Microinsurance offers affordable coverage tailored for low-income individuals, focusing on essential risks such as health, agriculture, or property protection. Travel insurance provides specialized protection for trip cancellations, medical emergencies, and lost luggage during domestic or international journeys. Explore the differences in benefits and coverage options to choose the best insurance for your needs.

Why it is important

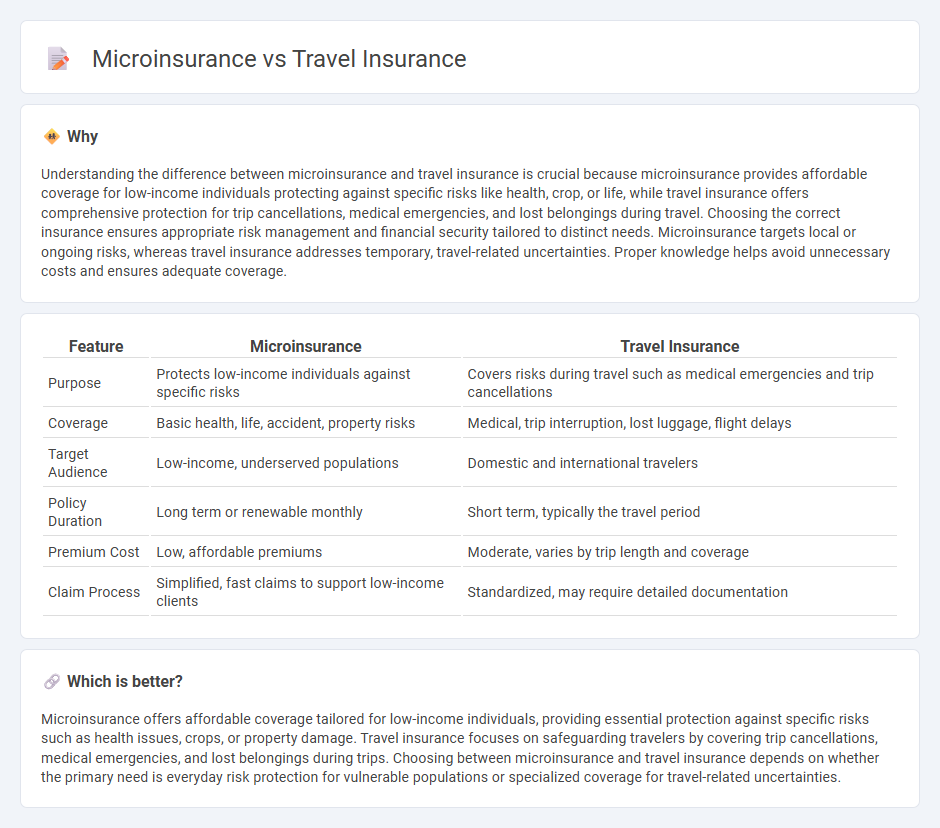

Understanding the difference between microinsurance and travel insurance is crucial because microinsurance provides affordable coverage for low-income individuals protecting against specific risks like health, crop, or life, while travel insurance offers comprehensive protection for trip cancellations, medical emergencies, and lost belongings during travel. Choosing the correct insurance ensures appropriate risk management and financial security tailored to distinct needs. Microinsurance targets local or ongoing risks, whereas travel insurance addresses temporary, travel-related uncertainties. Proper knowledge helps avoid unnecessary costs and ensures adequate coverage.

Comparison Table

| Feature | Microinsurance | Travel Insurance |

|---|---|---|

| Purpose | Protects low-income individuals against specific risks | Covers risks during travel such as medical emergencies and trip cancellations |

| Coverage | Basic health, life, accident, property risks | Medical, trip interruption, lost luggage, flight delays |

| Target Audience | Low-income, underserved populations | Domestic and international travelers |

| Policy Duration | Long term or renewable monthly | Short term, typically the travel period |

| Premium Cost | Low, affordable premiums | Moderate, varies by trip length and coverage |

| Claim Process | Simplified, fast claims to support low-income clients | Standardized, may require detailed documentation |

Which is better?

Microinsurance offers affordable coverage tailored for low-income individuals, providing essential protection against specific risks such as health issues, crops, or property damage. Travel insurance focuses on safeguarding travelers by covering trip cancellations, medical emergencies, and lost belongings during trips. Choosing between microinsurance and travel insurance depends on whether the primary need is everyday risk protection for vulnerable populations or specialized coverage for travel-related uncertainties.

Connection

Microinsurance and travel insurance both aim to provide affordable financial protection tailored to specific risks faced by individuals. Microinsurance often covers low-income populations against everyday risks, while travel insurance offers coverage for unexpected events during trips, such as medical emergencies, trip cancellations, or lost luggage. Both types emphasize risk mitigation through accessible, targeted insurance products that address unique vulnerabilities, enhancing financial security for policyholders in diverse contexts.

Key Terms

Coverage

Travel insurance typically offers comprehensive coverage including trip cancellations, medical emergencies, lost luggage, and travel delays, accommodating both international and domestic trips. Microinsurance focuses on providing affordable, limited coverage tailored to specific risks such as brief travel interruptions or minor medical expenses, often targeting low-income travelers. Explore detailed comparisons to determine which insurance type best suits your travel needs.

Premium

Travel insurance premiums typically vary based on factors such as trip duration, destination, age, and coverage limits, often resulting in higher costs due to comprehensive protection. Microinsurance premiums are generally lower, designed for affordability with limited coverage tailored to specific risks or short-term needs. Explore detailed comparisons to determine which premium structure best fits your travel requirements and budget.

Exclusions

Travel insurance often excludes pre-existing medical conditions, high-risk activities, and certain destinations, while microinsurance typically has more limited coverage and broader exclusions due to its lower premiums and simplified policies. Exclusions in microinsurance may include specific illnesses, natural disasters, or events occurring outside the policy period, reflecting its design for short-term needs with minimal underwriting. Explore detailed comparisons to understand which insurance type best suits your travel protection requirements.

Source and External Links

Travel insurance - Travelers Insurance - Travel insurance helps protect against losses and unexpected events during travel, covering trip cancellation, medical expenses, baggage, and personal effects, with plans for single or multi-trip coverage and optional add-ons for cancelation flexibility.

Travel Guard: Travel Insurance Plans - Travel Guard offers comprehensive travel insurance for international, domestic, senior, and family travelers with coverage including trip cancellation, medical expenses, baggage loss, and 24/7 emergency assistance, typically costing around 5-7% of the trip price.

Travel Insurance - Compare the Best Quotes & Buy Online - Squaremouth allows travelers to compare and buy travel insurance plans tailored for international trips, cruises, and specific needs such as pre-existing condition waivers and covers cancellation, medical, and evacuation, with single-trip or annual options available.

dowidth.com

dowidth.com