Pandemic Business Interruption Insurance covers losses specifically arising from government-mandated shutdowns or health crises like COVID-19, directly addressing interruptions caused by contagious disease outbreaks. Contingent Business Interruption Insurance protects against disruptions in the supply chain or key suppliers, ensuring business continuity when external partners face operational halts. Explore the distinctions and benefits of both policies to safeguard your business effectively during unpredictable disruptions.

Why it is important

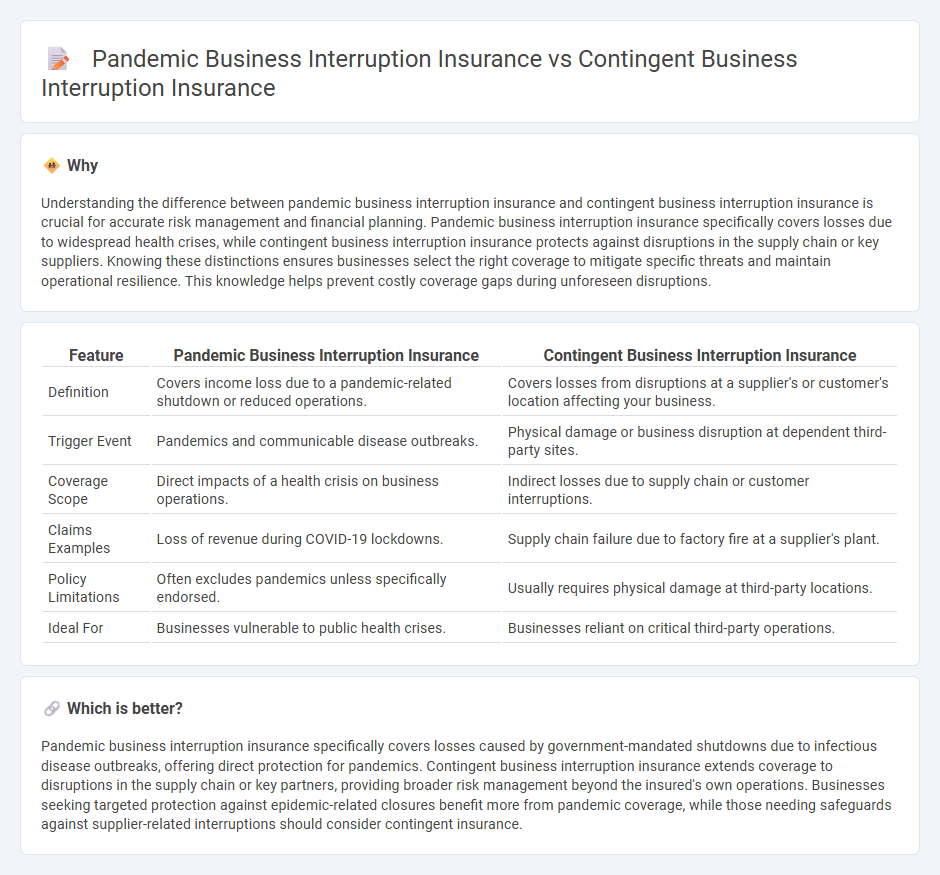

Understanding the difference between pandemic business interruption insurance and contingent business interruption insurance is crucial for accurate risk management and financial planning. Pandemic business interruption insurance specifically covers losses due to widespread health crises, while contingent business interruption insurance protects against disruptions in the supply chain or key suppliers. Knowing these distinctions ensures businesses select the right coverage to mitigate specific threats and maintain operational resilience. This knowledge helps prevent costly coverage gaps during unforeseen disruptions.

Comparison Table

| Feature | Pandemic Business Interruption Insurance | Contingent Business Interruption Insurance |

|---|---|---|

| Definition | Covers income loss due to a pandemic-related shutdown or reduced operations. | Covers losses from disruptions at a supplier's or customer's location affecting your business. |

| Trigger Event | Pandemics and communicable disease outbreaks. | Physical damage or business disruption at dependent third-party sites. |

| Coverage Scope | Direct impacts of a health crisis on business operations. | Indirect losses due to supply chain or customer interruptions. |

| Claims Examples | Loss of revenue during COVID-19 lockdowns. | Supply chain failure due to factory fire at a supplier's plant. |

| Policy Limitations | Often excludes pandemics unless specifically endorsed. | Usually requires physical damage at third-party locations. |

| Ideal For | Businesses vulnerable to public health crises. | Businesses reliant on critical third-party operations. |

Which is better?

Pandemic business interruption insurance specifically covers losses caused by government-mandated shutdowns due to infectious disease outbreaks, offering direct protection for pandemics. Contingent business interruption insurance extends coverage to disruptions in the supply chain or key partners, providing broader risk management beyond the insured's own operations. Businesses seeking targeted protection against epidemic-related closures benefit more from pandemic coverage, while those needing safeguards against supplier-related interruptions should consider contingent insurance.

Connection

Pandemic business interruption insurance and contingent business interruption insurance both provide coverage for financial losses due to disruptions in business operations, with pandemic insurance specifically addressing losses caused by infectious disease outbreaks like COVID-19. Contingent business interruption insurance extends protection to losses resulting from disruptions in the supply chain or customers' operations, which can be triggered by pandemic-related shutdowns. These policies are interconnected as pandemics can cause widespread operational halts both directly within a business and indirectly through affected suppliers or partners, highlighting the importance of comprehensive risk management strategies.

Key Terms

**Contingent Business Interruption Insurance:**

Contingent Business Interruption (CBI) insurance provides coverage for losses when a supplier or customer's business disruption impacts your operations, protecting against supply chain interruptions and dependency-related financial losses. Unlike Pandemic Business Interruption insurance, which addresses losses caused by widespread health crises, CBI focuses on interruptions linked to specific third-party business failures, including natural disasters or localized incidents. Explore more to understand how CBI insurance safeguards your business against external operational risks and ensures continuity.

Dependent Properties

Contingent business interruption insurance covers losses arising from disruptions at suppliers or customers' locations, while pandemic business interruption insurance addresses losses due to government-mandated closures and health crises. Dependent properties clauses are crucial in contingent insurance, as they provide coverage when third-party disruptions impact the insured's operations, a feature often excluded in pandemic policies. Explore the differences in these coverages to safeguard your business against complex interruption risks.

Supply Chain Disruption

Contingent Business Interruption Insurance covers losses arising from supplier or customer disruptions within the supply chain, typically triggered by physical damage to third-party premises. Pandemic Business Interruption Insurance specifically addresses income losses due to infectious disease outbreaks, including widespread supply chain interruptions caused by health crises like COVID-19. Explore detailed policy comparisons and coverage nuances to understand how each insurance mitigates risks in supply chain disruptions during public health emergencies.

Source and External Links

Contingent Business Interruption: Getting All the Facts - Contingent business interruption insurance reimburses lost profits and extra expenses when a business is interrupted due to damage at a supplier's or customer's location, even if the supplier's operation is only partially affected.

Contingent Business Interruption (CBI) - CBI coverage pays the insured for losses caused by damage to a supplier's or customer's property that interrupts the insured's business, provided the cause of loss would be covered if it had occurred at the insured's own property.

What is contingent business interruption? - Contingent business interruption insurance covers lost revenue when a third-party supplier or customer is shut down due to a covered event, directly impacting the insured's ability to operate.

dowidth.com

dowidth.com