On-demand insurance offers consumers flexible, pay-per-use coverage activated when needed, catering to specific situations or short durations. Embedded insurance integrates coverage directly into products or services, providing seamless protection at the point of purchase without requiring separate policies. Explore how these innovative insurance models are transforming risk management and customer experience.

Why it is important

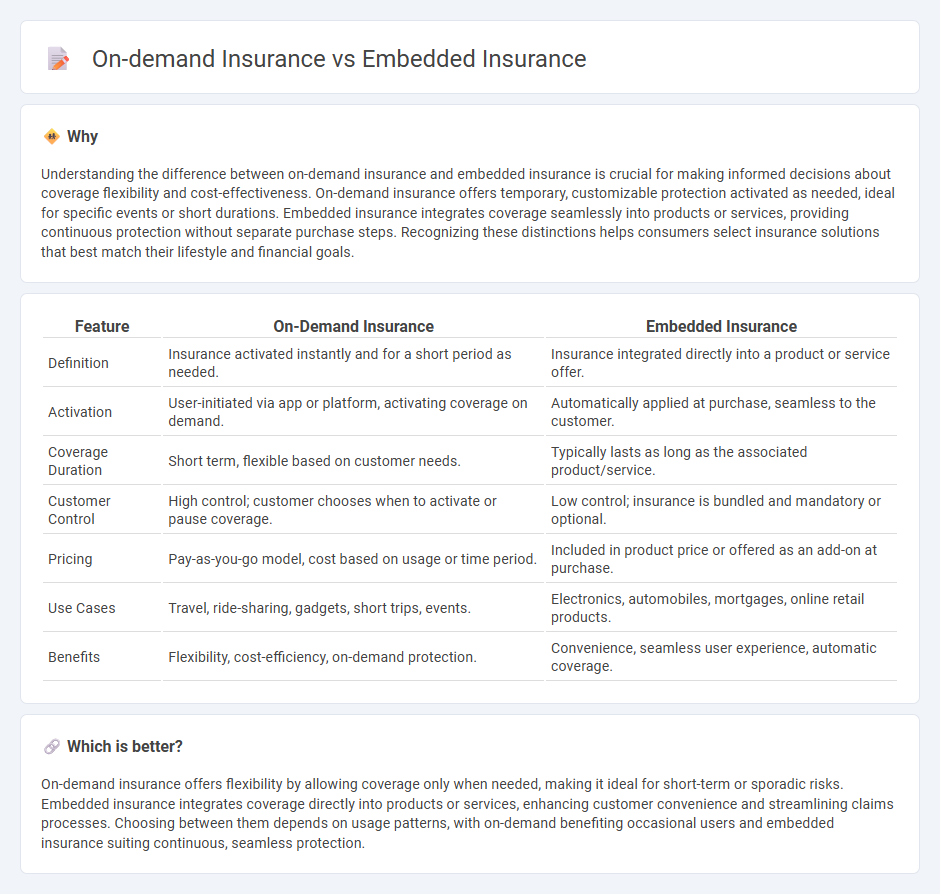

Understanding the difference between on-demand insurance and embedded insurance is crucial for making informed decisions about coverage flexibility and cost-effectiveness. On-demand insurance offers temporary, customizable protection activated as needed, ideal for specific events or short durations. Embedded insurance integrates coverage seamlessly into products or services, providing continuous protection without separate purchase steps. Recognizing these distinctions helps consumers select insurance solutions that best match their lifestyle and financial goals.

Comparison Table

| Feature | On-Demand Insurance | Embedded Insurance |

|---|---|---|

| Definition | Insurance activated instantly and for a short period as needed. | Insurance integrated directly into a product or service offer. |

| Activation | User-initiated via app or platform, activating coverage on demand. | Automatically applied at purchase, seamless to the customer. |

| Coverage Duration | Short term, flexible based on customer needs. | Typically lasts as long as the associated product/service. |

| Customer Control | High control; customer chooses when to activate or pause coverage. | Low control; insurance is bundled and mandatory or optional. |

| Pricing | Pay-as-you-go model, cost based on usage or time period. | Included in product price or offered as an add-on at purchase. |

| Use Cases | Travel, ride-sharing, gadgets, short trips, events. | Electronics, automobiles, mortgages, online retail products. |

| Benefits | Flexibility, cost-efficiency, on-demand protection. | Convenience, seamless user experience, automatic coverage. |

Which is better?

On-demand insurance offers flexibility by allowing coverage only when needed, making it ideal for short-term or sporadic risks. Embedded insurance integrates coverage directly into products or services, enhancing customer convenience and streamlining claims processes. Choosing between them depends on usage patterns, with on-demand benefiting occasional users and embedded insurance suiting continuous, seamless protection.

Connection

On-demand insurance and embedded insurance are connected through their focus on providing flexible, customer-centric coverage that integrates seamlessly with users' lifestyles and purchasing behaviors. Both models utilize digital platforms and APIs to offer real-time, context-specific insurance products, enhancing convenience and immediacy in risk protection. This integration drives innovation in the insurance industry by enabling personalized policies linked directly to specific events, transactions, or assets.

Key Terms

Embedded Insurance:

Embedded insurance integrates coverage directly into the purchase of products or services, streamlining the user experience and increasing policy adoption rates. This model allows businesses in travel, e-commerce, and automotive sectors to offer seamless protection without requiring separate transactions. Discover how embedded insurance can enhance customer value and drive revenue growth.

Integration

Embedded insurance integrates coverage seamlessly into the purchase process of products or services, enhancing customer experience by offering protection at the point of sale. On-demand insurance provides flexible, short-term coverage triggered by specific needs or events, accessible via mobile apps or digital platforms for immediate activation. Explore how these integration models transform risk management and customer engagement in modern insurance solutions.

Seamless Experience

Embedded insurance integrates coverage directly into the purchase of products or services, ensuring a seamless experience that eliminates separate policy management. On-demand insurance offers flexible, temporary coverage activated through digital platforms, providing users with convenience and control over their insurance needs. Explore how these innovative insurance models enhance customer experience and simplify protection.

Source and External Links

What is embedded insurance | Chubb - Embedded insurance integrates risk protection directly into a customer's purchase journey, allowing seamless and personalized insurance options to be added or included at the point of sale without leaving the buying process.

Embedded insurance: Definition, types, benefits - Endava - Embedded insurance offers immediate coverage integrated within a product or service purchase, increasing accessibility and simplifying the insurance buying experience compared to traditional separate insurance purchases.

The Rise of Embedded Insurance: Opportunities & Challenges - Embedded insurance is transforming the insurance industry by embedding insurance products in purchase journeys, projected to grow significantly and improve customer experience through seamless point-of-sale coverage integration.

dowidth.com

dowidth.com