Reciprocal insurance involves a group of policyholders who mutually insure each other by sharing risks and losses through an exchange agreement. Self-insurance, by contrast, means an individual or organization assumes full financial responsibility for losses without transferring risk to an insurer. Explore in-depth comparisons and benefits of reciprocal insurance versus self-insurance to determine the best fit for your risk management needs.

Why it is important

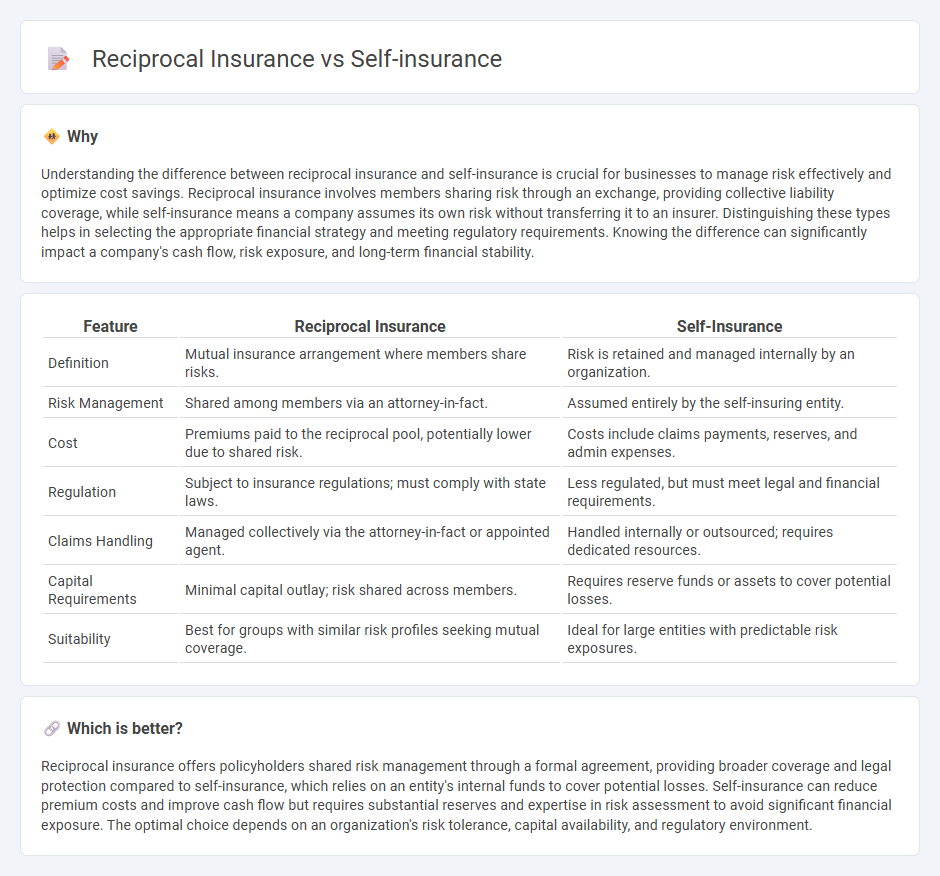

Understanding the difference between reciprocal insurance and self-insurance is crucial for businesses to manage risk effectively and optimize cost savings. Reciprocal insurance involves members sharing risk through an exchange, providing collective liability coverage, while self-insurance means a company assumes its own risk without transferring it to an insurer. Distinguishing these types helps in selecting the appropriate financial strategy and meeting regulatory requirements. Knowing the difference can significantly impact a company's cash flow, risk exposure, and long-term financial stability.

Comparison Table

| Feature | Reciprocal Insurance | Self-Insurance |

|---|---|---|

| Definition | Mutual insurance arrangement where members share risks. | Risk is retained and managed internally by an organization. |

| Risk Management | Shared among members via an attorney-in-fact. | Assumed entirely by the self-insuring entity. |

| Cost | Premiums paid to the reciprocal pool, potentially lower due to shared risk. | Costs include claims payments, reserves, and admin expenses. |

| Regulation | Subject to insurance regulations; must comply with state laws. | Less regulated, but must meet legal and financial requirements. |

| Claims Handling | Managed collectively via the attorney-in-fact or appointed agent. | Handled internally or outsourced; requires dedicated resources. |

| Capital Requirements | Minimal capital outlay; risk shared across members. | Requires reserve funds or assets to cover potential losses. |

| Suitability | Best for groups with similar risk profiles seeking mutual coverage. | Ideal for large entities with predictable risk exposures. |

Which is better?

Reciprocal insurance offers policyholders shared risk management through a formal agreement, providing broader coverage and legal protection compared to self-insurance, which relies on an entity's internal funds to cover potential losses. Self-insurance can reduce premium costs and improve cash flow but requires substantial reserves and expertise in risk assessment to avoid significant financial exposure. The optimal choice depends on an organization's risk tolerance, capital availability, and regulatory environment.

Connection

Reciprocal insurance and self-insurance both operate on the principle of risk sharing and risk retention within a defined group, reducing dependence on traditional commercial insurers. Reciprocal insurance involves policyholders agreeing to insure each other's risks through an attorney-in-fact, while self-insurance entails an entity setting aside funds to cover its own potential losses directly. Both mechanisms enhance control over insurance costs and claims management by leveraging collective or individual financial resources to handle risks internally.

Key Terms

Risk Retention

Self-insurance involves a company or individual retaining financial responsibility for their own risks, effectively setting aside funds to cover potential losses. Reciprocal insurance operates as an exchange of risk among members, where participants mutually insure each other through an attorney-in-fact managing the pool. Explore detailed comparisons and risk retention strategies to understand which option suits your risk management needs best.

Policyholder Group

Policyholder groups in self-insurance typically consist of a single organization assuming direct financial responsibility for risk, whereas reciprocal insurance involves multiple policyholders pooling resources to share risks collectively under an attorney-in-fact. The reciprocal model fosters a cooperative environment where each member's liability is proportionate to their share, contrasting with the concentrated risk-bearing in self-insurance. Explore further to understand the nuances of risk management strategies within these insurance frameworks.

Cost Sharing

Self-insurance involves an organization retaining the financial risk for losses and covering claims from its own funds, whereas reciprocal insurance pools resources among members who share in the costs and losses collectively. Cost sharing in self-insurance is typically more predictable internally but requires substantial capital reserves, while reciprocal insurance distributes costs across multiple parties, potentially lowering individual financial burden through mutual indemnification. Explore the distinct cost-sharing structures further to determine the best fit for your organization's risk management strategy.

Source and External Links

Self-insurance - Wikipedia - Self-insurance is a risk management method where an organization retains the financial risk itself instead of buying third-party insurance, setting aside funds to cover future losses, often resulting in cost savings compared to commercial insurance premiums.

A Guide to Self-Insurance - APP Tech - Self-insurance involves businesses setting aside money to cover potential losses and requires careful financial analysis, policy development, stop-loss insurance for high claims, and effective claims management.

Self-Insured Vs. Fully Insured Health Plans - Aetna - Self-insurance or self-funded plans mean the employer pays for claims directly, offering flexibility, potential cost savings, and the benefit of network contracts while avoiding some state insurance requirements.

dowidth.com

dowidth.com