Micro-mobility insurance covers electric scooters, bikes, and e-mopeds, focusing on personal liability, theft, and damage specific to short-distance urban travel. Car sharing insurance typically protects drivers and vehicles during shared usage, addressing collision, liability, and comprehensive coverage gaps in peer-to-peer or commercial fleet models. Explore the key differences and benefits of each to choose the ideal coverage for your mobility needs.

Why it is important

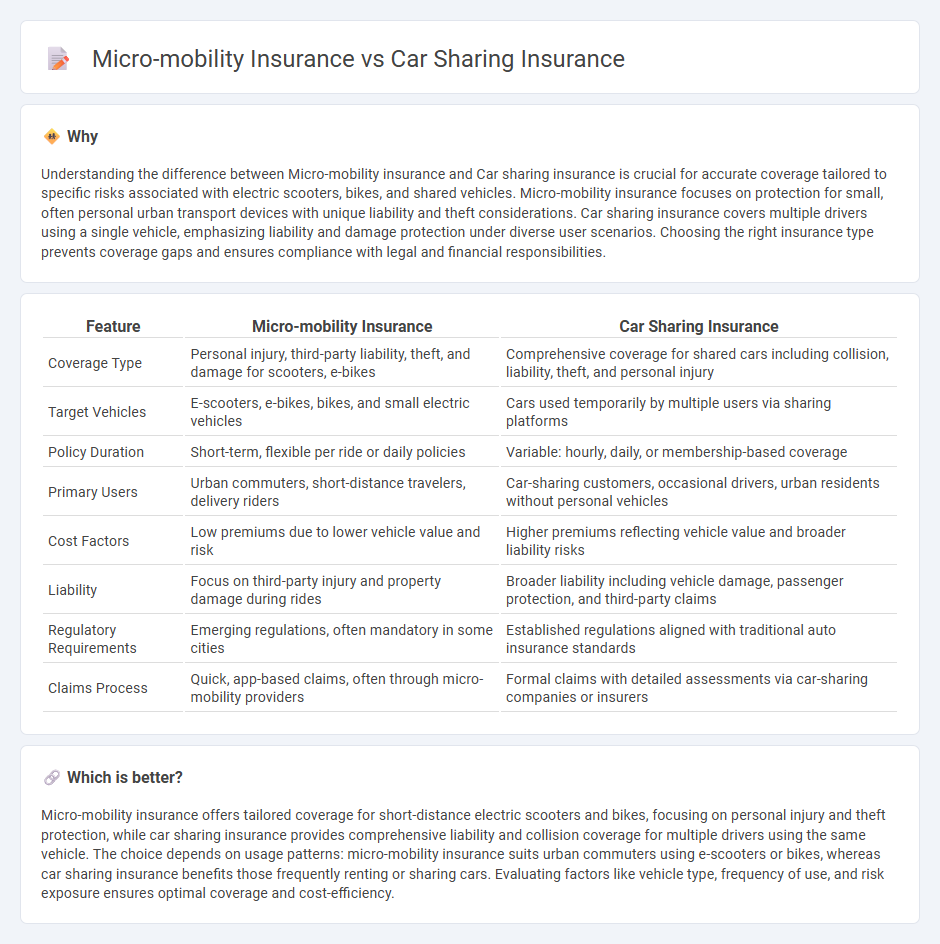

Understanding the difference between Micro-mobility insurance and Car sharing insurance is crucial for accurate coverage tailored to specific risks associated with electric scooters, bikes, and shared vehicles. Micro-mobility insurance focuses on protection for small, often personal urban transport devices with unique liability and theft considerations. Car sharing insurance covers multiple drivers using a single vehicle, emphasizing liability and damage protection under diverse user scenarios. Choosing the right insurance type prevents coverage gaps and ensures compliance with legal and financial responsibilities.

