Workers compensation carveout insurance specifically covers high-cost claims related to workplace injuries, providing a tailored risk management approach for employers. Stop-loss insurance protects self-insured plans by capping overall claims expenditures, ensuring financial stability against unexpectedly large aggregate or specific claims. Explore the differences and benefits of these insurance options to optimize your business risk strategy.

Why it is important

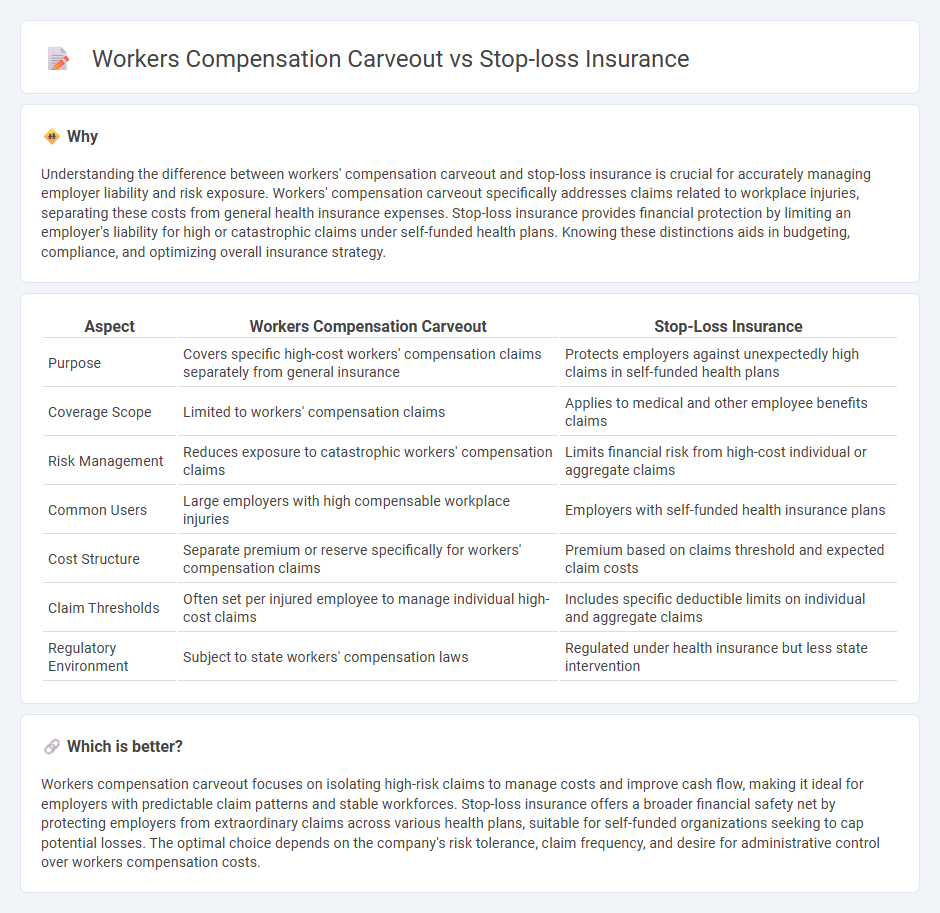

Understanding the difference between workers' compensation carveout and stop-loss insurance is crucial for accurately managing employer liability and risk exposure. Workers' compensation carveout specifically addresses claims related to workplace injuries, separating these costs from general health insurance expenses. Stop-loss insurance provides financial protection by limiting an employer's liability for high or catastrophic claims under self-funded health plans. Knowing these distinctions aids in budgeting, compliance, and optimizing overall insurance strategy.

Comparison Table

| Aspect | Workers Compensation Carveout | Stop-Loss Insurance |

|---|---|---|

| Purpose | Covers specific high-cost workers' compensation claims separately from general insurance | Protects employers against unexpectedly high claims in self-funded health plans |

| Coverage Scope | Limited to workers' compensation claims | Applies to medical and other employee benefits claims |

| Risk Management | Reduces exposure to catastrophic workers' compensation claims | Limits financial risk from high-cost individual or aggregate claims |

| Common Users | Large employers with high compensable workplace injuries | Employers with self-funded health insurance plans |

| Cost Structure | Separate premium or reserve specifically for workers' compensation claims | Premium based on claims threshold and expected claim costs |

| Claim Thresholds | Often set per injured employee to manage individual high-cost claims | Includes specific deductible limits on individual and aggregate claims |

| Regulatory Environment | Subject to state workers' compensation laws | Regulated under health insurance but less state intervention |

Which is better?

Workers compensation carveout focuses on isolating high-risk claims to manage costs and improve cash flow, making it ideal for employers with predictable claim patterns and stable workforces. Stop-loss insurance offers a broader financial safety net by protecting employers from extraordinary claims across various health plans, suitable for self-funded organizations seeking to cap potential losses. The optimal choice depends on the company's risk tolerance, claim frequency, and desire for administrative control over workers compensation costs.

Connection

Workers compensation carveout and stop-loss insurance intersect by managing risk exposures in employee benefit plans. Workers compensation carveout involves separating workers compensation claims from the general health plan to control costs and streamline claim management. Stop-loss insurance provides protection to employers by covering claims that exceed predetermined thresholds, ensuring financial stability when high-cost claims arise from workers compensation carveout arrangements.

Key Terms

Risk Retention

Stop-loss insurance provides protection by reimbursing employers for medical claims exceeding a predetermined threshold, effectively managing financial risks associated with self-funded health plans. Workers compensation carveouts isolate specific high-risk claims or employee categories, allowing businesses to retain control over the majority of claims while transferring selected liabilities to specialized insurers. Explore deeper insights into managing risk retention strategies and optimizing claims handling efficiency.

Claims Liability

Stop-loss insurance protects employers from high-cost claims by reimbursing expenses that exceed a predetermined threshold, whereas workers' compensation carveouts isolate specific liabilities, such as catastrophic injury costs, to specialized insurers for targeted risk management. Claims liability in stop-loss insurance centers around aggregate or specific loss limits, while carveouts shift particular claim responsibilities away from the primary workers' compensation policy to control costs and improve reserving accuracy. Explore detailed comparisons to optimize your risk strategy and claims management approach.

Cost Containment

Stop-loss insurance provides protection for employers against high claims by covering medical expenses exceeding predetermined thresholds, effectively managing unexpected costs. Workers' compensation carveouts selectively exclude certain high-cost claims from the standard policy, allowing specialized cost containment strategies. Explore in-depth comparisons and strategies to optimize cost containment through stop-loss insurance and workers' compensation carveouts.

Source and External Links

Stop Loss Insurance | HUB International - Stop loss insurance protects self-insured employers from catastrophic claims that exceed predetermined levels, available in specific and aggregate forms.

Stop-loss insurance - Wikipedia - Stop-loss insurance is a type of insurance that protects against large claims, typically used by insurers and self-insuring employers.

Understanding Stop-Loss Insurance - Stop-loss insurance helps manage risk for self-funded companies by limiting financial exposure to high or catastrophic claims.

dowidth.com

dowidth.com