NFT insurance protects digital assets and unique tokenized items from theft, fraud, or loss within the blockchain ecosystem, leveraging smart contracts for automated claims processing. Captive insurance involves a company creating its own insurance subsidiary to underwrite risks internally, offering tailored coverage and potential cost savings. Explore deeper insights into how these innovative insurance models address evolving risk landscapes.

Why it is important

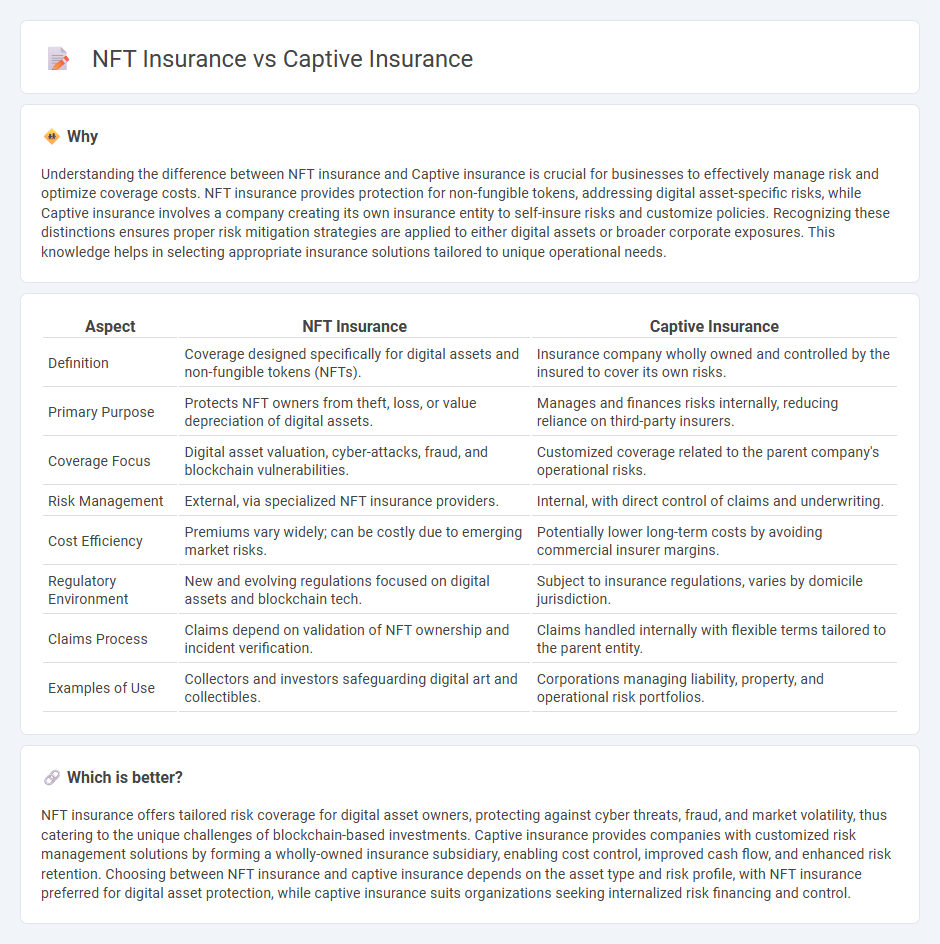

Understanding the difference between NFT insurance and Captive insurance is crucial for businesses to effectively manage risk and optimize coverage costs. NFT insurance provides protection for non-fungible tokens, addressing digital asset-specific risks, while Captive insurance involves a company creating its own insurance entity to self-insure risks and customize policies. Recognizing these distinctions ensures proper risk mitigation strategies are applied to either digital assets or broader corporate exposures. This knowledge helps in selecting appropriate insurance solutions tailored to unique operational needs.

