Short term rental insurance specifically covers risks related to renting out a property for brief periods, including property damage and guest injury, while general liability insurance protects businesses from claims of bodily injury or property damage arising from everyday operations. Understanding the key differences in coverage, exclusions, and claim processes between these insurance types is essential for property owners and operators. Explore further to determine which insurance option best safeguards your rental investment and business.

Why it is important

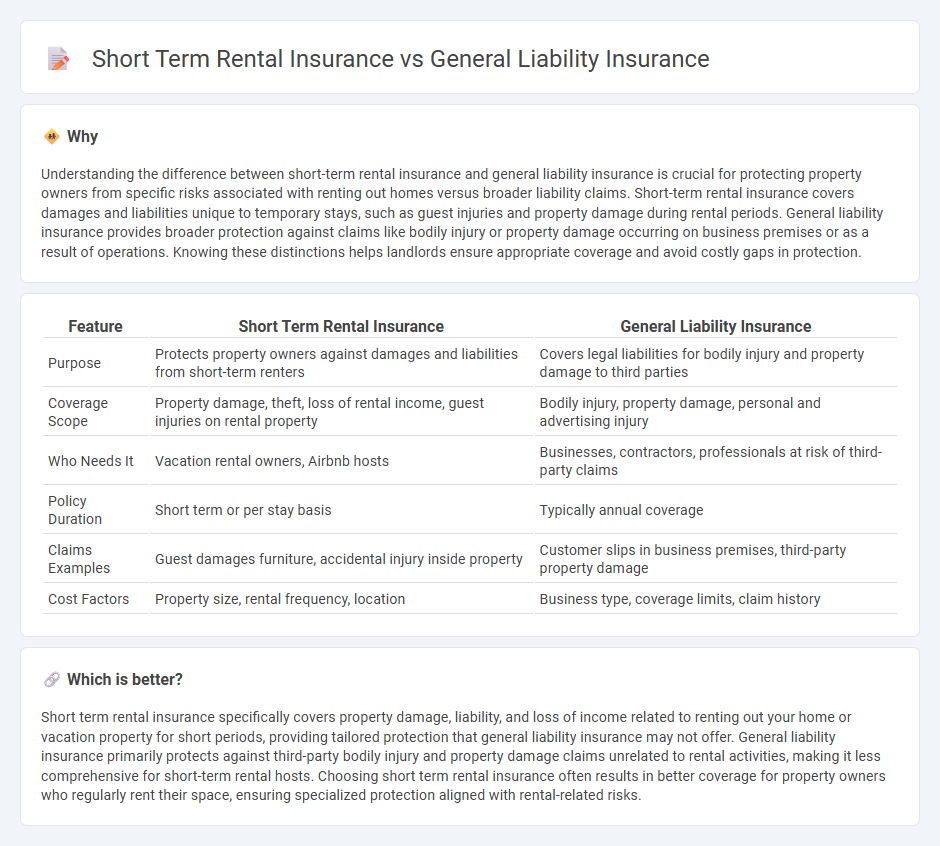

Understanding the difference between short-term rental insurance and general liability insurance is crucial for protecting property owners from specific risks associated with renting out homes versus broader liability claims. Short-term rental insurance covers damages and liabilities unique to temporary stays, such as guest injuries and property damage during rental periods. General liability insurance provides broader protection against claims like bodily injury or property damage occurring on business premises or as a result of operations. Knowing these distinctions helps landlords ensure appropriate coverage and avoid costly gaps in protection.

Comparison Table

| Feature | Short Term Rental Insurance | General Liability Insurance |

|---|---|---|

| Purpose | Protects property owners against damages and liabilities from short-term renters | Covers legal liabilities for bodily injury and property damage to third parties |

| Coverage Scope | Property damage, theft, loss of rental income, guest injuries on rental property | Bodily injury, property damage, personal and advertising injury |

| Who Needs It | Vacation rental owners, Airbnb hosts | Businesses, contractors, professionals at risk of third-party claims |

| Policy Duration | Short term or per stay basis | Typically annual coverage |

| Claims Examples | Guest damages furniture, accidental injury inside property | Customer slips in business premises, third-party property damage |

| Cost Factors | Property size, rental frequency, location | Business type, coverage limits, claim history |

Which is better?

Short term rental insurance specifically covers property damage, liability, and loss of income related to renting out your home or vacation property for short periods, providing tailored protection that general liability insurance may not offer. General liability insurance primarily protects against third-party bodily injury and property damage claims unrelated to rental activities, making it less comprehensive for short-term rental hosts. Choosing short term rental insurance often results in better coverage for property owners who regularly rent their space, ensuring specialized protection aligned with rental-related risks.

Connection

Short-term rental insurance and general liability insurance both provide financial protection against risks associated with property rental activities. While short-term rental insurance covers property damage and losses specific to rental periods, general liability insurance addresses claims related to bodily injury or property damage incurred by third parties. Combining these coverages ensures comprehensive protection for hosts managing short-term rental properties.

Key Terms

Coverage Scope

General liability insurance protects against third-party claims involving bodily injury or property damage occurring on your property, often excluding losses specific to short-term rentals such as guest injuries or property damage inside rented spaces. Short term rental insurance provides tailored coverage for hosts, including protection against guest-related liabilities, property damage, and potential loss of rental income due to property damage or cancellations. Explore detailed comparisons to determine the best insurance policy that safeguards your unique short-term rental risks.

Policy Duration

General liability insurance provides continuous coverage for permanent businesses, protecting against third-party claims such as bodily injury or property damage, typically renewable annually. Short term rental insurance offers tailored protection for temporary rental properties, with policy durations matching short stays, often ranging from days to weeks, addressing specific risks like guest damages and liability during the rental period. Learn more about how choosing the right policy duration can optimize your insurance protection.

Property Use

General liability insurance covers legal claims arising from injuries or property damage on your premises, suitable for businesses and homeowners but not tailored specifically for rental properties. Short term rental insurance provides specialized protection for property owners renting out homes or apartments on platforms like Airbnb, covering risks such as guest-related damages and liability during the rental period. Explore the differences in coverage and benefits to find the best insurance solution for your property use.

Source and External Links

Liability Insurance - General Coverage for Your Business - GEICO - General liability insurance protects businesses from claims arising from normal operations, covering bodily injury, property damage, legal defense costs, and advertising injuries.

General liability insurance for contractors and construction businesses - This insurance covers basic risks like accidental damage to a client's property or customer injury, helping pay for medical bills, repairs, and legal expenses, but does not cover employee injuries.

General Liability Insurance for Contractors | The Hartford - General liability insurance for contractors safeguards against claims of bodily injury or property damage caused by business activities, providing essential financial protection against lawsuits and related costs.

dowidth.com

dowidth.com