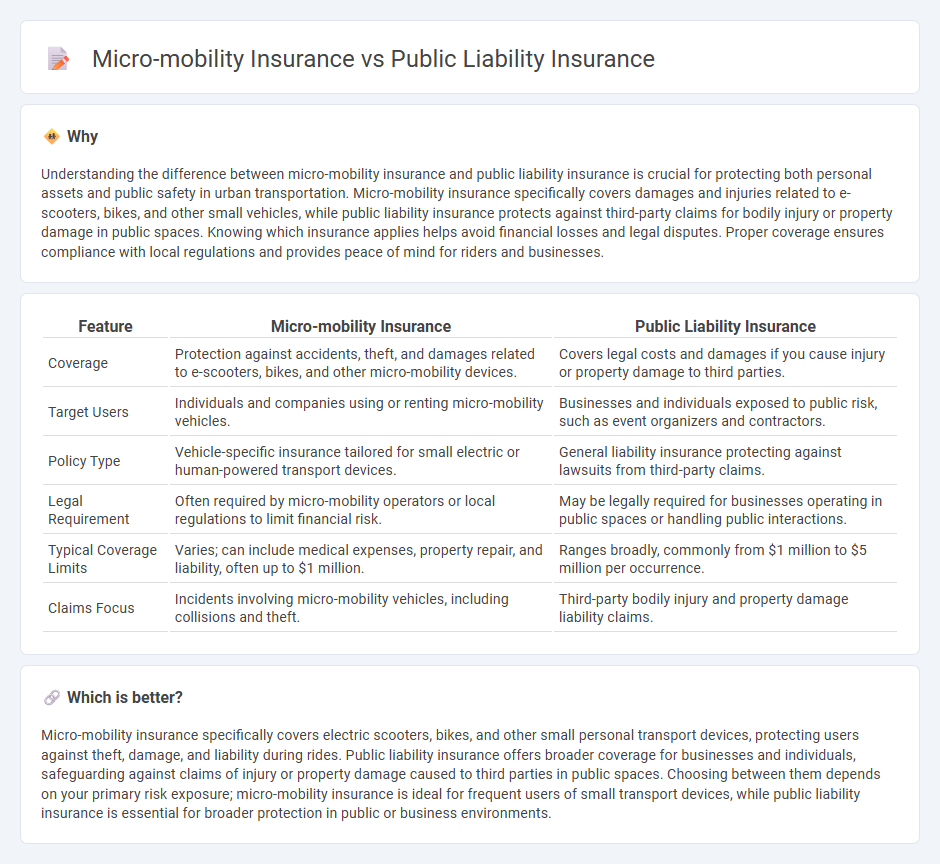

Understanding the difference between micro-mobility insurance and public liability insurance is crucial for protecting both personal assets and public safety in urban transportation. Micro-mobility insurance specifically covers damages and injuries related to e-scooters, bikes, and other small vehicles, while public liability insurance protects against third-party claims for bodily injury or property damage in public spaces. Knowing which insurance applies helps avoid financial losses and legal disputes. Proper coverage ensures compliance with local regulations and provides peace of mind for riders and businesses.

Comparison Table

| Feature | Micro-mobility Insurance | Public Liability Insurance |

|---|---|---|

| Coverage | Protection against accidents, theft, and damages related to e-scooters, bikes, and other micro-mobility devices. | Covers legal costs and damages if you cause injury or property damage to third parties. |

| Target Users | Individuals and companies using or renting micro-mobility vehicles. | Businesses and individuals exposed to public risk, such as event organizers and contractors. |

| Policy Type | Vehicle-specific insurance tailored for small electric or human-powered transport devices. | General liability insurance protecting against lawsuits from third-party claims. |

| Legal Requirement | Often required by micro-mobility operators or local regulations to limit financial risk. | May be legally required for businesses operating in public spaces or handling public interactions. |

| Typical Coverage Limits | Varies; can include medical expenses, property repair, and liability, often up to $1 million. | Ranges broadly, commonly from $1 million to $5 million per occurrence. |

| Claims Focus | Incidents involving micro-mobility vehicles, including collisions and theft. | Third-party bodily injury and property damage liability claims. |

Which is better?

Micro-mobility insurance specifically covers electric scooters, bikes, and other small personal transport devices, protecting users against theft, damage, and liability during rides. Public liability insurance offers broader coverage for businesses and individuals, safeguarding against claims of injury or property damage caused to third parties in public spaces. Choosing between them depends on your primary risk exposure; micro-mobility insurance is ideal for frequent users of small transport devices, while public liability insurance is essential for broader protection in public or business environments.

Connection

Micro-mobility insurance and public liability insurance intersect through shared risk management for third-party injuries and property damage involving smaller transport modes like e-scooters and bicycles. Both insurance types provide essential financial protection to individuals and companies against legal claims arising from accidents in public spaces. Coverage synergy supports sustainable urban mobility by mitigating liabilities linked to widespread micro-mobility adoption.

Key Terms

**Public liability insurance:**

Public liability insurance protects businesses and individuals against claims for bodily injury or property damage caused to third parties in public spaces, covering legal costs and compensation payments. This insurance is essential for entities operating in environments where interactions with the public occur frequently, ensuring financial security and reputation management. Explore more details on how public liability insurance mitigates risks and supports business continuity.

Third-party injury

Public liability insurance typically covers injuries to third parties resulting from activities on public or private property, offering broad protection for businesses and individuals. Micro-mobility insurance specializes in covering third-party injuries and property damage specifically arising from the use of shared electric scooters, bikes, and other small transportation devices, addressing unique risks tied to this sector. Explore more to understand which insurance best suits your liability needs in differing contexts.

Property damage

Public liability insurance covers property damage caused by third-party claims in public spaces, offering broad protection for businesses and individuals alike. Micro-mobility insurance specifically addresses property damage related to electric scooters, bikes, and other small vehicles, emphasizing coverage tailored to urban transportation risks. Explore the differences and benefits of each policy to ensure comprehensive protection for your unique needs.

Source and External Links

Public Liability Insurance: Definition, Coverage, Cost - Public liability insurance covers claims by the general public for injuries, death, and property damage related to your business, often bundled with business property insurance.

What Is Public Liability Insurance? - Public liability insurance protects your business from claims of accidents, bodily injuries, or property damage involving the general public at your business property.

Public Liability Insurance - Public liability insurance covers an insured's liability for bodily injury or property damage to third parties.

dowidth.com

dowidth.com