Comparison Table

| Aspect | NFT Insurance | Captive Insurance |

|---|---|---|

| Definition | Coverage designed specifically for digital assets and non-fungible tokens (NFTs). | Insurance company wholly owned and controlled by the insured to cover its own risks. |

| Primary Purpose | Protects NFT owners from theft, loss, or value depreciation of digital assets. | Manages and finances risks internally, reducing reliance on third-party insurers. |

| Coverage Focus | Digital asset valuation, cyber-attacks, fraud, and blockchain vulnerabilities. | Customized coverage related to the parent company's operational risks. |

| Risk Management | External, via specialized NFT insurance providers. | Internal, with direct control of claims and underwriting. |

| Cost Efficiency | Premiums vary widely; can be costly due to emerging market risks. | Potentially lower long-term costs by avoiding commercial insurer margins. |

| Regulatory Environment | New and evolving regulations focused on digital assets and blockchain tech. | Subject to insurance regulations, varies by domicile jurisdiction. |

| Claims Process | Claims depend on validation of NFT ownership and incident verification. | Claims handled internally with flexible terms tailored to the parent entity. |

| Examples of Use | Collectors and investors safeguarding digital art and collectibles. | Corporations managing liability, property, and operational risk portfolios. |

Which is better?

NFT insurance offers tailored risk coverage for digital asset owners, protecting against cyber threats, fraud, and market volatility, thus catering to the unique challenges of blockchain-based investments. Captive insurance provides companies with customized risk management solutions by forming a wholly-owned insurance subsidiary, enabling cost control, improved cash flow, and enhanced risk retention. Choosing between NFT insurance and captive insurance depends on the asset type and risk profile, with NFT insurance preferred for digital asset protection, while captive insurance suits organizations seeking internalized risk financing and control.

Connection

NFT insurance leverages blockchain technology to provide secure ownership verification and fraud protection for digital assets, while captive insurance allows companies to create their own tailored insurance solutions to cover unique risks. Organizations utilizing NFT insurance may establish captive insurance structures to manage and underwrite the specific risks associated with NFT portfolios, optimizing risk retention and cost control. This connection enhances risk management strategies by combining innovative digital asset protection with customized insurance frameworks.

Key Terms

Risk Retention (Captive insurance)

Captive insurance enables organizations to retain and manage their own risk through a wholly-owned insurance subsidiary, offering tailored coverage and potential cost savings compared to traditional insurance. In contrast, NFT insurance primarily focuses on protecting digital assets, with risk management often outsourced to third-party providers rather than retained internally. Explore the distinct benefits of risk retention in captive insurance for a deeper understanding of its strategic advantages.

Decentralization (NFT insurance)

Captive insurance operates within traditional centralized frameworks where a parent company creates a licensed insurance company to cover its own risks, offering control but limited flexibility. NFT insurance leverages blockchain technology to decentralize risk assessment and claims processing, providing transparent, peer-to-peer coverage for digital assets without relying on intermediaries. Explore how decentralization reshapes insurance paradigms and empowers NFT owners with novel protection solutions.

Regulatory Compliance

Captive insurance companies operate under well-established regulatory frameworks designed to ensure solvency and consumer protection, often requiring state approval and adherence to strict financial reporting standards. In contrast, NFT insurance is a rapidly evolving sector with limited regulatory oversight, creating challenges in standardizing policies and enforcing claims within decentralized environments. Explore the complexities of regulatory compliance to understand the strengths and risks inherent in both captive and NFT insurance models.

Source and External Links

Captive insurance - Wikipedia - Captive insurance is a licensed insurance company established by insured parties to cover their own risks, offering tailored risk management with potential tax benefits and control over premiums and reinsurance.

What Is Captive Insurance? - A captive insurer is wholly owned by its insureds and provides coverage for risks that are costly or unavailable in the commercial market, offering pricing stability and control over safety, loss control, and claims handling.

Captive Insurance | Alternative Risk Financing - Captive insurance lets mid- to large-sized companies create or join insurance entities to reduce premium costs, control risk, and customize their insurance programs, commonly as single-parent or group captives.

dowidth.com

dowidth.com