Flood risk modeling quantifies potential financial losses from flood events by analyzing hydrological data, geographic vulnerabilities, and historical flood patterns. Longevity risk modeling estimates the financial impact of increased life expectancy on pension funds and insurance liabilities, leveraging demographic trends and mortality rate projections. Explore the distinct methodologies and applications of these critical insurance risk models.

Why it is important

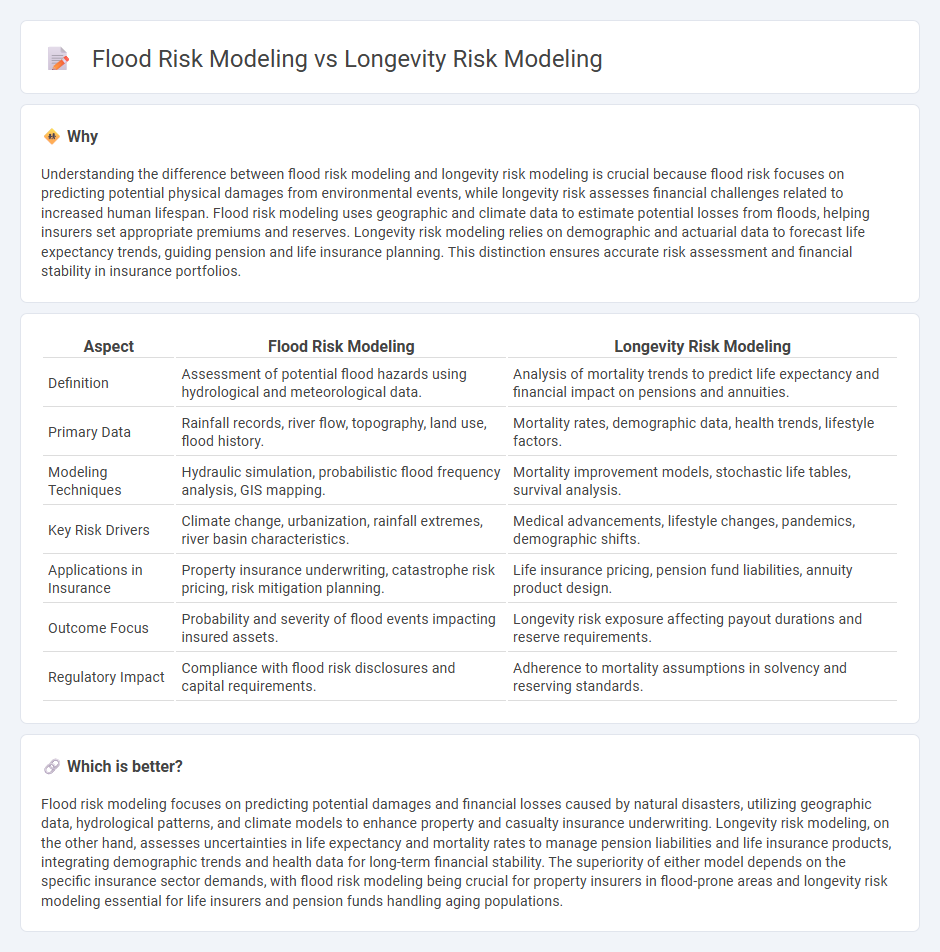

Understanding the difference between flood risk modeling and longevity risk modeling is crucial because flood risk focuses on predicting potential physical damages from environmental events, while longevity risk assesses financial challenges related to increased human lifespan. Flood risk modeling uses geographic and climate data to estimate potential losses from floods, helping insurers set appropriate premiums and reserves. Longevity risk modeling relies on demographic and actuarial data to forecast life expectancy trends, guiding pension and life insurance planning. This distinction ensures accurate risk assessment and financial stability in insurance portfolios.

Comparison Table

| Aspect | Flood Risk Modeling | Longevity Risk Modeling |

|---|---|---|

| Definition | Assessment of potential flood hazards using hydrological and meteorological data. | Analysis of mortality trends to predict life expectancy and financial impact on pensions and annuities. |

| Primary Data | Rainfall records, river flow, topography, land use, flood history. | Mortality rates, demographic data, health trends, lifestyle factors. |

| Modeling Techniques | Hydraulic simulation, probabilistic flood frequency analysis, GIS mapping. | Mortality improvement models, stochastic life tables, survival analysis. |

| Key Risk Drivers | Climate change, urbanization, rainfall extremes, river basin characteristics. | Medical advancements, lifestyle changes, pandemics, demographic shifts. |

| Applications in Insurance | Property insurance underwriting, catastrophe risk pricing, risk mitigation planning. | Life insurance pricing, pension fund liabilities, annuity product design. |

| Outcome Focus | Probability and severity of flood events impacting insured assets. | Longevity risk exposure affecting payout durations and reserve requirements. |

| Regulatory Impact | Compliance with flood risk disclosures and capital requirements. | Adherence to mortality assumptions in solvency and reserving standards. |

Which is better?

Flood risk modeling focuses on predicting potential damages and financial losses caused by natural disasters, utilizing geographic data, hydrological patterns, and climate models to enhance property and casualty insurance underwriting. Longevity risk modeling, on the other hand, assesses uncertainties in life expectancy and mortality rates to manage pension liabilities and life insurance products, integrating demographic trends and health data for long-term financial stability. The superiority of either model depends on the specific insurance sector demands, with flood risk modeling being crucial for property insurers in flood-prone areas and longevity risk modeling essential for life insurers and pension funds handling aging populations.

Connection

Flood risk modeling and longevity risk modeling intersect through their reliance on probabilistic assessments of extreme events that impact financial stability. Both models use advanced statistical techniques and large datasets to predict future risks, enabling insurers to price policies accurately and maintain sufficient reserves. By integrating environmental data with demographic trends, insurance firms enhance risk management strategies across property and life insurance sectors.

Key Terms

Longevity risk modeling:

Longevity risk modeling involves analyzing demographic data, mortality rates, and life expectancy trends to estimate the financial impact of longer-than-expected lifespans on pension funds and insurance portfolios. Techniques such as stochastic modeling, survival analysis, and cohort-based mortality projections are commonly used to capture uncertainty and improve accuracy in predicting future longevity risks. Explore our detailed resources to understand advanced methodologies and their applications in longevity risk management.

Mortality rates

Longevity risk modeling focuses on predicting future mortality rates to assess the financial impact of extended life spans on pensions and insurance liabilities, using detailed demographic and health data to estimate survival probabilities. Flood risk modeling estimates the probability and impact of flood events on properties, relying on hydrological data and environmental factors rather than mortality rates. Explore the methodologies used to enhance accuracy in mortality assumptions and their implications for risk management.

Life expectancy

Longevity risk modeling centers on forecasting life expectancy variations to manage financial risks in pensions and insurance, utilizing mortality tables and demographic factors for accuracy. Flood risk modeling assesses the probability and impact of flood events, relying on hydrological data, topography, and climate trends to inform urban planning and disaster mitigation. Explore further to understand the detailed methodologies and applications of these specialized risk models.

Source and External Links

Assessment of Longevity Risk - This paper investigates future mortality and longevity risk using the Lee-Carter model across different countries and scenarios.

Integrating Financial and Demographic Longevity Risk Models - This work develops a stochastic longevity model for financial pricing and risk management based on Australian population mortality rates.

Moody's LifeRisks - Moody's offers a longevity risk model that combines medical science with statistical and actuarial techniques to assess mortality drivers.

dowidth.com

dowidth.com