Workers compensation carveout specifically covers medical expenses and wage replacement related to workplace injuries, whereas group health insurance provides broader medical coverage for employees' general health needs. Carveouts help employers manage risk by isolating work-related injury costs from their overall health insurance pool. Explore more about how these insurance options affect your benefits and cost strategies.

Why it is important

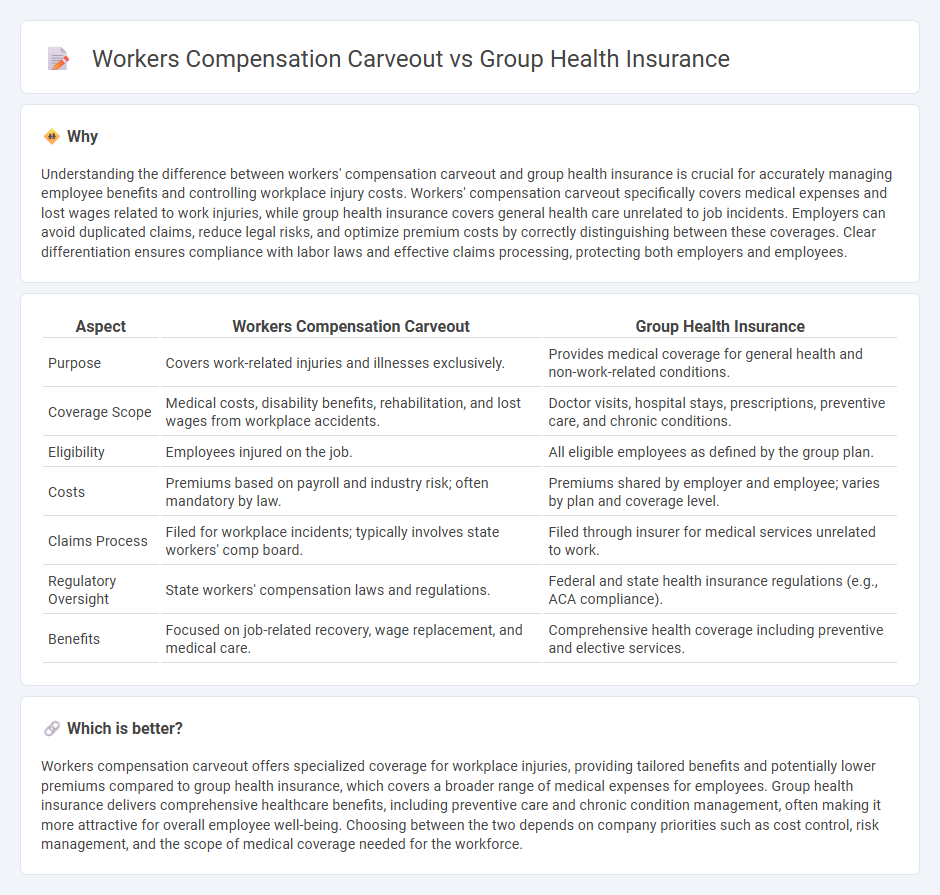

Understanding the difference between workers' compensation carveout and group health insurance is crucial for accurately managing employee benefits and controlling workplace injury costs. Workers' compensation carveout specifically covers medical expenses and lost wages related to work injuries, while group health insurance covers general health care unrelated to job incidents. Employers can avoid duplicated claims, reduce legal risks, and optimize premium costs by correctly distinguishing between these coverages. Clear differentiation ensures compliance with labor laws and effective claims processing, protecting both employers and employees.

Comparison Table

| Aspect | Workers Compensation Carveout | Group Health Insurance |

|---|---|---|

| Purpose | Covers work-related injuries and illnesses exclusively. | Provides medical coverage for general health and non-work-related conditions. |

| Coverage Scope | Medical costs, disability benefits, rehabilitation, and lost wages from workplace accidents. | Doctor visits, hospital stays, prescriptions, preventive care, and chronic conditions. |

| Eligibility | Employees injured on the job. | All eligible employees as defined by the group plan. |

| Costs | Premiums based on payroll and industry risk; often mandatory by law. | Premiums shared by employer and employee; varies by plan and coverage level. |

| Claims Process | Filed for workplace incidents; typically involves state workers' comp board. | Filed through insurer for medical services unrelated to work. |

| Regulatory Oversight | State workers' compensation laws and regulations. | Federal and state health insurance regulations (e.g., ACA compliance). |

| Benefits | Focused on job-related recovery, wage replacement, and medical care. | Comprehensive health coverage including preventive and elective services. |

Which is better?

Workers compensation carveout offers specialized coverage for workplace injuries, providing tailored benefits and potentially lower premiums compared to group health insurance, which covers a broader range of medical expenses for employees. Group health insurance delivers comprehensive healthcare benefits, including preventive care and chronic condition management, often making it more attractive for overall employee well-being. Choosing between the two depends on company priorities such as cost control, risk management, and the scope of medical coverage needed for the workforce.

Connection

Workers compensation carveouts specifically exclude certain medical benefits from standard workers compensation coverage, shifting the responsibility for these costs to group health insurance plans. This connection allows employers to manage claims more effectively by utilizing group health insurance for non-work-related medical expenses while maintaining workers compensation for workplace injuries. The coordination between these coverages ensures comprehensive healthcare protection for employees while controlling overall insurance costs.

Key Terms

Coverage Scope

Group health insurance typically covers employee medical expenses, preventive care, and wellness programs, providing comprehensive health benefits across a broad spectrum of health needs. Workers compensation carveouts specifically address workplace injuries and occupational illnesses, offering tailored coverage such as medical treatment, wage replacement, and disability benefits directly related to work incidents. Explore the differences further to understand which option best suits your business's risk management strategy.

Eligibility

Group health insurance eligibility typically covers full-time employees across various job roles without limitations related to injury type or work-related incidents. Workers' compensation carveouts, however, specifically target employees who sustain work-related injuries or illnesses, providing tailored benefits separate from general health plans. Explore detailed comparisons to understand which coverage best suits your workforce needs and compliance requirements.

Benefit Administration

Group health insurance provides comprehensive coverage for employees' medical expenses, while workers' compensation carveouts specifically address work-related injuries and occupational illnesses. Benefit administration for group health insurance involves managing claims, eligibility, and provider networks, whereas workers' compensation carveouts require specialized processes to handle injury claims and regulatory compliance separately. Explore detailed strategies to optimize benefit administration for both plans to enhance employee coverage and organizational efficiency.

Source and External Links

Are You Covered Under A Group Health Plan? - Describes what constitutes a group health plan, including employer-sponsored plans and those provided by unions or associations.

Health Insurance Through Professional and Trade Organizations - Explains how individuals can access group health insurance through professional, trade, or membership organizations.

Group Health Insurance Medical Plans - Offers employer health insurance plans and benefit packages across various industries, emphasizing quality care and personalized health approaches.

dowidth.com

dowidth.com