Earthquake microinsurance provides targeted financial protection for low-income communities in high seismic risk zones, covering damages to homes and essential assets caused by earthquakes. Typhoon microinsurance specifically addresses losses from severe storms, including wind damage and flooding, tailored for regions frequently affected by tropical cyclones. Discover how these tailored microinsurance solutions enhance resilience against natural disasters and support vulnerable populations.

Why it is important

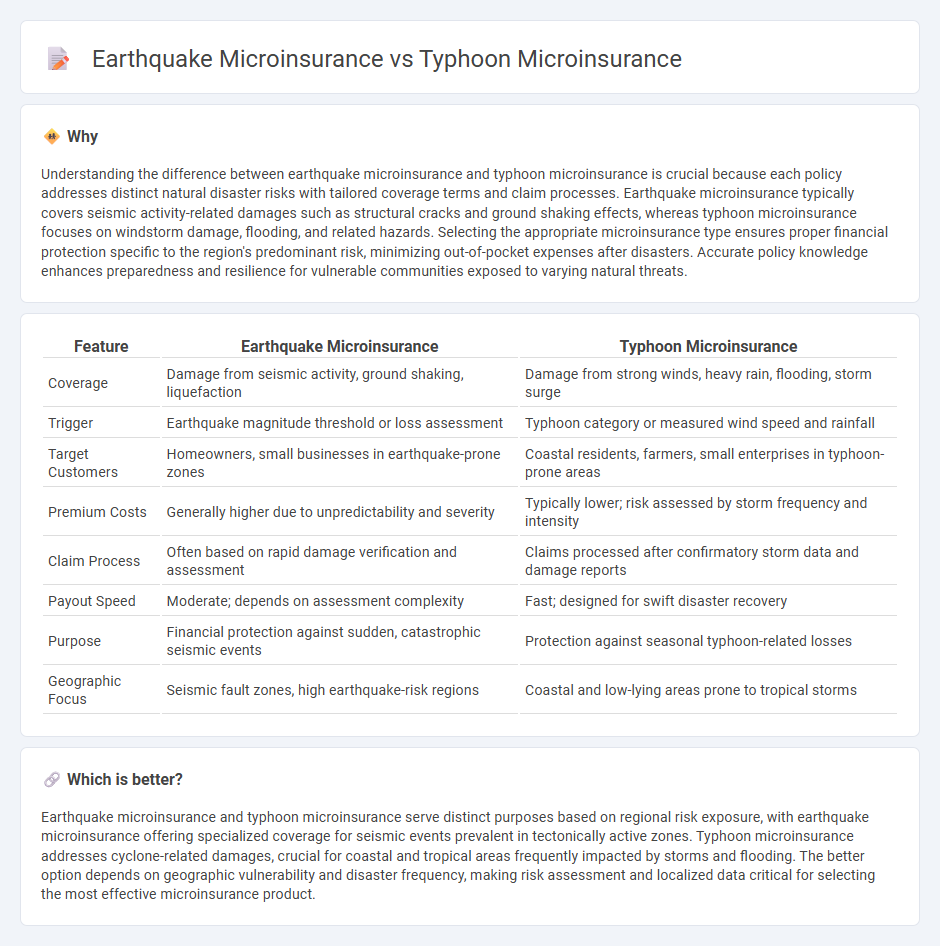

Understanding the difference between earthquake microinsurance and typhoon microinsurance is crucial because each policy addresses distinct natural disaster risks with tailored coverage terms and claim processes. Earthquake microinsurance typically covers seismic activity-related damages such as structural cracks and ground shaking effects, whereas typhoon microinsurance focuses on windstorm damage, flooding, and related hazards. Selecting the appropriate microinsurance type ensures proper financial protection specific to the region's predominant risk, minimizing out-of-pocket expenses after disasters. Accurate policy knowledge enhances preparedness and resilience for vulnerable communities exposed to varying natural threats.

