Insurance sandboxes allow innovators to test new products and services under regulatory supervision, promoting innovation while managing consumer risks. Regulatory waivers grant temporary relief from specific rules to facilitate market entry or experimentation but offer less structured oversight compared to sandboxes. Explore the distinctions between insurance sandboxes and regulatory waivers to understand their impact on industry innovation.

Why it is important

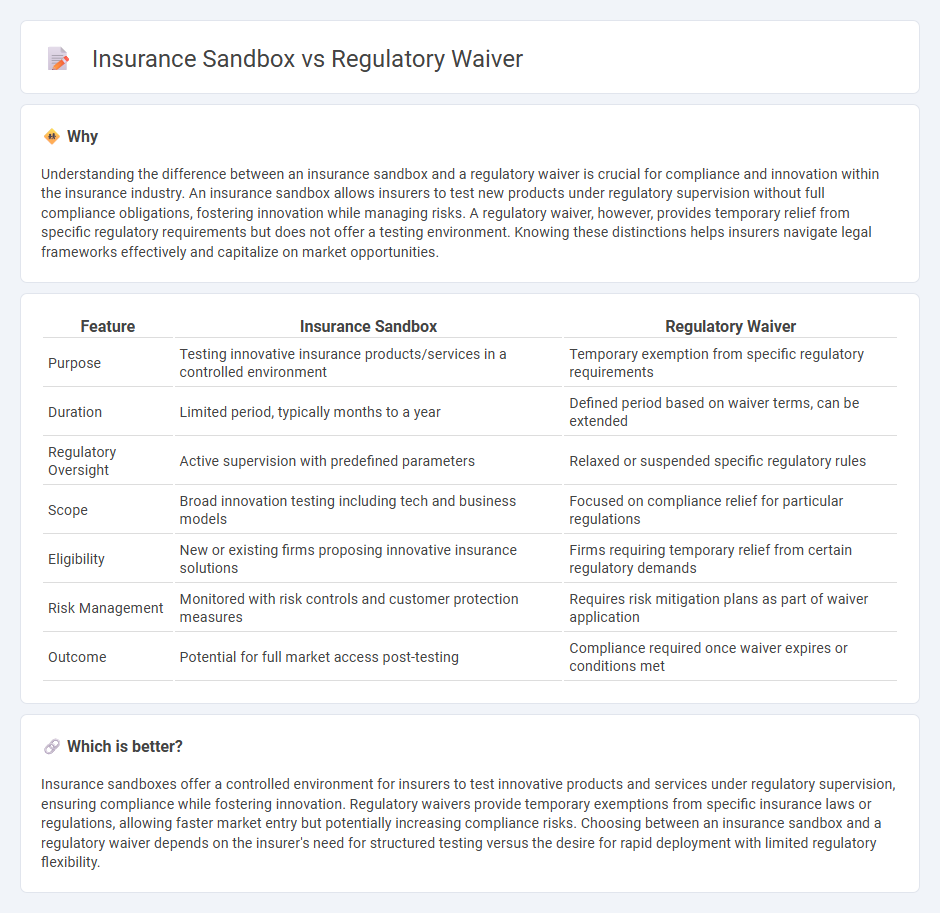

Understanding the difference between an insurance sandbox and a regulatory waiver is crucial for compliance and innovation within the insurance industry. An insurance sandbox allows insurers to test new products under regulatory supervision without full compliance obligations, fostering innovation while managing risks. A regulatory waiver, however, provides temporary relief from specific regulatory requirements but does not offer a testing environment. Knowing these distinctions helps insurers navigate legal frameworks effectively and capitalize on market opportunities.

Comparison Table

| Feature | Insurance Sandbox | Regulatory Waiver |

|---|---|---|

| Purpose | Testing innovative insurance products/services in a controlled environment | Temporary exemption from specific regulatory requirements |

| Duration | Limited period, typically months to a year | Defined period based on waiver terms, can be extended |

| Regulatory Oversight | Active supervision with predefined parameters | Relaxed or suspended specific regulatory rules |

| Scope | Broad innovation testing including tech and business models | Focused on compliance relief for particular regulations |

| Eligibility | New or existing firms proposing innovative insurance solutions | Firms requiring temporary relief from certain regulatory demands |

| Risk Management | Monitored with risk controls and customer protection measures | Requires risk mitigation plans as part of waiver application |

| Outcome | Potential for full market access post-testing | Compliance required once waiver expires or conditions met |

Which is better?

Insurance sandboxes offer a controlled environment for insurers to test innovative products and services under regulatory supervision, ensuring compliance while fostering innovation. Regulatory waivers provide temporary exemptions from specific insurance laws or regulations, allowing faster market entry but potentially increasing compliance risks. Choosing between an insurance sandbox and a regulatory waiver depends on the insurer's need for structured testing versus the desire for rapid deployment with limited regulatory flexibility.

Connection

Insurance sandboxes enable insurers and startups to test innovative products and services in a controlled environment under regulatory supervision. Regulatory waivers within these sandboxes temporarily relax specific legal requirements, allowing participants to experiment without full compliance burdens. This connection accelerates innovation while ensuring consumer protection and regulatory oversight remain intact.

Key Terms

Regulatory Exemption

Regulatory waivers provide specific exemptions from certain legal requirements to enable innovative financial services to operate without full compliance temporarily, while insurance sandboxes allow insurers to test products under relaxed regulations within controlled environments. Both mechanisms aim to foster innovation by reducing regulatory burdens but differ in scope and application, with waivers often being case-specific and sandboxes broader in regulatory experimentation. Discover how these regulatory approaches can accelerate insurance innovation and compliance strategies.

Innovation Testing

A regulatory waiver exempts companies from specific legal requirements to facilitate innovative testing under controlled conditions, reducing compliance burdens during product development. An insurance sandbox creates a supervised environment where insurers and startups can experiment with new business models and technologies while ensuring consumer protection and regulatory oversight. Explore more about how these frameworks accelerate innovation in the insurance sector and foster market evolution.

Compliance Flexibility

Regulatory waivers provide targeted relief from specific legal requirements, enabling companies to temporarily bypass certain compliance obligations while still operating within the regulatory framework. Insurance sandboxes offer a controlled environment where insurers can test innovative products and services under relaxed regulatory conditions, promoting experimentation without full compliance constraints. Explore how these compliance flexibility tools can accelerate innovation while managing regulatory risks effectively.

Source and External Links

4.2104 Waivers. - Acquisition.GOV - The head of an executive agency may grant a one-time regulatory waiver with compelling justification and a phase-out plan, allowing limited relief from specific prohibitions under government acquisition regulations.

Regulatory Waiver Requests Submitted To REAC/NASS - HUD - Regulatory waivers provide relief from strict compliance upon a finding of good cause and require a verifiable justification to be submitted through the designated agency channels, typically involving local field office review.

Regulatory Waivers and Exemptions - ACUS - Agencies use regulatory waivers and exemptions as tools to balance necessary flexibility with fairness and legal consistency, especially when strict compliance may be impractical or counterproductive in specific situations.

dowidth.com

dowidth.com