Gig worker insurance often offers flexible coverage tailored to freelance and contract work, including protection against income loss, liability, and health risks without employer benefits. Corporate employee insurance typically provides comprehensive packages including health, disability, and retirement benefits supported by employer contributions and regulatory compliance. Explore detailed comparisons to understand which insurance options best safeguard your work and financial security.

Why it is important

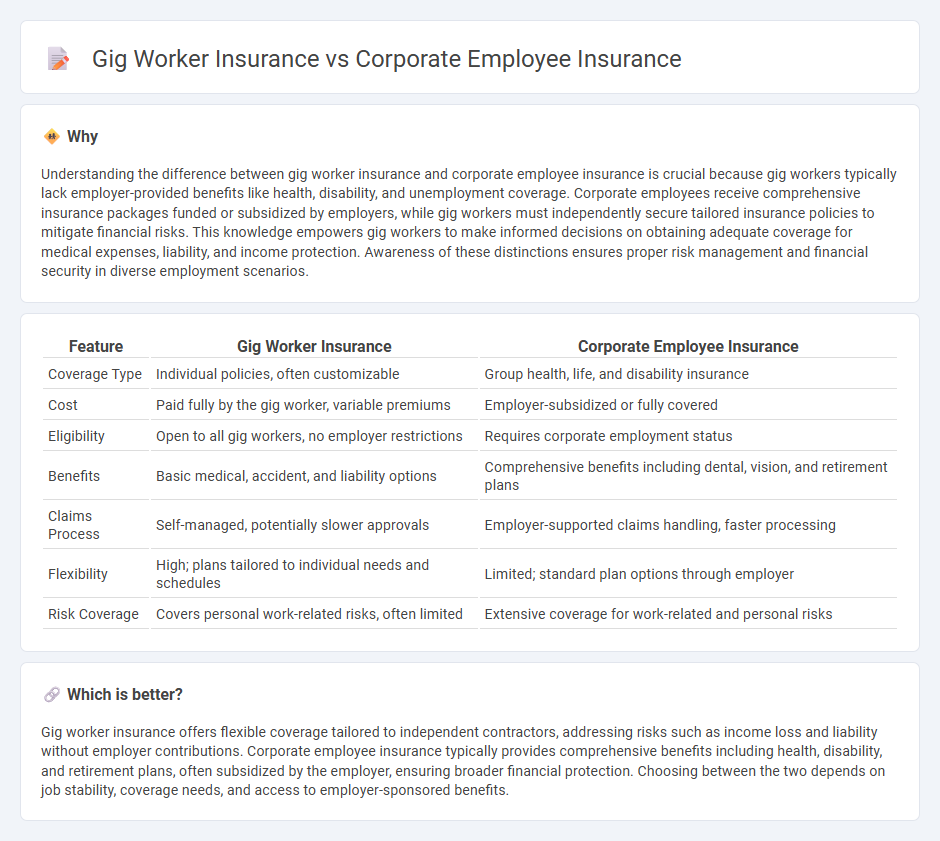

Understanding the difference between gig worker insurance and corporate employee insurance is crucial because gig workers typically lack employer-provided benefits like health, disability, and unemployment coverage. Corporate employees receive comprehensive insurance packages funded or subsidized by employers, while gig workers must independently secure tailored insurance policies to mitigate financial risks. This knowledge empowers gig workers to make informed decisions on obtaining adequate coverage for medical expenses, liability, and income protection. Awareness of these distinctions ensures proper risk management and financial security in diverse employment scenarios.

Comparison Table

| Feature | Gig Worker Insurance | Corporate Employee Insurance |

|---|---|---|

| Coverage Type | Individual policies, often customizable | Group health, life, and disability insurance |

| Cost | Paid fully by the gig worker, variable premiums | Employer-subsidized or fully covered |

| Eligibility | Open to all gig workers, no employer restrictions | Requires corporate employment status |

| Benefits | Basic medical, accident, and liability options | Comprehensive benefits including dental, vision, and retirement plans |

| Claims Process | Self-managed, potentially slower approvals | Employer-supported claims handling, faster processing |

| Flexibility | High; plans tailored to individual needs and schedules | Limited; standard plan options through employer |

| Risk Coverage | Covers personal work-related risks, often limited | Extensive coverage for work-related and personal risks |

Which is better?

Gig worker insurance offers flexible coverage tailored to independent contractors, addressing risks such as income loss and liability without employer contributions. Corporate employee insurance typically provides comprehensive benefits including health, disability, and retirement plans, often subsidized by the employer, ensuring broader financial protection. Choosing between the two depends on job stability, coverage needs, and access to employer-sponsored benefits.

Connection

Gig worker insurance and corporate employee insurance intersect in their shared goal of providing financial protection against risks such as illness, injury, and income loss. Both types of insurance increasingly incorporate digital platforms and customizable coverage options tailored to the unique needs of gig economy workers and traditional employees. Emerging trends highlight hybrid insurance models that bridge gaps between gig work variability and corporate benefits, promoting comprehensive risk management across diverse employment types.

Key Terms

**Corporate Employee Insurance:**

Corporate employee insurance typically offers comprehensive coverage including health, dental, vision, disability, and life insurance benefits, often subsidized partially or fully by the employer. This insurance provides financial protection through group rates and risk pooling, resulting in lower premiums and enhanced benefits compared to individual plans. Discover how these advantages compare to gig worker insurance options and what fits best for your employment situation.

Group Health Plan

Group Health Plans for corporate employees often provide comprehensive coverage including medical, dental, and vision benefits with employer contributions lowering individual costs. In contrast, gig workers typically lack access to employer-sponsored group plans, facing higher premiums and limited benefits when purchasing insurance independently or through marketplaces. Explore detailed comparisons to understand the best health insurance options tailored for corporate employees versus gig workers.

Employer Contribution

Corporate employee insurance typically benefits from substantial employer contributions covering a significant portion of premiums, often ranging from 70% to 90%, enhancing affordability and comprehensive coverage. Gig worker insurance frequently lacks employer-funded support, requiring independent workers to shoulder full premium costs, which can limit access to extensive health benefits. Explore further to understand how employer contributions impact insurance options and affordability for different workforce categories.

Source and External Links

What Is Group Health Insurance & How Does It Work? - Group health insurance is coverage provided to employees by a business or organization, often requiring participation from at least two employees and involving employer management of plan selection, enrollment, and ongoing administration.

Employer-Sponsored Health Insurance 101 - Employer-sponsored health insurance is the primary source of health coverage for non-elderly Americans, with premiums typically shared between employer and employee, and tax benefits making it a popular workplace benefit.

Group Health Insurance Plans for Employers - Employers can choose from a variety of group health plans, including medical, dental, vision, wellness, and supplemental coverage, with options tailored to businesses of all sizes and industries.

dowidth.com

dowidth.com