Comparison Table

| Feature | Earthquake Microinsurance | Typhoon Microinsurance |

|---|---|---|

| Coverage | Damage from seismic activity, ground shaking, liquefaction | Damage from strong winds, heavy rain, flooding, storm surge |

| Trigger | Earthquake magnitude threshold or loss assessment | Typhoon category or measured wind speed and rainfall |

| Target Customers | Homeowners, small businesses in earthquake-prone zones | Coastal residents, farmers, small enterprises in typhoon-prone areas |

| Premium Costs | Generally higher due to unpredictability and severity | Typically lower; risk assessed by storm frequency and intensity |

| Claim Process | Often based on rapid damage verification and assessment | Claims processed after confirmatory storm data and damage reports |

| Payout Speed | Moderate; depends on assessment complexity | Fast; designed for swift disaster recovery |

| Purpose | Financial protection against sudden, catastrophic seismic events | Protection against seasonal typhoon-related losses |

| Geographic Focus | Seismic fault zones, high earthquake-risk regions | Coastal and low-lying areas prone to tropical storms |

Which is better?

Earthquake microinsurance and typhoon microinsurance serve distinct purposes based on regional risk exposure, with earthquake microinsurance offering specialized coverage for seismic events prevalent in tectonically active zones. Typhoon microinsurance addresses cyclone-related damages, crucial for coastal and tropical areas frequently impacted by storms and flooding. The better option depends on geographic vulnerability and disaster frequency, making risk assessment and localized data critical for selecting the most effective microinsurance product.

Connection

Earthquake microinsurance and typhoon microinsurance both provide financial protection to low-income households vulnerable to natural disasters, mitigating economic losses from seismic and storm-related damages. These insurance products share risk assessment models focused on geographic hazard zones and use parametric triggers to expedite claims payouts. By combining data on earthquake faults and typhoon paths, insurers can offer integrated microinsurance solutions tailored to regions exposed to both threats.

Key Terms

Perils Covered

Typhoon microinsurance primarily covers damages caused by high winds, heavy rainfall, flooding, and storm surges associated with typhoons, offering protection for properties, crops, and livestock vulnerable to these weather events. Earthquake microinsurance focuses on coverage against seismic activities, including ground shaking, structural collapse, and subsequent risks like fires and landslides, which can severely impact livelihoods and infrastructure in earthquake-prone regions. Explore detailed coverage options and risk management strategies for both to safeguard assets in disaster-prone areas effectively.

Trigger Event

Typhoon microinsurance activates coverage based on specific wind speeds or rain thresholds during cyclonic storms, providing rapid financial relief after typhoon-triggered damage. Earthquake microinsurance relies on seismic intensity levels or magnitude thresholds to trigger payouts, targeting losses caused by ground shaking and structural collapse. Explore more to understand how trigger mechanisms tailor risk protection for different natural disasters.

Claims Assessment

Typhoon microinsurance claims assessment primarily centers on wind and water damage evaluation, requiring rapid on-site inspections and satellite imagery analysis to quantify losses accurately. Earthquake microinsurance claims involve detailed structural damage assessments and seismic impact data to determine the extent of property and livelihood disruption. Explore comprehensive comparisons of these claim processes to understand risk management better.

Source and External Links

Microinsurance as disaster risk management tool after Typhoon - This study found that microinsurance claims after Typhoon Haiyan in the Philippines helped bridge the financial gap for low-income households, with payouts used to restart livelihoods and rebuild homes.

Mutual microinsurance and the Sustainable Development Goals - The impact of mutual microinsurance on recovery after Typhoon Haiyan demonstrates its effectiveness in enhancing community resilience through robust networks and regulatory support.

Typhoon Haiyan highlights the scope to expand microinsurance - Typhoon Haiyan showed both the benefits and limitations of microinsurance in disaster recovery, revealing opportunities for expansion in the Philippines.

dowidth.com

dowidth.com