Ghost broking involves fraudulent insurance intermediaries who misrepresent policies, leading to invalid coverage and financial loss for clients. Non-disclosure refers to the failure to reveal critical information to insurers, which can result in claim denial or policy cancellation. Explore the risks and protections related to ghost broking and non-disclosure to safeguard your insurance investment.

Why it is important

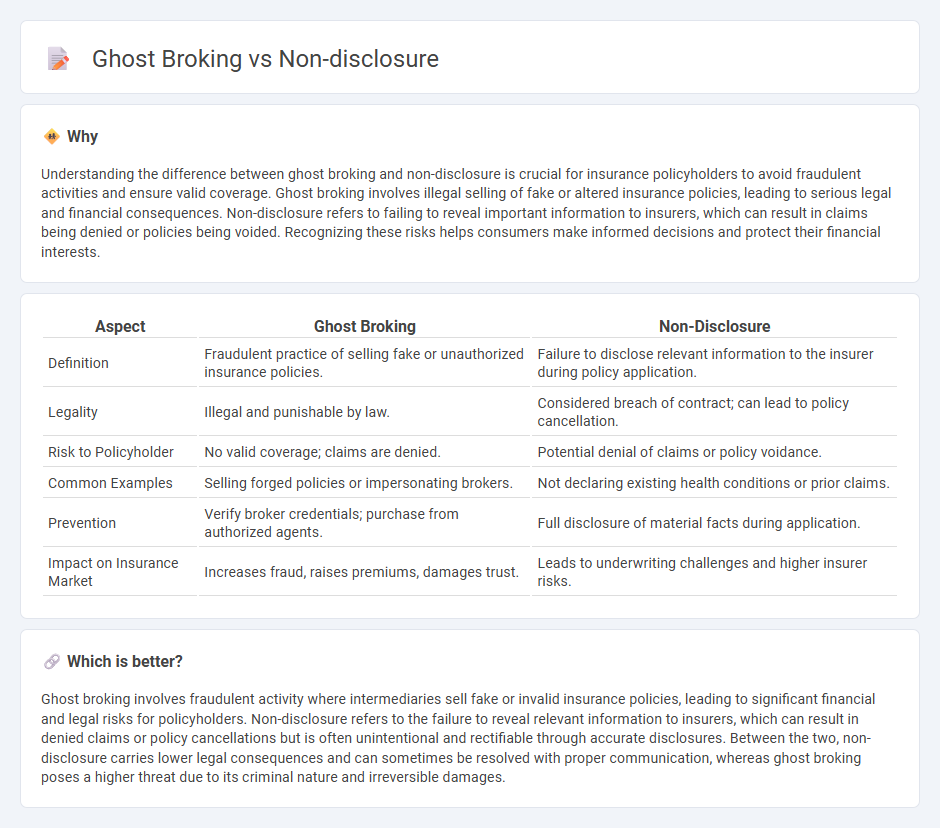

Understanding the difference between ghost broking and non-disclosure is crucial for insurance policyholders to avoid fraudulent activities and ensure valid coverage. Ghost broking involves illegal selling of fake or altered insurance policies, leading to serious legal and financial consequences. Non-disclosure refers to failing to reveal important information to insurers, which can result in claims being denied or policies being voided. Recognizing these risks helps consumers make informed decisions and protect their financial interests.

Comparison Table

| Aspect | Ghost Broking | Non-Disclosure |

|---|---|---|

| Definition | Fraudulent practice of selling fake or unauthorized insurance policies. | Failure to disclose relevant information to the insurer during policy application. |

| Legality | Illegal and punishable by law. | Considered breach of contract; can lead to policy cancellation. |

| Risk to Policyholder | No valid coverage; claims are denied. | Potential denial of claims or policy voidance. |

| Common Examples | Selling forged policies or impersonating brokers. | Not declaring existing health conditions or prior claims. |

| Prevention | Verify broker credentials; purchase from authorized agents. | Full disclosure of material facts during application. |

| Impact on Insurance Market | Increases fraud, raises premiums, damages trust. | Leads to underwriting challenges and higher insurer risks. |

Which is better?

Ghost broking involves fraudulent activity where intermediaries sell fake or invalid insurance policies, leading to significant financial and legal risks for policyholders. Non-disclosure refers to the failure to reveal relevant information to insurers, which can result in denied claims or policy cancellations but is often unintentional and rectifiable through accurate disclosures. Between the two, non-disclosure carries lower legal consequences and can sometimes be resolved with proper communication, whereas ghost broking poses a higher threat due to its criminal nature and irreversible damages.

Connection

Ghost broking involves fraudulent intermediaries who manipulate insurance policies, often by submitting false information or hiding critical details, which directly leads to non-disclosure of material facts. Non-disclosure in insurance refers to the failure to reveal important information that could affect the insurer's risk assessment, a common tactic employed by ghost brokers to lower premiums illegally. This deceptive practice compromises policy validity and exposes both insurers and policyholders to significant financial and legal risks.

Key Terms

Material Fact

Material fact disclosure is essential in insurance to ensure accurate risk assessment and policy validity; non-disclosure can lead to claim denial or policy cancellation. Ghost broking involves illegally selling fraudulent insurance policies, often by omitting or falsifying material facts to deceive customers and insurers. Explore the implications of material fact in insurance integrity and fraud prevention for comprehensive understanding.

Fraud

Non-disclosure fraud occurs when an insured party fails to reveal critical information to the insurer, leading to misrepresented risk and potentially voided policies. Ghost broking involves fraudsters acting as legitimate insurance brokers, selling fake or invalid insurance policies to unsuspecting clients. Learn more about these insurance frauds to protect yourself and your assets effectively.

Misrepresentation

Non-disclosure involves withholding critical information that can alter the terms or validity of an insurance contract, leading to misrepresentation through omission. Ghost broking entails fraudulent intermediaries selling fake or misrepresented insurance policies, directly deceiving clients about coverage legitimacy. Explore the nuances and legal implications of these misrepresentation tactics to protect yourself in insurance transactions.

Source and External Links

non-disclosure agreement (NDA) | Wex - Law.Cornell.Edu - A non-disclosure agreement (NDA) is a contract where parties agree certain information will remain confidential, and disclosure of that information can result in legal consequences for breach of contract.

Non-Disclosure Agreements (NDAs): Everything You Need to Know - NDAs are legally enforceable contracts that establish a confidential relationship between parties to protect sensitive business information from being shared with unauthorized individuals.

Non-Disclosure Agreements: 10 Key Provisions You Need to Know - NDAs protect sensitive data in business by clearly defining confidential information, specifying obligations, remedies for breaches, and ensuring legal compliance through detailed provisions.

dowidth.com

dowidth.com