Microinsurance provides affordable, tailored coverage for low-income individuals to protect against everyday risks like health emergencies or property loss. Crop insurance specifically safeguards farmers from financial losses due to crop failure caused by natural disasters, pests, or extreme weather conditions. Explore how these insurance types address distinct needs and offer vital security to vulnerable populations.

Why it is important

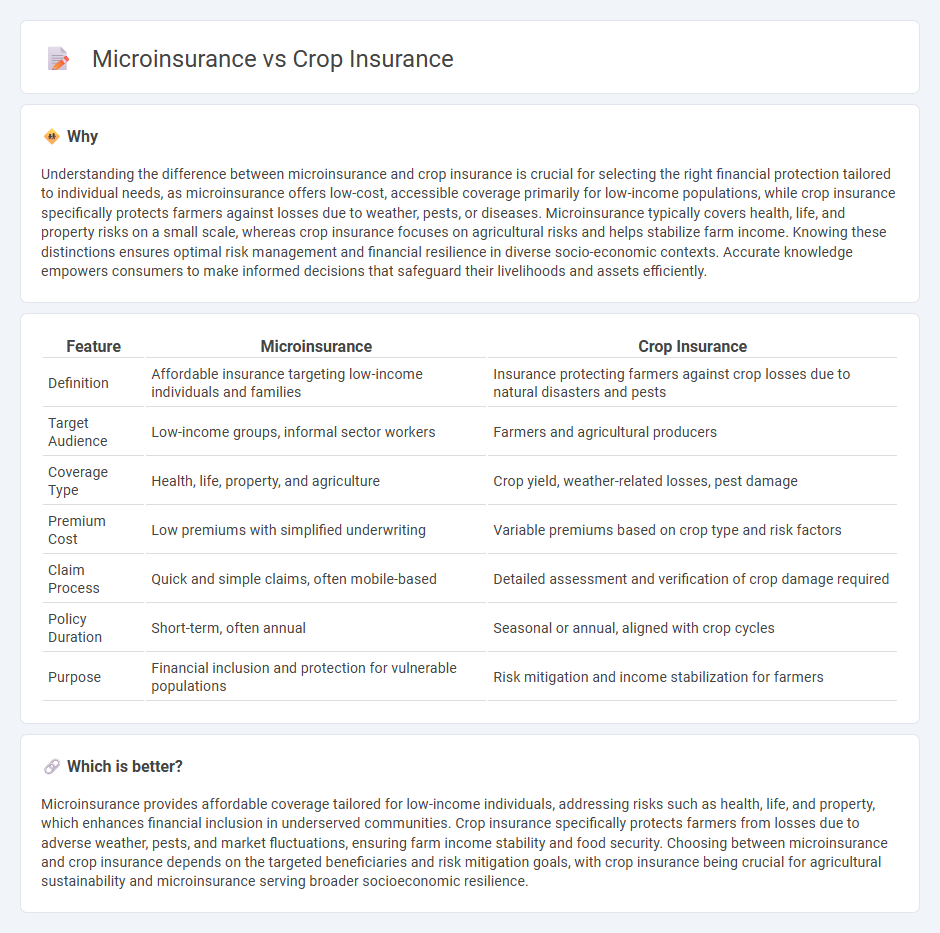

Understanding the difference between microinsurance and crop insurance is crucial for selecting the right financial protection tailored to individual needs, as microinsurance offers low-cost, accessible coverage primarily for low-income populations, while crop insurance specifically protects farmers against losses due to weather, pests, or diseases. Microinsurance typically covers health, life, and property risks on a small scale, whereas crop insurance focuses on agricultural risks and helps stabilize farm income. Knowing these distinctions ensures optimal risk management and financial resilience in diverse socio-economic contexts. Accurate knowledge empowers consumers to make informed decisions that safeguard their livelihoods and assets efficiently.

Comparison Table

| Feature | Microinsurance | Crop Insurance |

|---|---|---|

| Definition | Affordable insurance targeting low-income individuals and families | Insurance protecting farmers against crop losses due to natural disasters and pests |

| Target Audience | Low-income groups, informal sector workers | Farmers and agricultural producers |

| Coverage Type | Health, life, property, and agriculture | Crop yield, weather-related losses, pest damage |

| Premium Cost | Low premiums with simplified underwriting | Variable premiums based on crop type and risk factors |

| Claim Process | Quick and simple claims, often mobile-based | Detailed assessment and verification of crop damage required |

| Policy Duration | Short-term, often annual | Seasonal or annual, aligned with crop cycles |

| Purpose | Financial inclusion and protection for vulnerable populations | Risk mitigation and income stabilization for farmers |

Which is better?

Microinsurance provides affordable coverage tailored for low-income individuals, addressing risks such as health, life, and property, which enhances financial inclusion in underserved communities. Crop insurance specifically protects farmers from losses due to adverse weather, pests, and market fluctuations, ensuring farm income stability and food security. Choosing between microinsurance and crop insurance depends on the targeted beneficiaries and risk mitigation goals, with crop insurance being crucial for agricultural sustainability and microinsurance serving broader socioeconomic resilience.

Connection

Microinsurance and crop insurance both target risk mitigation in vulnerable populations, specifically smallholder farmers. Microinsurance provides affordable coverage for low-income households against agricultural risks, while crop insurance directly protects farmers from losses due to natural disasters, pests, or price fluctuations. Together, they enhance financial resilience and promote sustainable agricultural productivity in developing economies.

Key Terms

**Crop Insurance:**

Crop insurance offers financial protection to farmers against losses caused by natural disasters such as droughts, floods, or pests, ensuring stability in agricultural production and income. It often involves government subsidies and tailored policies based on crop type, region, and farming practices, making it a critical component for large-scale and commercial farmers. Discover how crop insurance can safeguard your farming investment and enhance resilience against climate risks.

Yield Protection

Crop insurance primarily covers losses in agricultural yield due to natural calamities, pests, and diseases, providing farmers with financial stability. Microinsurance targets smallholder farmers with affordable premiums and simplified claim processes, focusing on yield protection tailored to their specific risks and financial constraints. Explore detailed comparisons and benefits of each to make informed decisions on safeguarding your crops.

Weather Index

Weather index crop insurance uses predefined climatic parameters like rainfall and temperature to trigger payouts, reducing delays and minimizing moral hazard. Microinsurance offers affordable, accessible coverage tailored to low-income farmers, often leveraging mobile technology for weather index data collection and claim processing. Explore the benefits and applications of weather index microinsurance to protect vulnerable agricultural communities effectively.

Source and External Links

Uninsured: Federal Crop Insurance Program Leaves Most Farms Unprotected - Federal crop insurance is a major taxpayer-subsidized program protecting farms from losses due to weather and market risks, covering mostly large farms and insuring 78% of cropland acres in 2022.

Crop insurance - Wikipedia - In the U.S., federal crop insurance subsidizes about 62% of premiums, covering roughly 90% of crop acreage with policies on major crops like corn and soybeans, administered by the Risk Management Agency through private insurers.

Crop Insurance 101: The Basics | Market Intel - Crop insurance helps protect farmers from growing and market risks, requiring adherence to USDA good farm practices and allowing different insured unit types such as basic, optional, enterprise, and whole farm units for coverage customization.

dowidth.com

dowidth.com