Crop yield insurance protects farmers against losses caused by adverse weather, pests, or diseases that reduce agricultural output, while livestock insurance covers risks related to animal health, injury, or death. Both insurance types mitigate financial risks in agriculture but focus on different aspects of farm production, with crop yield insurance emphasizing plant-based assets and livestock insurance safeguarding animal investments. Explore detailed comparisons and benefits of each policy to optimize your farm's risk management strategy.

Why it is important

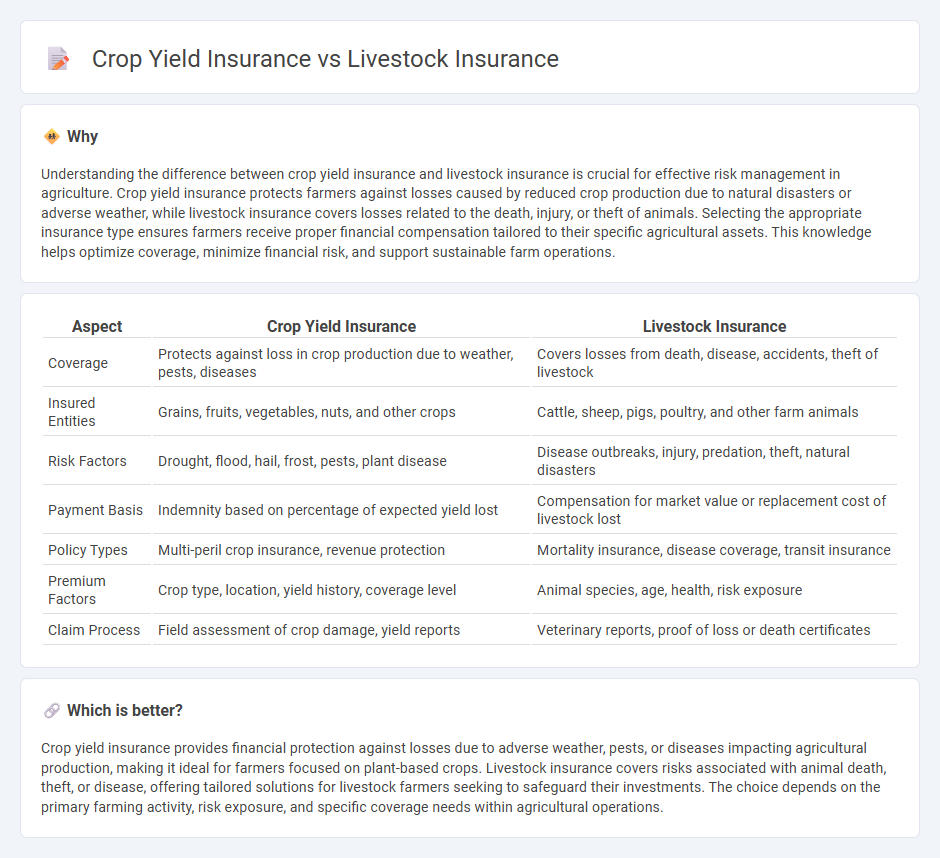

Understanding the difference between crop yield insurance and livestock insurance is crucial for effective risk management in agriculture. Crop yield insurance protects farmers against losses caused by reduced crop production due to natural disasters or adverse weather, while livestock insurance covers losses related to the death, injury, or theft of animals. Selecting the appropriate insurance type ensures farmers receive proper financial compensation tailored to their specific agricultural assets. This knowledge helps optimize coverage, minimize financial risk, and support sustainable farm operations.

Comparison Table

| Aspect | Crop Yield Insurance | Livestock Insurance |

|---|---|---|

| Coverage | Protects against loss in crop production due to weather, pests, diseases | Covers losses from death, disease, accidents, theft of livestock |

| Insured Entities | Grains, fruits, vegetables, nuts, and other crops | Cattle, sheep, pigs, poultry, and other farm animals |

| Risk Factors | Drought, flood, hail, frost, pests, plant disease | Disease outbreaks, injury, predation, theft, natural disasters |

| Payment Basis | Indemnity based on percentage of expected yield lost | Compensation for market value or replacement cost of livestock lost |

| Policy Types | Multi-peril crop insurance, revenue protection | Mortality insurance, disease coverage, transit insurance |

| Premium Factors | Crop type, location, yield history, coverage level | Animal species, age, health, risk exposure |

| Claim Process | Field assessment of crop damage, yield reports | Veterinary reports, proof of loss or death certificates |

Which is better?

Crop yield insurance provides financial protection against losses due to adverse weather, pests, or diseases impacting agricultural production, making it ideal for farmers focused on plant-based crops. Livestock insurance covers risks associated with animal death, theft, or disease, offering tailored solutions for livestock farmers seeking to safeguard their investments. The choice depends on the primary farming activity, risk exposure, and specific coverage needs within agricultural operations.

Connection

Crop yield insurance and livestock insurance are interconnected through their shared goal of mitigating agricultural risks caused by natural disasters, diseases, and market fluctuations. Both types of insurance provide financial protection to farmers by covering potential losses in crop production and livestock health, ensuring farm income stability. This integrated risk management approach supports sustainable farming practices and agricultural productivity.

Key Terms

Sum Insured

Livestock insurance covers financial losses due to death, disease, or theft of animals, with the sum insured typically based on market value or replacement cost of the livestock. Crop yield insurance compensates for losses from reduced agricultural output caused by adverse weather, pests, or diseases, with the sum insured linked to expected crop production or revenue. Explore detailed comparisons to understand which insurance type best safeguards your agribusiness investments.

Peril Coverage

Livestock insurance primarily covers risks such as disease outbreaks, accidents, and weather-related hazards impacting animal health and productivity, while crop yield insurance protects against losses from drought, floods, pests, and diseases affecting plant growth and harvest quantity. Peril coverage in livestock insurance tends to be more focused on biological and environmental threats specific to animals, whereas crop yield insurance emphasizes abiotic factors and agronomic risks influencing crop output. Explore detailed comparisons of peril coverage to enhance your risk management strategy.

Indemnity

Livestock insurance indemnifies farmers against financial losses caused by the death or disease of animals, providing coverage based on the value of the insured livestock. Crop yield insurance compensates growers when actual crop production falls below a predetermined guaranteed yield, protecting against risks like drought, pests, and floods. Explore the specifics of indemnity calculations and policy options to choose the best insurance for your agricultural needs.

Source and External Links

National Livestock Insurance - Offers comprehensive, customizable livestock insurance solutions for cattle, horses, poultry, and more, including protection against accidents and natural disasters.

Livestock Insurance - Nationwide - Provides coverage under AgriChoice policies for livestock against accidents, natural disasters, and offers protection against unfounded animal abuse allegations.

Livestock Insurance | Farm Bureau Financial Services - Offers Livestock Gross Margin and other revenue protection options to help farmers guard against declining market prices and feed costs.

dowidth.com

dowidth.com