Short term rental insurance specifically covers risks associated with renting out a property for brief periods, protecting against guest-related damage, liability claims, and income loss. Homeowners insurance offers broader coverage for permanent residents, including property damage, theft, and personal liability, but often excludes short term rental activities. Explore the key differences and find the best insurance solution for your property needs.

Why it is important

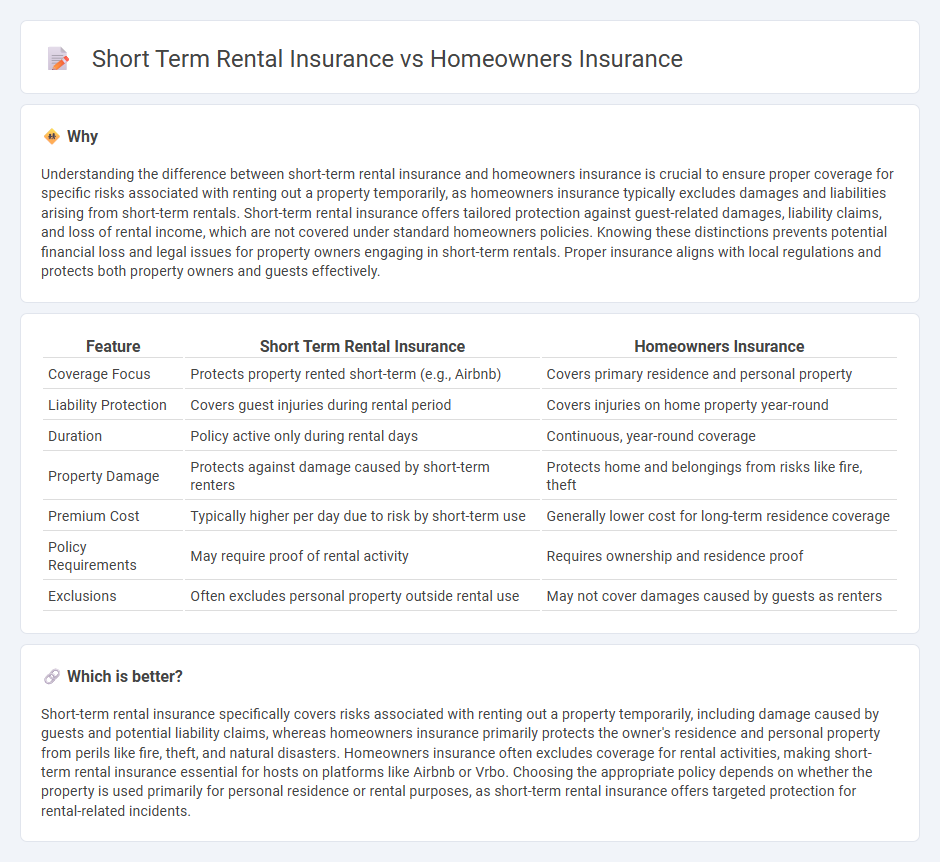

Understanding the difference between short-term rental insurance and homeowners insurance is crucial to ensure proper coverage for specific risks associated with renting out a property temporarily, as homeowners insurance typically excludes damages and liabilities arising from short-term rentals. Short-term rental insurance offers tailored protection against guest-related damages, liability claims, and loss of rental income, which are not covered under standard homeowners policies. Knowing these distinctions prevents potential financial loss and legal issues for property owners engaging in short-term rentals. Proper insurance aligns with local regulations and protects both property owners and guests effectively.

Comparison Table

| Feature | Short Term Rental Insurance | Homeowners Insurance |

|---|---|---|

| Coverage Focus | Protects property rented short-term (e.g., Airbnb) | Covers primary residence and personal property |

| Liability Protection | Covers guest injuries during rental period | Covers injuries on home property year-round |

| Duration | Policy active only during rental days | Continuous, year-round coverage |

| Property Damage | Protects against damage caused by short-term renters | Protects home and belongings from risks like fire, theft |

| Premium Cost | Typically higher per day due to risk by short-term use | Generally lower cost for long-term residence coverage |

| Policy Requirements | May require proof of rental activity | Requires ownership and residence proof |

| Exclusions | Often excludes personal property outside rental use | May not cover damages caused by guests as renters |

Which is better?

Short-term rental insurance specifically covers risks associated with renting out a property temporarily, including damage caused by guests and potential liability claims, whereas homeowners insurance primarily protects the owner's residence and personal property from perils like fire, theft, and natural disasters. Homeowners insurance often excludes coverage for rental activities, making short-term rental insurance essential for hosts on platforms like Airbnb or Vrbo. Choosing the appropriate policy depends on whether the property is used primarily for personal residence or rental purposes, as short-term rental insurance offers targeted protection for rental-related incidents.

Connection

Short term rental insurance complements homeowners insurance by covering unique liabilities and property risks related to renting out a residential property temporarily. While homeowners insurance protects the owner's personal residence and belongings against perils like fire and theft, short term rental insurance specifically addresses guest-related damages, liability claims, and loss of rental income during vacancies. Together, these policies ensure comprehensive protection for property owners who monetize their homes through platforms like Airbnb or VRBO.

Key Terms

Property Coverage

Homeowners insurance typically provides broad property coverage for personal residences, protecting against risks like fire, theft, and certain natural disasters, but often excludes incidents related to short-term rentals or commercial use. Short term rental insurance offers specialized property coverage designed to address unique risks associated with renting out a home or part of it on platforms like Airbnb, including property damage by guests and liability for short-term stays. Explore the key differences to determine the optimal insurance strategy for your property rental needs.

Liability Protection

Homeowners insurance typically offers limited liability protection for short-term rental activities, often excluding damages or injuries occurring during guest stays. Short term rental insurance provides specialized liability coverage tailored to risks such as property damage, guest injuries, and loss related to short-term guests. Explore more about how specific liability protections can safeguard your investment in the short-term rental market.

Loss of Income (or Loss of Use)

Homeowners insurance typically provides limited or no coverage for loss of income when a property is rented short-term, whereas short term rental insurance includes specific protection for loss of income or loss of use due to property damage. Short term rental policies cover rental income interruptions caused by covered perils like fire or flooding, ensuring financial stability for hosts. Explore detailed policy options to safeguard your rental income effectively.

Source and External Links

Homeowners Insurance - Get a Home Insurance Quote - Homeowners insurance is a contract in which you pay a premium to an insurer who then covers damages to your home from covered events minus any deductible; premiums vary based on factors like location, construction materials, and personal property.

Learn how home insurance works - Typical homeowners policies cover dwelling repair or replacement, other structures on the property, personal belongings often on an actual cash value or replacement cost basis, and may allow add-ons for valuables or additional coverage needs.

Homeowners Insurance - Online Quotes - Homeowners insurance protects your home, personal property, and liability, covering repairs, replacements, legal fees, and additional living expenses if you cannot live in your home due to a covered loss; coverage can be customized to your needs and budget.

dowidth.com

dowidth.com