Micro-mobility insurance specifically covers electric scooters, bikes, and other small, shared vehicles, offering tailored protection against theft, accidents, and liability distinct from traditional personal auto insurance policies that focus on cars and trucks. Personal auto insurance typically provides broader coverage including collision, comprehensive, and uninsured motorist protection, which may not fully apply to micro-mobility devices due to their unique usage patterns and risk profiles. Explore the key differences and benefits of each policy type to choose the best coverage for your transportation needs.

Why it is important

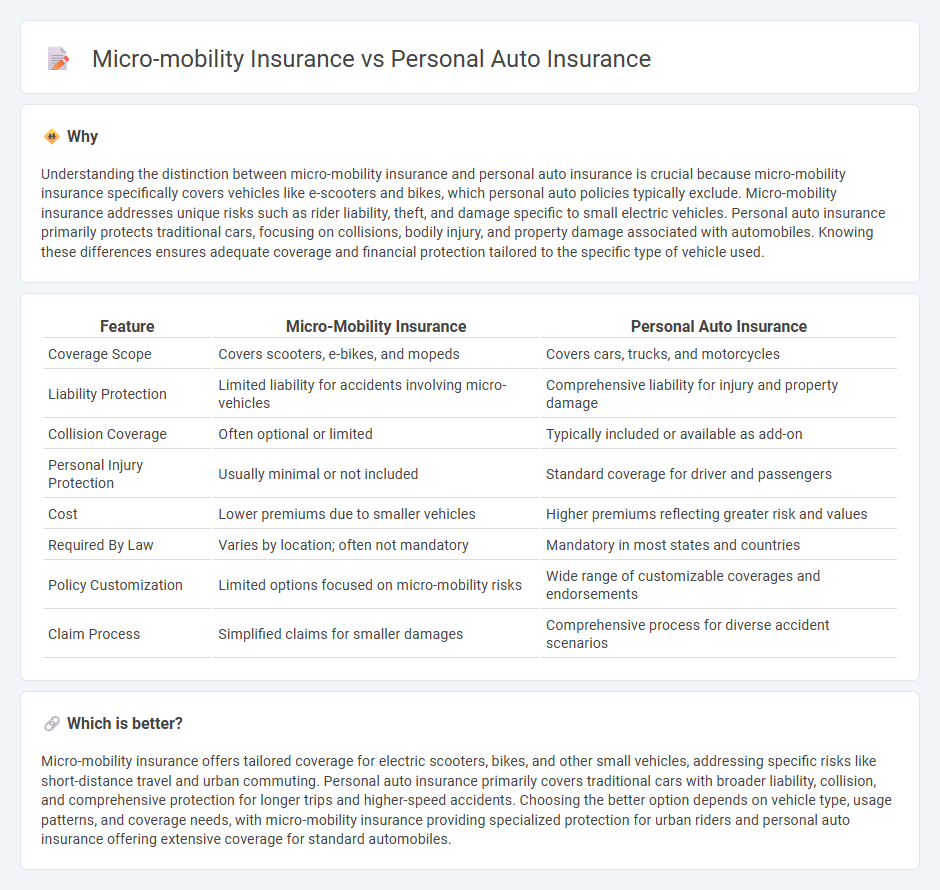

Understanding the distinction between micro-mobility insurance and personal auto insurance is crucial because micro-mobility insurance specifically covers vehicles like e-scooters and bikes, which personal auto policies typically exclude. Micro-mobility insurance addresses unique risks such as rider liability, theft, and damage specific to small electric vehicles. Personal auto insurance primarily protects traditional cars, focusing on collisions, bodily injury, and property damage associated with automobiles. Knowing these differences ensures adequate coverage and financial protection tailored to the specific type of vehicle used.

Comparison Table

| Feature | Micro-Mobility Insurance | Personal Auto Insurance |

|---|---|---|

| Coverage Scope | Covers scooters, e-bikes, and mopeds | Covers cars, trucks, and motorcycles |

| Liability Protection | Limited liability for accidents involving micro-vehicles | Comprehensive liability for injury and property damage |

| Collision Coverage | Often optional or limited | Typically included or available as add-on |

| Personal Injury Protection | Usually minimal or not included | Standard coverage for driver and passengers |

| Cost | Lower premiums due to smaller vehicles | Higher premiums reflecting greater risk and values |

| Required By Law | Varies by location; often not mandatory | Mandatory in most states and countries |

| Policy Customization | Limited options focused on micro-mobility risks | Wide range of customizable coverages and endorsements |

| Claim Process | Simplified claims for smaller damages | Comprehensive process for diverse accident scenarios |

Which is better?

Micro-mobility insurance offers tailored coverage for electric scooters, bikes, and other small vehicles, addressing specific risks like short-distance travel and urban commuting. Personal auto insurance primarily covers traditional cars with broader liability, collision, and comprehensive protection for longer trips and higher-speed accidents. Choosing the better option depends on vehicle type, usage patterns, and coverage needs, with micro-mobility insurance providing specialized protection for urban riders and personal auto insurance offering extensive coverage for standard automobiles.

Connection

Micro-mobility insurance complements personal auto insurance by covering emerging transportation modes such as e-scooters and e-bikes, often excluded under traditional auto policies. Both insurance types address liability and damage protection but differ in coverage specifics, reflecting varied risk profiles and usage patterns. Integrating these policies provides comprehensive protection for individuals using multiple transportation methods, enhancing overall risk management.

Key Terms

**Personal Auto Insurance:**

Personal auto insurance provides coverage for private vehicles including cars, trucks, and motorcycles, protecting against liability, collision, and comprehensive risks such as theft or natural disasters. This insurance typically covers medical expenses, property damage, uninsured motorists, and roadside assistance essential in personal transportation. Explore more details to understand how personal auto insurance offers tailored protection for everyday driving needs.

Liability Coverage

Personal auto insurance typically covers liability for bodily injury and property damage resulting from car accidents, with limits often ranging from $100,000 to $500,000 per occurrence. Micro-mobility insurance, designed for e-scooters, e-bikes, and similar vehicles, addresses liability risks specific to these modes, including pedestrian injuries and property damage, often featuring lower coverage limits but specialized clauses for urban environments. Explore more to understand which insurance best protects you in the evolving landscape of personal and micro-mobility transportation.

Collision Coverage

Personal auto insurance typically offers comprehensive collision coverage protecting against damages from vehicle impacts, covering costs for repairs or replacement of personal cars. Micro-mobility insurance provides specialized collision coverage tailored to e-scooters, e-bikes, and other lightweight vehicles, addressing unique risks like low-speed accidents and urban commuting hazards. Discover how these distinct policies safeguard you by exploring more about collision coverage options for personal autos and micro-mobility devices.

Source and External Links

Car Insurance - Travelers - Offers comprehensive coverage options including liability, collision, comprehensive, loan/lease gap insurance, and extended transportation expenses, with customizable deductibles and premiums to fit your needs.

Car Insurance - Nationwide - Provides affordable auto insurance through bundling, safe driving discounts, and a variety of coverage types such as bodily injury, property damage liability, personal injury protection, and uninsured/underinsured motorist coverage--tailored to your state's requirements and personal circumstances.

Personal Car Insurance - Kemper - Specializes in flexible, affordable policies with options for those with unique circumstances (like no driver's license or suspended license), offering standard coverages, roadside assistance, and annual policy rate locks.

dowidth.com

dowidth.com