Comparison Table

| Feature | Micro-mobility Insurance | Car Sharing Insurance |

|---|---|---|

| Coverage Type | Personal injury, third-party liability, theft, and damage for scooters, e-bikes | Comprehensive coverage for shared cars including collision, liability, theft, and personal injury |

| Target Vehicles | E-scooters, e-bikes, bikes, and small electric vehicles | Cars used temporarily by multiple users via sharing platforms |

| Policy Duration | Short-term, flexible per ride or daily policies | Variable: hourly, daily, or membership-based coverage |

| Primary Users | Urban commuters, short-distance travelers, delivery riders | Car-sharing customers, occasional drivers, urban residents without personal vehicles |

| Cost Factors | Low premiums due to lower vehicle value and risk | Higher premiums reflecting vehicle value and broader liability risks |

| Liability | Focus on third-party injury and property damage during rides | Broader liability including vehicle damage, passenger protection, and third-party claims |

| Regulatory Requirements | Emerging regulations, often mandatory in some cities | Established regulations aligned with traditional auto insurance standards |

| Claims Process | Quick, app-based claims, often through micro-mobility providers | Formal claims with detailed assessments via car-sharing companies or insurers |

Which is better?

Micro-mobility insurance offers tailored coverage for short-distance electric scooters and bikes, focusing on personal injury and theft protection, while car sharing insurance provides comprehensive liability and collision coverage for multiple drivers using the same vehicle. The choice depends on usage patterns: micro-mobility insurance suits urban commuters using e-scooters or bikes, whereas car sharing insurance benefits those frequently renting or sharing cars. Evaluating factors like vehicle type, frequency of use, and risk exposure ensures optimal coverage and cost-efficiency.

Connection

Micro-mobility insurance and car sharing insurance both address coverage for shared transportation modes, enhancing protection for users and providers against liability, accidents, and theft. They incorporate real-time data and usage-based policies to tailor premiums according to individual behavior and vehicle usage patterns. Integration of these insurance types supports the growing ecosystem of urban mobility by reducing risks across multiple shared vehicle platforms.

Key Terms

Liability Coverage

Car sharing insurance typically offers higher liability coverage limits due to the potential for more severe vehicle damage and bodily injury claims, reflecting the greater risks associated with automobiles. Micro-mobility insurance provides tailored liability protection that addresses unique risks linked to scooters, bikes, and other small vehicles, often emphasizing personal injury and third-party damage in urban environments. Explore detailed comparisons to understand which insurance best safeguards your specific mobility needs.

Usage-based Policy

Usage-based insurance policies in car sharing and micro-mobility sectors provide tailored coverage by analyzing real-time data such as distance traveled, trip duration, and driving behavior. Car sharing insurance often includes comprehensive liability and collision protections specific to vehicle usage periods, while micro-mobility insurance emphasizes rider safety and low-speed accident coverage for devices like e-scooters and bikes. Explore further to understand which usage-based insurance best suits your mobility needs.

Exclusions

Car sharing insurance typically excludes coverage for personal rides outside the sharing platform, damage due to unauthorized drivers, and personal belongings inside the vehicle, while micro-mobility insurance often excludes accidents caused by user negligence, theft without proper locking, and coverage beyond specified zones or vehicle types like e-scooters or bikes. Understanding these exclusions is crucial for users to avoid unexpected liabilities and ensure adequate protection during usage. Explore our detailed guide to learn more about how exclusions impact your coverage choice.

Source and External Links

Car Share Insurance: Everything You Need To Know - This article provides an overview of car-sharing insurance, including coverage details for services like Getaround, JustShareIt, and Turo.

Does car insurance cover peer-to-peer rentals? - Explains how peer-to-peer car rental insurance works for both car owners and renters, including coverage options and limitations.

Peer-to-Peer Car Rental - Offers comprehensive coverage options for Turo hosts, filling gaps left by traditional auto insurance with policies starting at $20 per month.

dowidth.com

dowidth.com