Pay per mile insurance charges customers based on the exact number of miles driven, promoting cost efficiency for low-mileage drivers. Black box insurance uses telematics devices to monitor driving behavior, offering personalized premiums based on factors like speed, acceleration, and braking patterns. Explore the differences to find the best insurance option tailored to your driving habits.

Why it is important

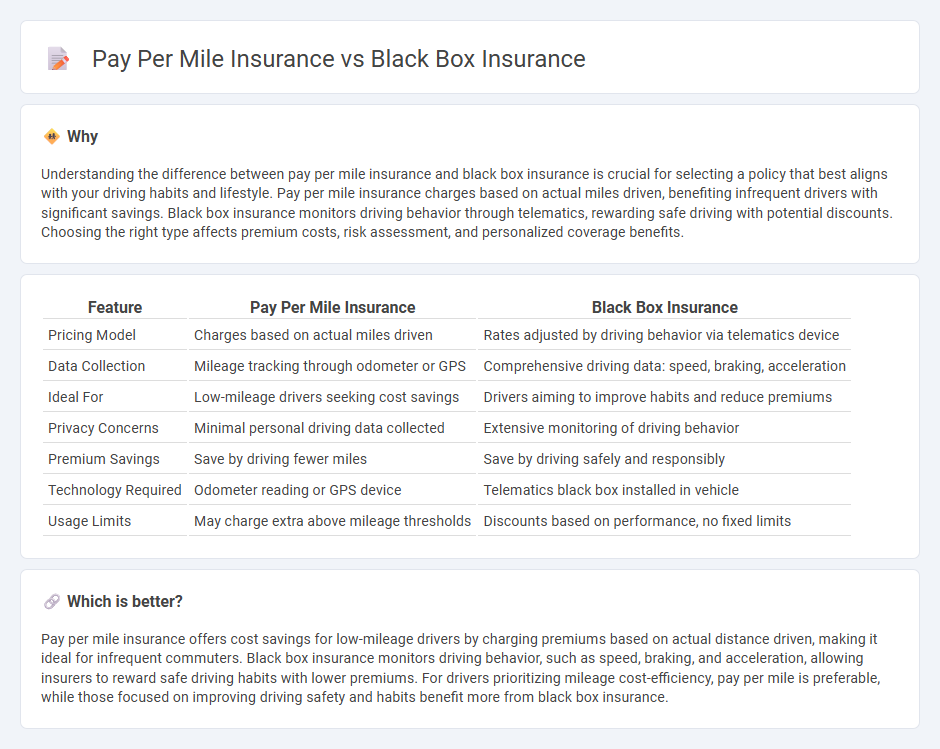

Understanding the difference between pay per mile insurance and black box insurance is crucial for selecting a policy that best aligns with your driving habits and lifestyle. Pay per mile insurance charges based on actual miles driven, benefiting infrequent drivers with significant savings. Black box insurance monitors driving behavior through telematics, rewarding safe driving with potential discounts. Choosing the right type affects premium costs, risk assessment, and personalized coverage benefits.

Comparison Table

| Feature | Pay Per Mile Insurance | Black Box Insurance |

|---|---|---|

| Pricing Model | Charges based on actual miles driven | Rates adjusted by driving behavior via telematics device |

| Data Collection | Mileage tracking through odometer or GPS | Comprehensive driving data: speed, braking, acceleration |

| Ideal For | Low-mileage drivers seeking cost savings | Drivers aiming to improve habits and reduce premiums |

| Privacy Concerns | Minimal personal driving data collected | Extensive monitoring of driving behavior |

| Premium Savings | Save by driving fewer miles | Save by driving safely and responsibly |

| Technology Required | Odometer reading or GPS device | Telematics black box installed in vehicle |

| Usage Limits | May charge extra above mileage thresholds | Discounts based on performance, no fixed limits |

Which is better?

Pay per mile insurance offers cost savings for low-mileage drivers by charging premiums based on actual distance driven, making it ideal for infrequent commuters. Black box insurance monitors driving behavior, such as speed, braking, and acceleration, allowing insurers to reward safe driving habits with lower premiums. For drivers prioritizing mileage cost-efficiency, pay per mile is preferable, while those focused on improving driving safety and habits benefit more from black box insurance.

Connection

Pay per mile insurance and Black box insurance are connected through their reliance on telematics technology to monitor driving behavior and mileage in real-time, allowing personalized premium calculations based on usage and risk factors. Black box devices collect data on speed, acceleration, braking patterns, and distance driven, which insurers use to determine pay per mile insurance rates tailored to individual driving habits. This integration promotes fair pricing models by aligning insurance costs directly with actual vehicle usage and driver performance.

Key Terms

Telematics

Telematics-based black box insurance uses a device installed in the vehicle to track driving behavior, offering tailored premiums based on real-time data such as speed, acceleration, and braking patterns. Pay per mile insurance, alternatively, charges customers solely based on the distance driven, leveraging GPS and telematics technology to monitor mileage accurately. Discover how these innovative telematics solutions can optimize your insurance costs and enhance driving safety.

Mileage Tracking

Black box insurance uses telematics devices to continuously monitor driving behavior and mileage, providing precise data that influences premiums in real-time. Pay per mile insurance charges customers based solely on the number of miles driven, tracked through odometer readings or GPS, offering a straightforward cost structure for low-mileage drivers. Explore how each option can optimize your insurance costs based on your unique driving patterns.

Premium Calculation

Black box insurance calculates premiums based on real-time driving behavior data collected through telematics devices, which monitor speed, acceleration, braking, and mileage, allowing insurers to reward safer drivers with lower rates. Pay per mile insurance charges premiums primarily on the actual miles driven, combining a fixed base fee with a variable rate per mile, making it ideal for low-mileage drivers seeking cost-effective coverage. Explore how each premium calculation impacts your insurance costs to find the best option tailored to your driving habits.

Source and External Links

Your Complete Guide to Black Boxes in Cars - This guide provides an overview of black box insurance, including its functionality and how it affects insurance premiums based on driving behavior.

What is Black Box Car Insurance & How Does it Work? - This article explains how black box car insurance works by tracking driving habits to determine insurance premiums and rewards safe drivers with lower costs.

Telematics Car Insurance | Black Box Insurance - This page discusses AIG's telematics insurance, which uses a black box to track driving and offers rewards for safe driving practices.

dowidth.com

dowidth.com