Pet health insurance protects against unexpected veterinary expenses, covering treatments, surgeries, and medications for pets. Crop insurance mitigates financial risks for farmers by safeguarding yields against adverse weather, pests, and disease-related losses. Explore detailed comparisons to determine which insurance suits your specific needs best.

Why it is important

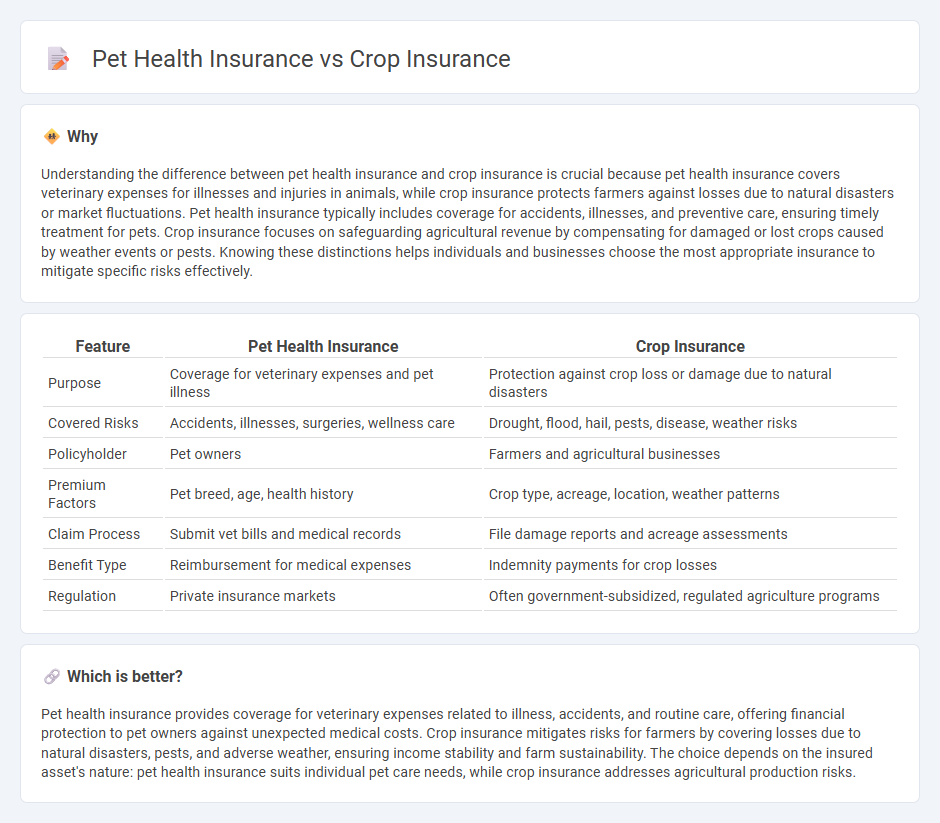

Understanding the difference between pet health insurance and crop insurance is crucial because pet health insurance covers veterinary expenses for illnesses and injuries in animals, while crop insurance protects farmers against losses due to natural disasters or market fluctuations. Pet health insurance typically includes coverage for accidents, illnesses, and preventive care, ensuring timely treatment for pets. Crop insurance focuses on safeguarding agricultural revenue by compensating for damaged or lost crops caused by weather events or pests. Knowing these distinctions helps individuals and businesses choose the most appropriate insurance to mitigate specific risks effectively.

Comparison Table

| Feature | Pet Health Insurance | Crop Insurance |

|---|---|---|

| Purpose | Coverage for veterinary expenses and pet illness | Protection against crop loss or damage due to natural disasters |

| Covered Risks | Accidents, illnesses, surgeries, wellness care | Drought, flood, hail, pests, disease, weather risks |

| Policyholder | Pet owners | Farmers and agricultural businesses |

| Premium Factors | Pet breed, age, health history | Crop type, acreage, location, weather patterns |

| Claim Process | Submit vet bills and medical records | File damage reports and acreage assessments |

| Benefit Type | Reimbursement for medical expenses | Indemnity payments for crop losses |

| Regulation | Private insurance markets | Often government-subsidized, regulated agriculture programs |

Which is better?

Pet health insurance provides coverage for veterinary expenses related to illness, accidents, and routine care, offering financial protection to pet owners against unexpected medical costs. Crop insurance mitigates risks for farmers by covering losses due to natural disasters, pests, and adverse weather, ensuring income stability and farm sustainability. The choice depends on the insured asset's nature: pet health insurance suits individual pet care needs, while crop insurance addresses agricultural production risks.

Connection

Pet health insurance and crop insurance share the principle of risk management by providing financial protection against unexpected losses, whether due to illness in animals or adverse weather conditions affecting crops. Both types of insurance use actuarial data to assess risk and set premiums, ensuring coverage handles the variability inherent in biological systems. This connection highlights the broader role of insurance in safeguarding livelihoods tied to living organisms and enhancing resilience in agriculture and pet care sectors.

Key Terms

Crop Insurance:

Crop insurance protects farmers against financial losses due to natural disasters, pest infestations, and adverse weather conditions, ensuring crop yield stability and market resilience. It often includes policies like multi-peril crop insurance (MPCI) and revenue protection, tailored to various crop types and regional agricultural risks. Explore more about crop insurance coverage options and benefits for maximizing farm profitability.

Yield Loss

Crop insurance primarily protects farmers against yield loss due to natural disasters, pests, or disease, covering financial risks tied to agricultural production. Pet health insurance, focused on veterinary care, does not cover yield loss but helps manage medical expenses for pets, emphasizing individual health rather than production outcomes. Explore more about how different insurance types address specific risk areas and financial protection needs.

Weather Risk

Crop insurance specifically covers losses resulting from adverse weather events such as droughts, floods, hail, and storms, which directly impact agricultural yield and farm income. Pet health insurance, on the other hand, primarily addresses veterinary care costs for illnesses and injuries and rarely includes coverage for weather-related risks affecting pets. To explore detailed differences and coverage options between crop insurance and pet health insurance, continue reading for expert insights.

Source and External Links

Crop insurance - Wikipedia - Crop insurance, often subsidized by governments like the U.S. (averaging 62% of the premium), protects agricultural producers from losses due to natural disasters, with programs covering over 100 crops and administered by private companies under federal oversight.

How Does Crop Insurance Work? - ProAg - Crop insurance, sold since 1880 in the U.S. and now offered through government-approved providers, helps farmers recover from weather and market disruptions, with standardized policies accessible to producers nationwide.

dowidth.com

dowidth.com