Pet insurance covers veterinary expenses for illnesses, accidents, and routine care of cats and dogs, helping owners manage unexpected medical costs. Dental insurance focuses on reducing out-of-pocket expenses for preventative care and treatments such as cleanings, fillings, and orthodontics, improving oral health outcomes. Discover the key differences and benefits of each insurance type to choose the right coverage for your needs.

Why it is important

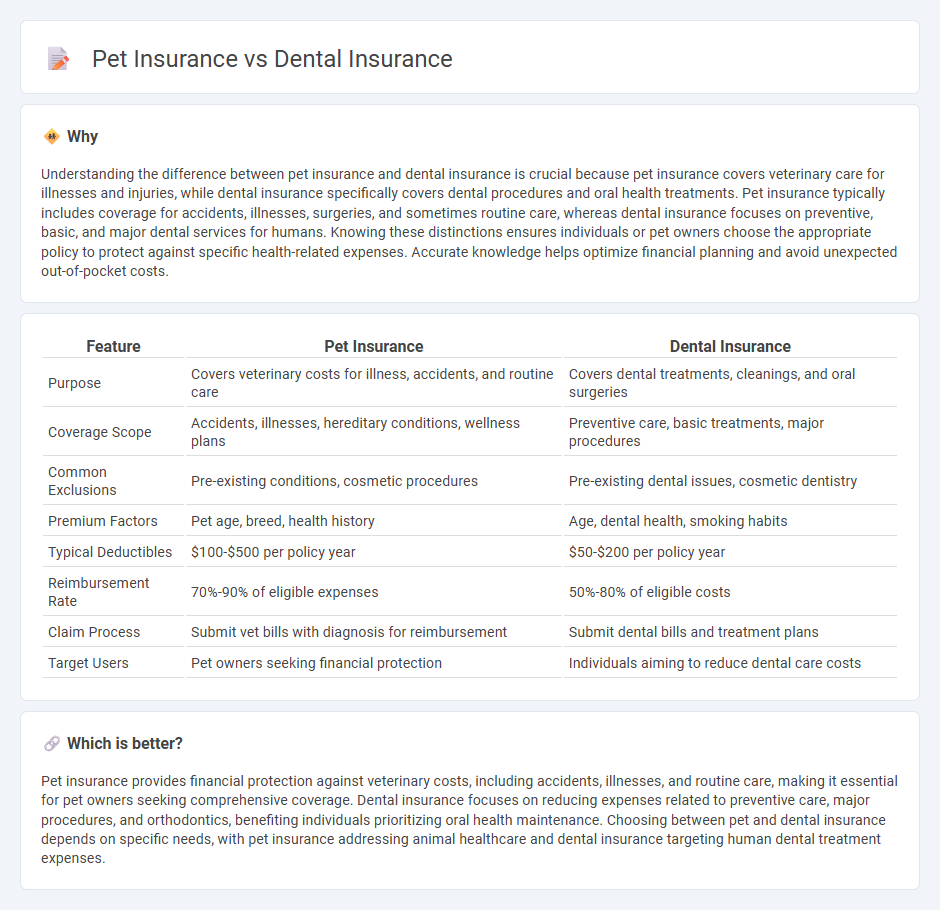

Understanding the difference between pet insurance and dental insurance is crucial because pet insurance covers veterinary care for illnesses and injuries, while dental insurance specifically covers dental procedures and oral health treatments. Pet insurance typically includes coverage for accidents, illnesses, surgeries, and sometimes routine care, whereas dental insurance focuses on preventive, basic, and major dental services for humans. Knowing these distinctions ensures individuals or pet owners choose the appropriate policy to protect against specific health-related expenses. Accurate knowledge helps optimize financial planning and avoid unexpected out-of-pocket costs.

Comparison Table

| Feature | Pet Insurance | Dental Insurance |

|---|---|---|

| Purpose | Covers veterinary costs for illness, accidents, and routine care | Covers dental treatments, cleanings, and oral surgeries |

| Coverage Scope | Accidents, illnesses, hereditary conditions, wellness plans | Preventive care, basic treatments, major procedures |

| Common Exclusions | Pre-existing conditions, cosmetic procedures | Pre-existing dental issues, cosmetic dentistry |

| Premium Factors | Pet age, breed, health history | Age, dental health, smoking habits |

| Typical Deductibles | $100-$500 per policy year | $50-$200 per policy year |

| Reimbursement Rate | 70%-90% of eligible expenses | 50%-80% of eligible costs |

| Claim Process | Submit vet bills with diagnosis for reimbursement | Submit dental bills and treatment plans |

| Target Users | Pet owners seeking financial protection | Individuals aiming to reduce dental care costs |

Which is better?

Pet insurance provides financial protection against veterinary costs, including accidents, illnesses, and routine care, making it essential for pet owners seeking comprehensive coverage. Dental insurance focuses on reducing expenses related to preventive care, major procedures, and orthodontics, benefiting individuals prioritizing oral health maintenance. Choosing between pet and dental insurance depends on specific needs, with pet insurance addressing animal healthcare and dental insurance targeting human dental treatment expenses.

Connection

Pet insurance and dental insurance both provide coverage for health-related expenses, focusing on preventive care and treatment of conditions to reduce overall costs. Veterinary dental care and human dental care share similarities in procedures such as cleanings, extractions, and periodontal treatments, highlighting a common emphasis on oral health maintenance. Both insurance types help manage the financial burden of unexpected dental issues, promoting routine care to prevent severe complications.

Key Terms

**Dental Insurance:**

Dental insurance covers preventive care, diagnostics, and treatments for oral health issues including cleanings, X-rays, fillings, and root canals, often with annual limits and network restrictions. It reduces out-of-pocket expenses for procedures linked to gum disease, cavities, and oral surgeries, improving access to routine dental care and overall health outcomes. Learn more about how dental insurance plans can protect your smile and budget effectively.

Annual Maximum

Dental insurance typically features an annual maximum payout ranging from $1,000 to $2,000, which limits the total coverage available for dental procedures within a policy year. Pet insurance annual maximums vary widely, from no cap to fixed limits between $5,000 and $15,000, depending on the plan and provider, affecting the extent of coverage for veterinary care. Explore detailed comparisons to understand how annual maximums impact your investment in dental or pet health insurance.

Waiting Period

Dental insurance typically features waiting periods ranging from 6 to 12 months before major procedures are covered, aiming to prevent immediate claims abuse. Pet insurance waiting periods vary widely, with some providers enforcing a 14-day waiting period for accidents and up to 6 months for certain illnesses to avoid pre-existing condition claims. Explore detailed comparisons on waiting periods to choose the best coverage for your needs.

Source and External Links

Dental insurance | Supplemental | UnitedHealthcare - Dental insurance plans typically cover preventive care with no deductible, basic services like fillings, major services such as root canals, and offer access to a wide dental network with direct payments to in-network dentists, helping manage costs and support overall health.

Dental Coverage in the Health Insurance Marketplace - Dental coverage in the Marketplace can be included within some health plans or purchased as separate dental plans, with options categorized into high or low coverage levels affecting premiums and out-of-pocket costs.

Affordable Dental Insurance Plans for Individuals | Cigna Healthcare - Cigna offers year-round enrollment for nationwide dental insurance plans including large networks, tools for cost savings, and coverage that supports preventive care to reduce more serious dental issues.

dowidth.com

dowidth.com