Catastrophe bonds transfer risk from insurers to capital markets, providing upfront capital upon a predefined disaster event, while contingent capital offers pre-arranged loan access to insurers during financial stress triggered by catastrophes. These financial instruments enhance insurer solvency and liquidity in extreme loss scenarios, minimizing the impact on policyholders. Explore more about how these tools protect insurance companies against catastrophic losses.

Why it is important

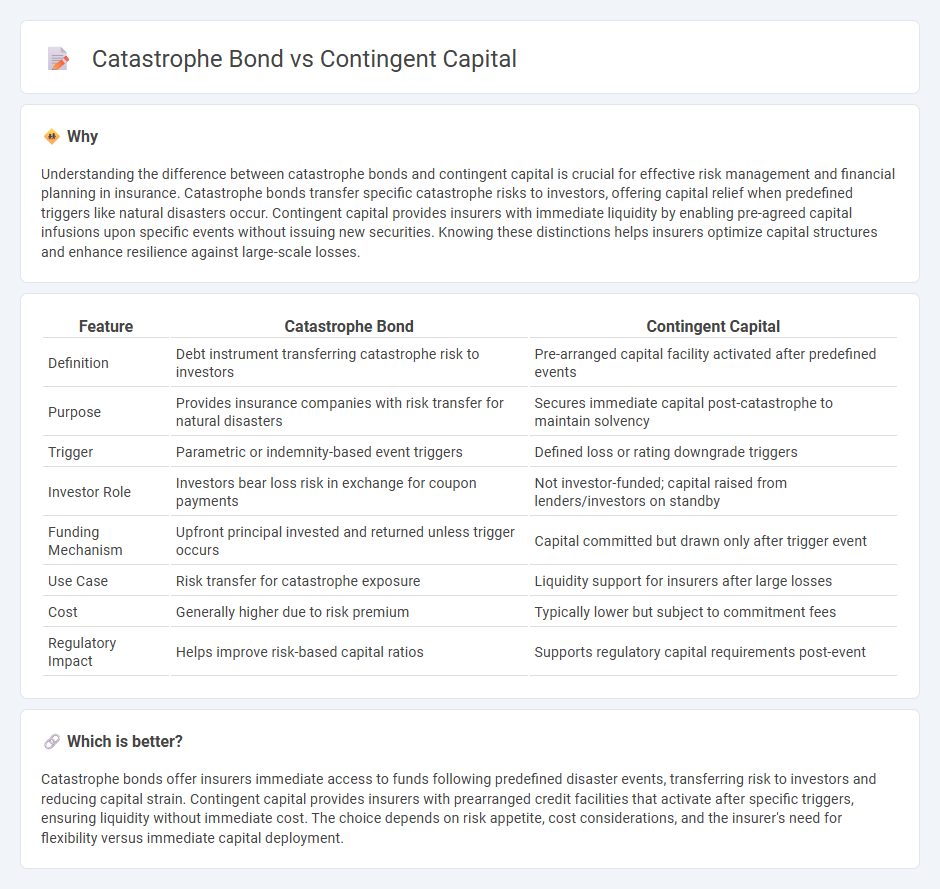

Understanding the difference between catastrophe bonds and contingent capital is crucial for effective risk management and financial planning in insurance. Catastrophe bonds transfer specific catastrophe risks to investors, offering capital relief when predefined triggers like natural disasters occur. Contingent capital provides insurers with immediate liquidity by enabling pre-agreed capital infusions upon specific events without issuing new securities. Knowing these distinctions helps insurers optimize capital structures and enhance resilience against large-scale losses.

Comparison Table

| Feature | Catastrophe Bond | Contingent Capital |

|---|---|---|

| Definition | Debt instrument transferring catastrophe risk to investors | Pre-arranged capital facility activated after predefined events |

| Purpose | Provides insurance companies with risk transfer for natural disasters | Secures immediate capital post-catastrophe to maintain solvency |

| Trigger | Parametric or indemnity-based event triggers | Defined loss or rating downgrade triggers |

| Investor Role | Investors bear loss risk in exchange for coupon payments | Not investor-funded; capital raised from lenders/investors on standby |

| Funding Mechanism | Upfront principal invested and returned unless trigger occurs | Capital committed but drawn only after trigger event |

| Use Case | Risk transfer for catastrophe exposure | Liquidity support for insurers after large losses |

| Cost | Generally higher due to risk premium | Typically lower but subject to commitment fees |

| Regulatory Impact | Helps improve risk-based capital ratios | Supports regulatory capital requirements post-event |

Which is better?

Catastrophe bonds offer insurers immediate access to funds following predefined disaster events, transferring risk to investors and reducing capital strain. Contingent capital provides insurers with prearranged credit facilities that activate after specific triggers, ensuring liquidity without immediate cost. The choice depends on risk appetite, cost considerations, and the insurer's need for flexibility versus immediate capital deployment.

Connection

Catastrophe bonds and contingent capital are financial instruments designed to provide insurance companies with liquidity in the event of significant losses caused by natural disasters. Catastrophe bonds transfer risk to investors by triggering payouts when predefined catastrophe events occur, while contingent capital provides insurers with pre-agreed access to capital upon specific triggers. Both mechanisms enhance insurers' capital resilience and support rapid recovery following catastrophic events.

Key Terms

Trigger Event

Contingent capital and catastrophe bonds both rely on trigger events to activate financial protection mechanisms, but differ significantly in nature and purpose. Contingent capital triggers typically involve specific financial or balance sheet thresholds, such as a credit rating downgrade or loss event, leading to capital infusion for insurers; catastrophe bonds trigger on predefined physical or parametric events like hurricanes or earthquakes, releasing funds to cover disaster-related losses. Explore detailed comparisons of trigger event structures and implications to understand risk transfer strategies better.

Payout Structure

Contingent capital involves pre-agreed funding from investors or insurers that activates when a specific trigger event occurs, ensuring immediate liquidity for financial institutions. Catastrophe bonds transfer insurance risk to capital markets, paying out only if predefined disaster losses exceed a threshold, with investors accepting principal loss in exchange for higher yields. Explore the detailed differences in payout structures and their impact on risk management by diving deeper into these financial instruments.

Risk Transfer

Contingent capital and catastrophe bonds represent innovative risk transfer mechanisms designed for extreme event financing in insurance and reinsurance sectors. Contingent capital provides pre-arranged capital injections upon specified trigger events, enhancing liquidity post-disaster, while catastrophe bonds transfer defined catastrophe risks to investors, mitigating insurer balance sheet volatility. Explore the differences and strategic advantages of contingent capital versus catastrophe bonds in effective risk management solutions.

Source and External Links

Contingent Capital: Definition, Mechanism, Triggers & Risks - Contingent capital is a long-term hybrid debt instrument that automatically converts into equity when certain trigger events occur, such as a decline in the issuer's capital ratio or regulatory intervention, helping absorb losses and strengthen balance sheets in times of financial stress.

Contingent Risk Capital - Contingent capital is securitized capital accessed through an options contract that provides capital only if predefined conditions occur, allowing institutions to mobilize funds during stress without transferring risk as insurance does.

Understanding Contingent Capital - Contingent capital is favored over traditional hybrid securities due to its loss absorption via conversion or write-down features triggered when capital ratios fall below a threshold, effectively providing a capital injection and risk mitigation tool used by banks and insurers.

dowidth.com

dowidth.com