Insurtech platforms leverage advanced technologies like AI, big data analytics, and blockchain to streamline insurance processes, offering personalized policies and instant claims processing. Mutual insurance companies operate on a member-owned model, emphasizing policyholder benefits and profit redistribution rather than shareholder profits. Explore how these models impact customer experience and industry efficiency by learning more about their distinct advantages.

Why it is important

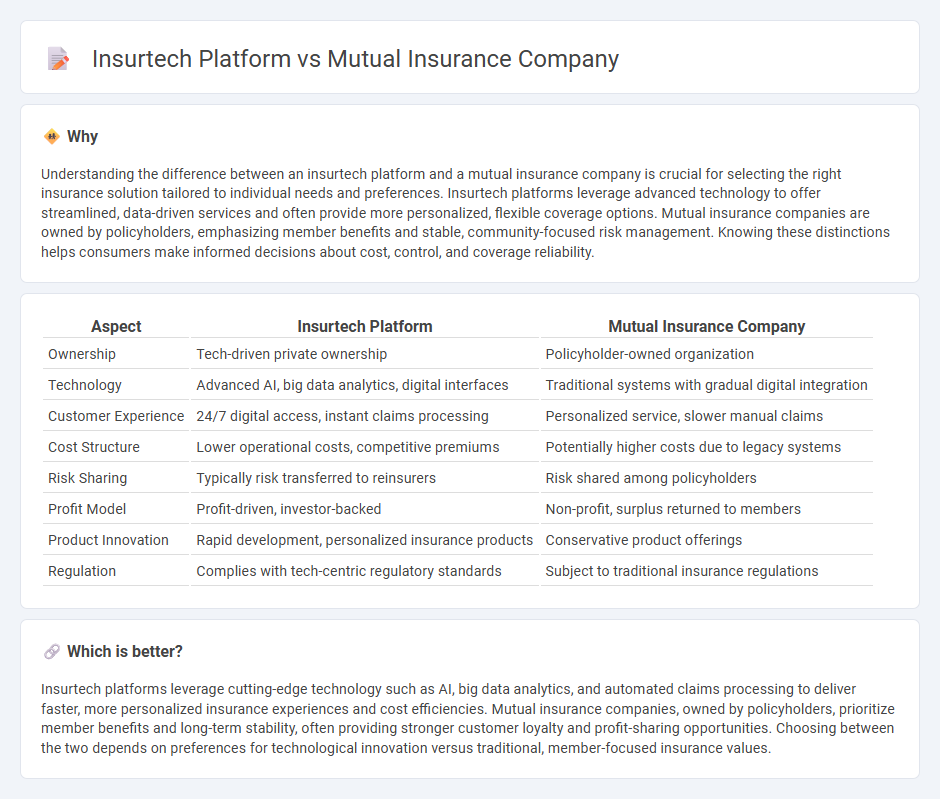

Understanding the difference between an insurtech platform and a mutual insurance company is crucial for selecting the right insurance solution tailored to individual needs and preferences. Insurtech platforms leverage advanced technology to offer streamlined, data-driven services and often provide more personalized, flexible coverage options. Mutual insurance companies are owned by policyholders, emphasizing member benefits and stable, community-focused risk management. Knowing these distinctions helps consumers make informed decisions about cost, control, and coverage reliability.

Comparison Table

| Aspect | Insurtech Platform | Mutual Insurance Company |

|---|---|---|

| Ownership | Tech-driven private ownership | Policyholder-owned organization |

| Technology | Advanced AI, big data analytics, digital interfaces | Traditional systems with gradual digital integration |

| Customer Experience | 24/7 digital access, instant claims processing | Personalized service, slower manual claims |

| Cost Structure | Lower operational costs, competitive premiums | Potentially higher costs due to legacy systems |

| Risk Sharing | Typically risk transferred to reinsurers | Risk shared among policyholders |

| Profit Model | Profit-driven, investor-backed | Non-profit, surplus returned to members |

| Product Innovation | Rapid development, personalized insurance products | Conservative product offerings |

| Regulation | Complies with tech-centric regulatory standards | Subject to traditional insurance regulations |

Which is better?

Insurtech platforms leverage cutting-edge technology such as AI, big data analytics, and automated claims processing to deliver faster, more personalized insurance experiences and cost efficiencies. Mutual insurance companies, owned by policyholders, prioritize member benefits and long-term stability, often providing stronger customer loyalty and profit-sharing opportunities. Choosing between the two depends on preferences for technological innovation versus traditional, member-focused insurance values.

Connection

Insurtech platforms leverage advanced technologies like AI, blockchain, and big data analytics to streamline insurance processes, reduce operational costs, and enhance customer experience. Mutual insurance companies benefit from insurtech by adopting these innovations to improve risk assessment, policy management, and claims processing while maintaining member-centric ownership structures. The synergy between insurtech platforms and mutual insurers drives digital transformation, fostering more transparent, efficient, and customer-driven insurance solutions.

Key Terms

Ownership Structure

Mutual insurance companies are owned by policyholders, ensuring profits are reinvested for their benefit and fostering a customer-centric approach. Insurtech platforms typically operate as investor-backed entities prioritizing rapid growth and technological innovation within the insurance sector. Explore deeper insights into the ownership models shaping insurance innovation and customer value.

Underwriting Model

Mutual insurance companies employ risk-based underwriting models prioritizing member risk pools and long-term stability, leveraging historical data to set premiums aligned with policyholder interests. Insurtech platforms utilize AI-driven underwriting models that incorporate real-time data analytics, telematics, and machine learning algorithms to enhance accuracy, efficiency, and personalized pricing. Explore further to understand how these contrasting underwriting approaches reshape risk assessment and customer value.

Technology Integration

Mutual insurance companies traditionally rely on established risk-sharing mechanisms and member-driven governance, often facing slower technology adoption due to legacy systems and regulatory structures. Insurtech platforms leverage advanced digital tools, such as AI-driven underwriting, blockchain for claims processing, and seamless mobile integrations, to rapidly innovate customer experience and operational efficiency. Explore how the evolving landscape of technology integration is transforming insurance models and what it means for policyholders.

Source and External Links

Mutual insurance - A mutual insurance company is owned entirely by its policyholders, operates as a form of consumers' co-operative, and any profits are either retained within the company or returned to policyholders as dividends or reduced premiums.

Nationwide: Insurance and Financial Services Company - Nationwide, originally a mutual auto insurance company owned by its policyholders, has grown into one of the largest insurance and financial services companies in the world while continuing to operate primarily for the benefit of its members.

An Insurance Company Built on Empathy | Amica Mutual - Amica Mutual is a policyholder-owned insurance company offering auto, home, and life insurance with a strong emphasis on customer service and empathy.

dowidth.com

dowidth.com